‘This is not supposed to happen’: Experts on DBS, Citi outage caused by data centre failure

NEEDED Files, Healing Programs

Due to the significance of the data center, banks generally have a storage facility. Additionally, some businesses have two information centers that simultaneously share the load. If one fails in like circumstances, the different can make up the difference.

There are typically several levels of redundancy for mission-critical applications like banks, according to Dr. Dennis Khoo, managing partner at online firm allDigitalFuture. & nbsp,

According to Dr. Khoo,” In the majority of advanced banks, using the most recent technologies, the database may be quickly replicated, which means they will have a main site and an alternate site, and the data is duplicated suddenly on both sites.” & nbsp,

According to the Singapore Computer Society, the majority of data centers are built with real-time repair capabilities and some degree of reliability. They are also particularly constructed, according to the company, to match the precise duplication requirements of the business.

To reduce potential customer disruption, the world added that a files center’s typical uptime guarantee would typically be 99.982 %. & nbsp,

But, there is still 0.018 percent of outage that could occur. In order for their crucial IT systems and data information to quickly failure to the supplementary data center in the shortest amount of time if such an incident happen, the client may establish an effective Business Continuity Management System and IT Disaster Recovery Plan.

WHAT CAN Businesses DO IF THE Information Areas ARE DOWN?

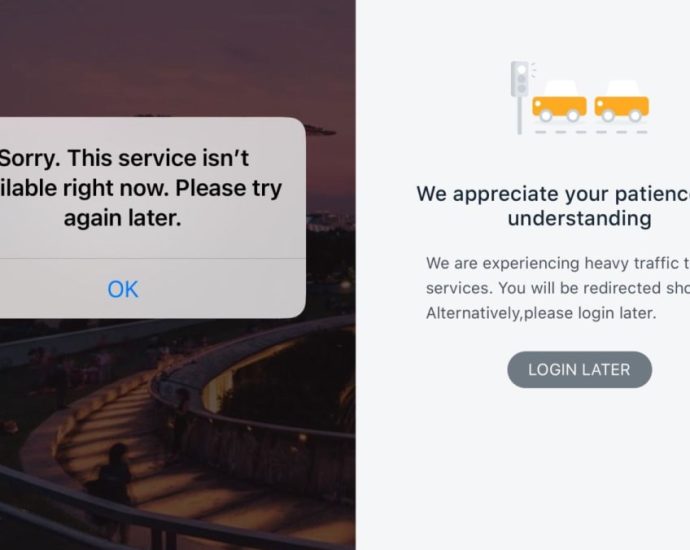

However, if all data centers fail, there isn’t much — if any — service a bank can offer. & nbsp,

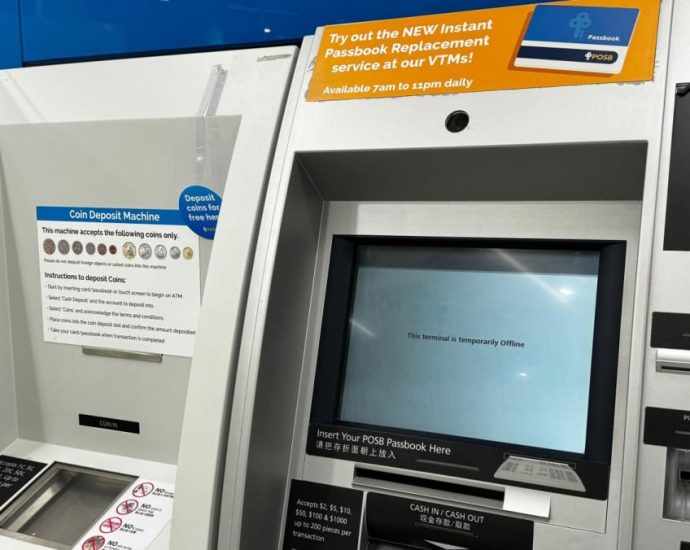

Banks activate what they refer to as” offline mode ,” according to Dr. Thng, which means they provide some services at branch offices using what is available. When the information center is restarted, these purchases are finally updated with the server. & nbsp,

These services may include money deposits, transaction instructions, and credit card transactions, as banks have extra cash on hand. DBS reopened departments to assist customers with some companies. & nbsp,

Dr. Thng claims that everyday This incidents like processing delays happen. Some of these go unrecognized by clients. However, company outages will harm the company’s reputation and possibly have economic repercussions. For instance, if a client receives late fees because they were able to pay their bill on time due to an outage, they may also cause financial losses. & nbsp,

Dr. Khoo claimed that banks would own” broken” their support commitments to offer customers around-the-clock service in terms of social impact.

Therefore, it is certain that your reputation will suffer as a result of your inability to provide excellent customer service. And this is not supposed to happen with suitable style. “& nbsp,