China’s property fixes leave investors in suspense – Asia Times

” The China capital deal is back”. Or at least but says Société Générale, which reckons Beijing’s current efforts to fix the house crisis has moved Asia’s biggest sector beyond the” trust problems” that dominated China’s market tale in 2023.

A fair watch? The jury is still out as to how China’s home stocks last year entered a professional keep market amid concerns Beijing is n’t acting desperately or bravely enough to maintain the sector.

Although the US$ 7 trillion investment market retreat from a 2021 optimum to January 2024 may be over, buyers are still paused by the extreme volatility in Shanghai and Shenzhen areas.

Yet so,” the market is starting to get some assurance that the earnings crisis is coming to an end, as the latest earnings time appears to suggest”, says Wei Yao, mind of Asia- Pacific research at Société Générale.

” Unlike the revenue growth of 2 % – 1 % ex- financials – in 2023, the weakest since 2020, the consensus revenue growth estimate of 4 % – and 7.5 % ex- financials– for this year is closer to the GDP growth forecast and looks plausible, in our view”, Yao says, citing Beijing’s 5 % economic growth target.

Some see related perks emerging. ” We see China’s companies gaining momentum, particularly if stimulus policies meet marketplace anticipation”, adds Jonathan Fortun, scholar at the Institute of International Finance in Washington DC.

The government’s recent announcement to stabilize the struggling property sector, which has historically contributed up to 25 % of GDP, is the main driver.

Recent moves to revive the sector include prodding , local , state authorities to purchase unsold , properties , and reducing the amount home buyers need for a deposit.

According to Kelvin Wong, senior analyst at currency broker Oanda,” This latest set of positive macro data suggests the piecemeal stimulus measures from China’s top policymakers are working to stop the deflationary risk spiral that has been triggered by the significant slowdown inherent in the domestic , property , market.”

Logan Wright, economist at Rhodium Group, says “it’s reasonable to expect” that construction activity” will stabilize soon”.

However, the fact that shares of Chinese developers are now down more than 20 % from their peak in May suggests that investors still believe Team Xi needs to work harder to restore confidence.

Despite all the talk of Xi and Premier Li Qiang rolling up their sleeves to promote property,” there has n’t been a clean-up,” says Natixis economist Alicia Garcia-Herrera. ” China looks more like Japan than the US or Spain,” the author claims.

Will local governments in China experience a crisis similar to that that afflicted Japanese banks in the 1990s? This is still a question. Beijing’s slow pace of action could mean a “longer, more protracted adjustment”, Garcia- Herrero says.

Analysts at Bank of Communications Co predicted that recent policy changes would increase sales by more than 1 trillion yuan ($ 138 billion ) in a report released last week.

The reason investors might take notice, says Tracy Chen, a portfolio manager at , Brandywine , Global, is that China’s latest “property market rescue package is focused more on risk management than engineering another property boom. It aims to achieve multiple goals, including boosting housing demand, reducing housing inventory and supporting developers”.

Those steps include land buybacks by local governments, which will purchase excess land from developers at “appropriate” prices. While funding will come from special bond issuances, land can be used for low-cost rental housing. Bottom line: In the event of tight financial conditions, municipalities will be encouraged to purchase land.

Next, stepped up inventory reduction. Local governments will be compelled to purchase additional housing stock through local, state-owned organizations and convert it to affordable rental housing. Then, as a result of relaxed home loan requirements, will there be more funding for unfinished projects.

These include record lows, with minimum down payments being cut by another 5 percentage points to 15 % for first homes and 25 % for second homes, both of which are marked by record lows. There are no longer any restrictions on the maximum mortgage interest rates.

The rescue package is a step toward stabilizing China’s real estate market, but Chen says Chen’s success depends on overcoming significant difficulties and restoring households ‘ confidence in buying new homes. ” However, the stimulus may fall short again due to the size of the supply problem. The inventory purchases ‘ scale, funding, and implementation are ambiguous and underwhelming.

Hence, Chen adds,” the rescue package is not a game- changer yet. Foresightful and obstinate policies are required for the supply of housing in mountainous regions. Policymakers need to go big to revive homebuyers ‘ confidence. The scope of the property inventory supply issue likely will derail China’s economy’s growth for years to come, despite a more substantial intervention.

Raymond Yeung, chief Greater China economist at Australia &, New Zealand Banking Group, notes that Team Xi could be” treading a tightrope” if the move to reduce mortgage rates “fails to revive demand”. Because a lower downpayment ratio increases the risk of negative equity in the sector overall.

This is more compelling just for Xi to implement even more drastic reforms. As Xi’s policymakers attempt to deleverage the economy, they must find a more difficult balance. Beijing may experience internal pressure to hit the gas again as global headwinds increase in terms of fiscal and monetary stimulus.

