Australia’s gas industry hangs by a Japanese thread – Asia Times

Without funding from Japan, many of Australia’s gas projects would n’t have gone ahead. Australia’s now-expensive fossil gas industry is being supported by large open loans from Japanese taxpayers. Japan is even gaining more business in the oil industry, and it exports more oil than it imports from Australia.

Japan is emerging as a fossil fuel hold as the earth transitions swiftly toward a clean energy potential. The world’s fifth- biggest market, Japan has long been dependent on foreign resources of fossil fuels. Japan has focused on fuel while China has filled its plains with solar fields.

These initiatives impede Australia’s ability to meet its climate targets and reverse the transition to clean electricity industries. These exporting industries are being impacted by new gas projects that threaten to deflect funding and workforce.

But this can alter. The government’s Coming Made in Australia policies include a significant investment in clean energy, green manufacturing, and natural exports, which could lead to a long-lasting partnership between the two countries.

Establishing new clean energy collaborations with energy-hungry Asian countries like Japan, China, and South Korea was increase climate assistance, foster fresh clean energy imports, and encourage investment.

Chinese funding, American gasoline

Worried about energy security, Japan is subsidizing new offshore gas projects in Australia which probably would n’t go ahead otherwise.

The largest producer of foreign public funds for fuel production in the world is Japan. Japan has maintained the flow of the funds despite various countries ‘ commitments, including Australia, to stop global fossil fuel financing.

For example, last month, the Japan Bank for International Cooperation provided Australia’s biggest gas corporation, Woodside, with A$ 1.5 billion ( US$ 992 million ) in loans to develop the Scarborough gas field offshore from Western Australia.

Japanese power utility JERA also received A$ 1.2billion ( US$ 794 million ) from the Japanese bank to acquire a 15 % stake in the project, gaining rights to a share of the liquefied natural gas ( LNG ) produced.

New oil projects would be more unlikely to continue without this kind of funding.

Another sponsors are unlikely to intervene, it is suspected. According to remoteness and higher operating costs, oil production in Australia is comparatively cheap. Over the past ten years, American gas projects have generally been delivered late and over budget, giving investors poor returns.

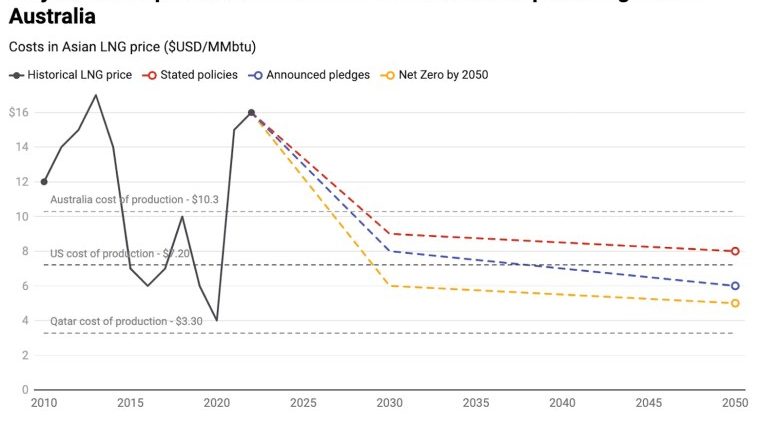

American gas projects will fight to deliver gas at prices that are competitive with those that are expected in the future. In 2022, Russia’s invasion of Ukraine triggered a surge in demand for LNG. The world is currently dealing with a significant glut of oil.

In two years, significant new Gas volumes will be available from Middle Eastern, primarily Qatar, and North America, at the same time as oil demand declines in important markets. According to the American government’s personal analysis, the cost of producing LNG from these producers is significantly lower than the cost of producing it in Australia.

If we left it up to the business, Australia’s extremely weak gas imports would gain market share. But it’s not being left up to the business. To appear practical, Japan is underwriting fresh oil projects in order to make money-losing tasks seem attractive. And that makes it much more difficult for Australia to transition to a rewarding alternative business.

Tokyo’s bright lights will stay glowing

Yamagami Shingo, the embassy to Japan, claimed last year that American gas exports were essential to keeping Tokyo’s neon lights glowing.

In fact, Japan is then reselling more Gas to other Asian countries than it imports from Australia. Over the next ten years, Chinese gas companies have agreements to purchase more than Japan will use domestically, and they intend to sell the excess oil in other Asian markets.

This is a direct result of official policy, which supports Asian firms in supplying that need by providing financial support for oil transfer stations and gas-fired power vegetation and offering financial help for those that are in need of Southeast Asia.

This is not hidden. It’s an empty purpose. The Chinese government wants its companies to “handle” 100 million kilograms of LNG annually by 2030, which is far more than Japan will need to satisfy its energy needs.

Why? Maintaining impact in the region’s LNG market is crucial to Japan’s government’s individual energy security.

Solar offer Japan real energy security

The oil market has attempted to portray gas as being more eco-friendly than fuel or as a transition fuel. In truth, oil is a risky fossil fuel. It’s generally gas, 80 times more potent in heating the earth than carbon monoxide. Since the Industrial Revolution, metal has added almost a third ( 30 % ) of the extra heat building up.

Meg O’Neill, the head of Woodside, claims that American gas exports” you help Asia decarbonize by replacing coal.” However, fuel has a higher carbon footprint than coal. Leaks of metal are quite prevalent throughout the fuel supply chain. For pollution to be on par with fuel and gas, you just need a very small leakage.

Japan’s personal power grid is green while it purchases and sells Asian gas. The government then plans to double the part of biofuels– rising from 18 % of energy generation in 2019 to 37 % by 2030 – while gasoline- fired power drops.

Japan’s need for oil at home is now falling. It fell 18 % in the generation to 2022. In 2023 only, demand for oil fell by 8 %.

By reducing its reliance on imported oil, switching to renewable electricity would increase Japan’s energy security even further. By 2035, according to recent research, Japan may have a 90 % clean power system.

Without Chinese funds, Asian gas would become dwindling

In the five times to 2017, Australia’s gas market grew considerably. By 2019 Australia became the country’s largest LNG supplier. This is amazing given how isolated and comparatively little Australia’s oil reserves are, according to an analysis from the Institute for Energy Economics and Financial Analysis.

Australia’s transition to a fossil fuel giant was aided by foreign incentives, including Japan’s money. However, these subsidies wo n’t long serve our needs. The government wants to grow the green sectors for the future by continuing to permit discounted investment in new fuel projects, which divert investment, workplace, and supply chain capacity apart from these projects.

This does n’t mean turning our back on Japan. Japan has a great need for electricity. However, it may obtain it without using fossil fuels. Japan and Australia could work together to provide crucial minerals and green metals for batteries and renewable energy, clean ammonia for fertilizers and industries, and green gas for transportation and business.

Acknowledgments: Ben McLeod ( Quantitative analyst, Climate Council ) and Josh Runciman ( Lead analyst, Australian Gas, IEEFA ) provided data used in the article.

Wesley Morgan is Research Fellow, Griffith Asia Institute, Griffith University

The Conversation has republished this post under a Creative Commons license. Read the original post.