China-Russia relations: What is Xi Jinping prepared to pay for Putin’s war?

Getty Images

Getty ImagesVladimir Putin, the Russian president, praised the “unprecedented” levels of ties between the two nations ahead of his state visit. Beijing is scheduled to welcome him.

China has emerged as a key supporter more than two decades after his conquest of Ukraine. Much to the chagrin of the US and the European Union, it has continued to trade with a heavily sanctioned Russia and has refused to condemn the conflict.

Nevertheless, it appears Mr Putin wants more. But will China pay the price?

A juggling work

Perhaps it is amazing that the Russian president chose China as his first international trip since taking the oath of office next week. Their relationship has reached its “highest level always,” he told Foreign state media during the two-day state visit. He mentioned his interest in Chinese martial art and beliefs, and claimed that members of his family are studying Mandarin.

” In the face of a hard global situation, our relations are also strengthening”, he said.

But while Mr Putin brags about their friendship, Mr Xi may had reason to worry.

The US has really made a number of new sanctions against Beijing and Hong Kong-based institutions and businesses that allegedly work with Moscow and aide in evading the country’s existing restrictions.

This picture can not be played

You must help Java in your computer to perform this picture.

For them, this has become a dark range. China insists that its position on Ukraine is natural, and that exports that are not used for business purposes besides war do not break the law.

However, the allegations followed Mr Xi on his trip to France next year, distracting from what was supposed to be a beauty unpleasant.

As the EU considers tariffs of its own, the Sino-skeptics and China eagles are also becoming louder, urging Mr. Xi to put more pressure on his Soviet rival.

And the truth is that China’s slow business cannot afford to experience this pressure from its trading partners. It needs those businesses overseas because of weak demand at house.

All of this leaves Mr Xi in an odd situation.

Finding the parameters

Weeks before Russia invaded Ukraine, the two frontrunners announced a” no- limits” collaboration to strengthen co- activity. This made feeling for the armies in their intellectual conflict with the West.

