Syed Ahmad Fuqaha believes there’s blue in the red ocean, and, in letting startups fail while it’s cheap

- 10th month as , businessman with Katsana, an business mobility solutions provider

- Shutting down a significant item taught difficult lessons about adapting to business challenges.

” To cultivate fresh companies, you have to let them fail. Let them flunk when they are still on the cheap, soars Syed Ahmad Fuqaha, the founder and CEO of Katsana, who founded it in April 2014. Reflecting on a decade of entrepreneurship, he does n’t mince words about the company ecology:” Currently, there’s almost no street to fail. It’s the epitome of entrepreneurs. Innovation is about failing, failing strong and profitably. If someone wanted to know what the government should be doing, I’d suggest they may provide more chances of failing.

As his business celebrates its 10th anniversary, Fuqaha activists for a dramatic change in how we nurture fresh companies. His message is clear: make more options for startups to neglect quick and inexpensively. It’s a theory that flies in the face of some government initiatives, which Fuqaha, who was a boss with business JomSocial which was sold in 2013 to a Silicon Valley company,  , sees as extremely safe. In his watch, real innovation thrives on the freedom to take risks, slip, and study from those mistakes.  ,

This counterintuitive approach to developing technology has shaped Fuqaha and Katsana’s voyage from a budding company to a focused business provider offering integrated fleet solutions , with , over 3, 600 customers, while offering useful lessons for entrepreneurs. Along the way he has raised US$ 1.39 million ( RM6.5 million ) in funding from Axiata’s Digital Innovation Fund ( ADIF ) managed by Intres Capital in 2016 , and US$ 535, 200 ( RM2.5 , million ) in , venture debt from Malaysian Debt Ventures ( MDV ) in 2022.  ,

Lesson 1: Understand when to cut your loses

Fuqaha’s words are n’t just rhetoric – they’re born from experience. The rise and fall of DriveMark, one of the bank’s first advances, was perhaps best illustrated by the company’s own trip, which is punctuated by calculated dangers and proper pivots.

Fuqaha’s words are n’t just rhetoric – they’re born from experience. The rise and fall of DriveMark, one of the bank’s first advances, was perhaps best illustrated by the company’s own trip, which is punctuated by calculated dangers and proper pivots.

A smartphone-based scoring system called DriveMark was created to bridge the gap between driver behavior and insurance premiums. It was intended to promote safer driving. At its peak, it boasted an impressive 80, 000 to 90, 000 users. ” We came up with a solution that is very much scalable, using smartphones”, Fuqaha explains, highlighting the system’s accessibility and initial promise.

However, DriveMark soon encountered challenges unique to the Malaysian market. Malaysian insurance premiums are comparatively low compared to those in the US or the UK, where young or first-time drivers can be exorbitantly expensive. ” In Malaysia, on average, if I’m not mistaken, takaful is around US$ 150 ( RM700 ). For general insurance, the premium is around US$ 192.7 ( RM900 ) on average”.

This pricing structure presented a fundamental challenge to the business model of DriveMark. The majority of users fell into a less exciting category, whereas the top performers with the highest DriveMark scores could receive significant rebates of up to RM160, which were entirely funded by DriveMark. ” For a majority of users, the RM15-RM20 in rebate is just too small to be meaningful”, Fuqaha explains, highlighting the bell curve distribution of benefits.

]RM1 = US$ 0.214]

Ultimately, DriveMark’s business model proved unsustainable. Relying on insurance renewal commissions that averaged only RM70 to RM80 per user, the economics did n’t work out. Two years into the pandemic, Katsana had to make the difficult but necessary decision to stop using DriveMark despite some respectable income. ” We just decided to kill it”, Fuqaha states, acknowledging the need to adapt to market realities

The decision was n’t made hastily. In fact, Katsana spent a year exploring ways to pivot and salvage the technology. After a year of refuting the idea and attempting to convert it to a method for businesses to measure Scope 3 carbon emissions, particularly those involving mobility emissions, we shut DriveMark down in 2022, Fuqaha said.  ,

User privacy and data protection were key components of the process. ” The shut down meant erasure of user data, as we did not want to abuse the consent they gave to DriveMark”, Fuqaha explains.  ,

This decision to shutter DriveMark, while difficult, exemplifies Fuqaha’s philosophy of adapting. As a provider of solutions, Katsana was able to refocus its resources on more promising areas of its business, which ultimately led to a more sustainable enterprise market.  ,

The driveMark experience served as a valuable lesson in Katsana’s decade-long journey, emphasizing the importance of adapting to market conditions and being willing to let go of initiatives that do n’t align with the company’s core strengths or financial viability.