” China’s economy is marred by insufficient domestic demand”, says Emily Jin, an analyst at advisory firm Datenna. ” For years, analysts have urged Beijing to boost consumption’s role in China’s economy, to little avail. The 5.2 % increase in consumer demand in 2023, largely attributable to a low base effect from pandemic consumption levels, may not hold up until 2024.

To be sure, China’s deflation is cheering many bond investors. In early March, yields on 30- year bonds hit a record low of 2.4 %. Yet Beijing’s fiscal spending plans– and its debt issuance plans – mean Xi and Li must tread carefully.

China, for example, is selling a record 1 trillion yuan ($ 138 billion ) of ultra- long- term bonds, more than two times the average issuance between 2019 and 2023.

Beijing still needs to work to create a long-term rally in stocks, though. However, recent efforts to encourage local governments to buy apartments could have a significant impact on reducing deflationary risks.

The effort “does represent a significant evolution in the government’s response to the property crisis”, says Andrew Batson, an analyst at Gavekal Dragonomics. ” The solution is n’t here yet, but the , chances of a solution , actually arriving are now much higher”.

It’s reasonable, Batson says, to call the plan” an early downpayment on the recent promise of a new approach” to stabilizing a sector that generates a disproportionate amount of China’s economic growth.

Construction is slowing down significantly, and default risks are rising among developers, from big companies like state-owned companies like to smaller private companies, with the stock of unsold homes and empty land at their highest levels in years. Efforts are still being made to make China Evergrande Group default risks a thing of the past.

In recent months, the People’s Bank of China has enabled lending facilities to gorge on finished- but- unsold housing, but more arguably needs to be done, analysts say.

Any game-changing housing easing measures, including those for housing destocking, would likely require significantly more funding than is currently available, according to Goldman Sachs ‘ Lisheng Wang.

However, the solution to the housing oversupply will be more important than the amount of liquidity in the system. That implies that any adjustment will ultimately require balancing the needs of developers and the supply side of the housing market with efforts to support the demand side of the economy.

A number of failed government initiatives to stabilize real estate, as Batson sees it, have been undermined by three issues.

One, a hyper- focus on the demand rather than the supply side. Two, a disinclination to provide sufficient scale of direct financial support from the central government. Three, opaque efforts to boost the market, which have limited the positive impact on confidence.

Although these issues have not yet been fully resolved, recent policy shifts “mark a step forward on all three fronts,” Batson claims.

Thus, the focus of the entire world is on what Chinese leaders will do next. Putting aside the occasional green shoot, global investors are still concerned about the deflationary strains still having an impact on the economy.

The PBOC runs the risk of letting deflationary forces fester without taking decisive action, as Japan would have it done. Another is that Beijing’s officials may be overly optimistic about the state of world demand.

In response, many global funds are also investing in trust- but verify crouch as Beijing announces more stimulus and increases manufacturing to revive the economy.

According to analyst Xiao Jinchuan of Guangfa Securities Co., the question is whether” the roll-out of policies like the large-scale equipment upgrade will continue to support demand for the manufacturing sector.”

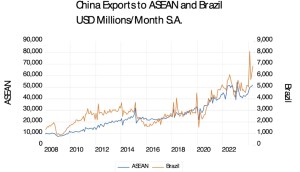

Looking at China’s manufacturing growth, says Jeremy Mark, a senior fellow at the Geoeconomics Center of the Atlantic Council, it’s safe to “assume that much of that expansion is likely to go straight to exports”.

Defeating deflation, though, requires bold moves on the supply side, too. The stock rally China bulls like Société Générale are anticipating are currently still outnumbered by the wait-and-see bears as Xi and Li signal further moves to clean up the property sector.

Follow William Pesek on X at @WilliamPesek

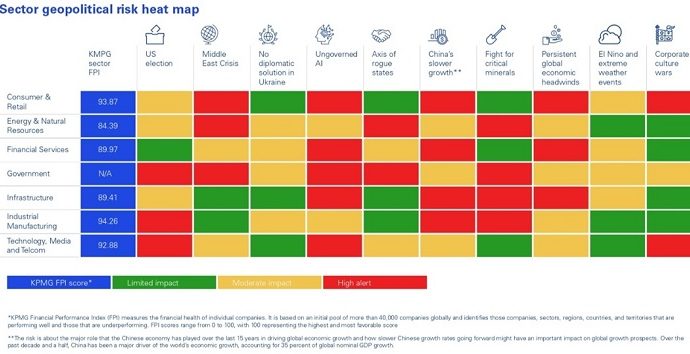

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.