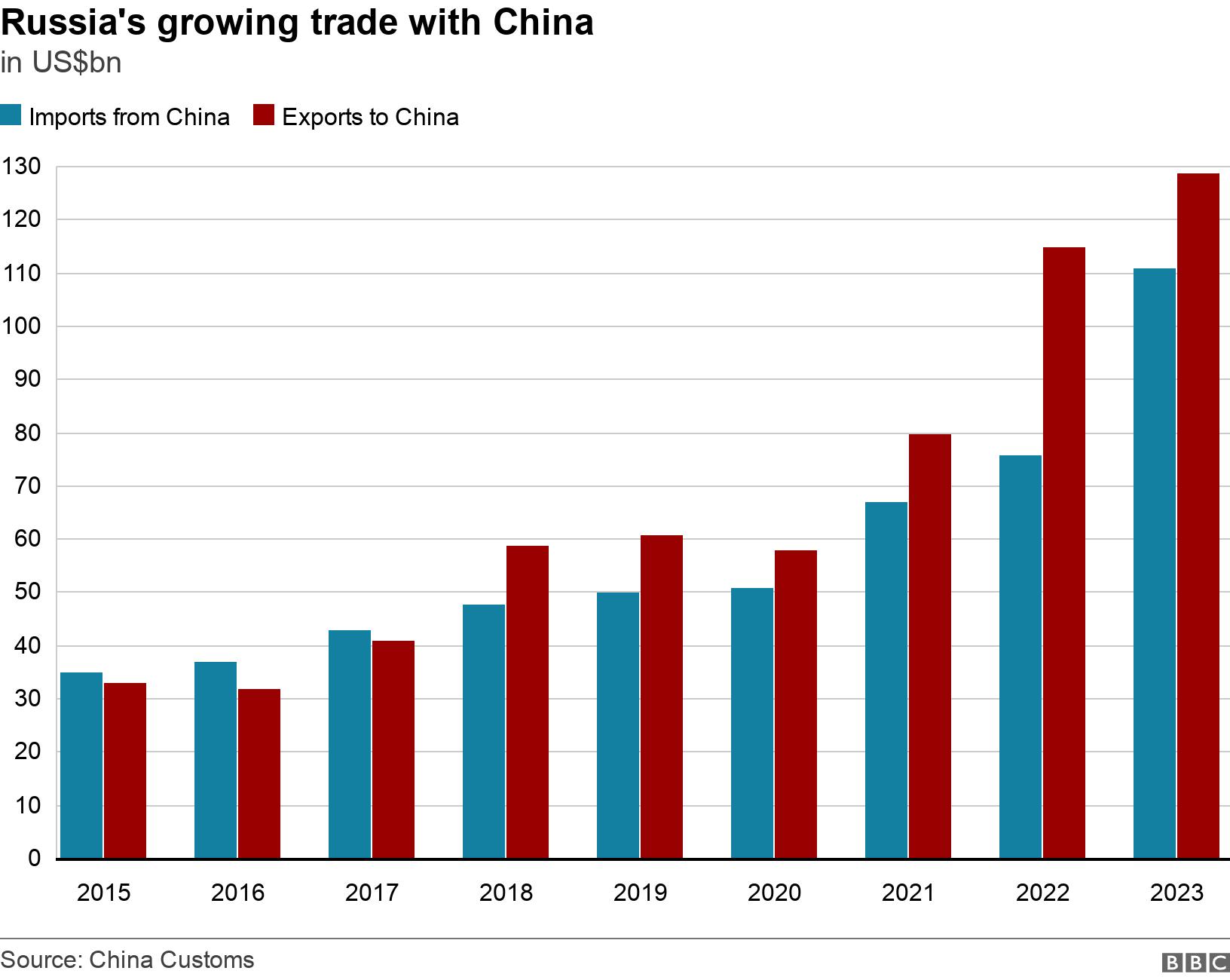

Moscow is also crucial to the changing of a US-led world order, according to Beijing. Trade between them is flourishing. Low Russian energy, including regular gas supplies via the Power of Siberia pipelines, have been a profit for China.

But, as the conflict has dragged on, the ally has never seemed so “limitless”. For one, the word has almost disappeared from status press, a BBC research has found.

Zhao Tong, a senior fellow at the Carnegie Endowment, claims that Beijing is downplaying the unwavering character of its strategic relationship with Moscow.

” While China supports the goal of undermining American control, it does not agree with some of Russia’s methods, including the risk of using radioactive arms. China is acutely aware of the social costs associated with presenting itself as a supporter of Russia, and it is constantly developing strategies to improve its image of legitimacy on the international level.

On his recent visit to Europe, Mr Xi said the state is “neither the father of the issue, not a group to it or a student”. China keeps telling its own people about this.

Russians are still bleeding in pits, according to the statement.

However, the avowed neutrality does not imply support for Ukraine is easily discernible on China’s very censored media.

Foreign state media however justifies Russia’s war, calling it swift retribution by Moscow against US- backed Nato growth.

When Xu Weixin, a Taiwanese artist, first witnessed the first loud explosions to strike the Russian capital Kyiv on television in 2022, he felt compelled to record it.

” I do n’t have a weapon, but I have my pen”, he told the BBC from his studio in the US. His initial drawing, a photograph of the Ukrainian President Volodymyr Zelenskyy, was a hit on social media.

Since the start of the war, I’ve been painting every time. I did n’t stop even for one day. When I got Covid, when I travelled worldwide, I also drew every day”.

Although his work has not been subject to any restrictions in China, the responses it received stunned him.

” It’s very different to my past knowledge”, he said. ” When I painted about fuel miners, all the responses I got were good. Perhaps my depictions of the social revolution received acclaim. I barely got any criticism”.

But this time, he says, he saw a reaction. ” It’s okay, I merely blocked them”, he says. Some of my friends disliked me because they were against my opinions. But what am I capable of? I believe I’m doing a proper point. I want to become a role model for my daughter”.

It’s a sign of hope for Ukrainian like Vita Golod, who want to control Chinese mind. She was in Kyiv at the time the conflict broke out, and she made the decision to convert Russian media into Chinese using her Mandarin proficiency to share it on social media.

On a trip to Beijing, she told the BBC,” We wanted to let folks know the truth about this war because we were aware at the time there were no Russian media outlets or sources.” She is currently the vice president of the Ukrainian Association of Sinologists.

” It was hard physically to be honest, and it took a lot of time”, she says. A group of around 100 people translated formal announcement, President Zelensky’s remarks, and the stories of regular Ukrainians caught in the battle zone, she added.

She claims she hopes to arrange for Chinese scholars to travel to Ukraine so they can witness the destruction themselves and, eventually, put pressure on Russia. She is aware that this is an ambitious objective but wants to try. Her parents still reside in their hometown close to Bucha, and her brother is in the forefront.

” People in Ukraine are still suffering, they are still hiding in shelters, still bleeding in trenches. Ukraine needs sanctions on Russia, not beautiful words”.

So far, her work has not been censored, which implies some tolerance by the Chinese government.

Xi, the peace keeper

Other voices from Beijing are coming out, suggesting that some of the Chinese public’s attitudes toward this unrestrained relationship may be changing.

Feng Yujun, director of Fudan University’s Center for Russian and Central Asian Studies, recently stated in The Economist that Russia was certain to lose in Ukraine.

It’s a bold opinion in China.

But then, Mr Xi has also suggested he could be a peace keeper.

He phoned the Ukrainian president Volodymyr Zelensky in March of last year and emphasized that China has “always stood on the side of peace.” China also released a 12-point peace plan that calls for the end of nuclear weapons.

However, neither of Presidents Putin and Xi’s meeting this week is likely to change their minds significantly.

However, he will be calculating the risk of standing shoulder to shoulder with an international pariah who he once called both a comrade and his “dear friend” as the West becomes more impatient with their alliance and Mr. Xi’s hopes of playing peacekeeper have been so unsuccessful.