Lesson 2: The pandemic pivot: Finding the silver lining

As with businesses worldwide, the Covid-19 pandemic forced Katsana to reevaluate its operations. However, Fuqaha views this disruption as a” silver lining” that allowed the company to sharpen its focus.

Prior to the pandemic, Katsana was active in various telematics-related auto sector. The business also provided fleet management solutions for business clients like bus and taxi drivers, as well as GPS tracking solutions for private vehicles and the RunMark smartphone-based driver scoring system. They were also looking into potential opportunities in the insurance industry, and they were putting their knowledge and technology to use to create usage-based insurance products.

” We had a silver lining from the pandemic,” said the spokesperson. We made the decision to concentrate on the three areas that “made sense for us financially” and to stop providing tracking for private vehicles, Fuqaha said.

While there was money to be made in the private vehicle market, the economics simply did n’t work for Katsana’s high-touch operational model. ” For private vehicles, we have so many competitors out there. Fuqaha explains that there are numerous GPS trackers that can be purchased on Shopee for about RM70.

Katsana would primarily concentrate on its enterprise solutions, particularly fleet management for businesses, as a result of the strategic refocus. This allowed the company to leverage its strengths in developing sophisticated, tailored solutions that go beyond the capabilities of off-the-shelf products.

” What we are doing for enterprises, it makes a lot of sense and it is the best use of our capability”, Fuqaha explains. This change required removing the consumer market and concentrating on larger clients with more complex needs.

By streamlining its offerings, Katsana was able to focus its resources on developing more advanced fleet management solutions, including features for monitoring driver behavior ( building on its DriveMark experience ), vehicle performance, and operational efficiency.

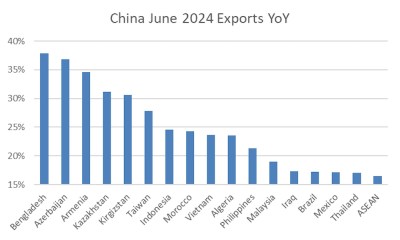

This refocusing made it possible for Katsana to stand out in a noisy market. While many competitors offer white-label solutions from countries like China, Katsana’s intensified focus enabled it to develop unique, high-value offerings for enterprise clients. ” What we do is quite unique”, Fuqaha asserts, highlighting the company’s established expertise in providing sophisticated fleet management tools for larger operations.

Katsana went from being a company spread across multiple market segments to a more focused operation as a result of the pandemic-induced strategic realignment. This change enabled the business to escape the abyss of the pandemic and allowed for more sustainable expansion in the post-pandemic economy.

Lesson 3: Strategic focus trumps rapid expansion

Fuqaha’s journey has included expanding regional, leading to ongoing projects in Indonesia and Brunei. This expansion predated the pandemic. However, he remains cautious about further expansion. ” It is an interesting proposition, but right now, if you want to have a broader presence over there, it is going to stretch us thin”.

This measured approach to growth demonstrates a maturation that comes from experience. Fuqaha has learned to play to its strengths and keep a laser focus on its core competencies as it continues to serve its existing regional clients as it pursues each opportunity rather than chasing every one.

When the pandemic struck, which presented significant challenges to businesses around the world, this strategic focus proved crucial. Katsana, however, managed to navigate the turbulent times without reducing its workforce, which currently stands at around 45 employees. The company’s resilience stemmed from a combination of its focused strategy and pragmatic decision-making.

” During the pandemic, we made a conscious decision not to hire anymore”, Fuqaha reveals, highlighting the importance of adaptability in times of crisis. He chose a more measured strategy as opposed to fighting against unchecked market forces. He also strategically used government funding, utilizing Malaysian Debt Ventures ‘ Covid Relief Fund for Startup program to boost finances.

Fuqaha was able to weather the storm effectively by maintaining its focus on its core competencies while utilizing government support mechanisms.  ,

Looking to the future: A focused SaaS vision

Katsana enters its second decade with a more in-depth analysis and clearer vision than ever. ” Before the pandemic, we had a lot of things on our plate”, Fuqaha reflects. ” We are now more focused,” she said. No doubt, right before the pandemic, we were on the verge of profitability, even last year we were”.

This transition from a multi-faceted startup to a specialized enterprise solutions provider encapsulates many of the difficulties faced by tech companies in emerging markets. When focus and specialization are what is truly needed, Fuqaha’s story is one of learning to ignore the siren song of diversification.

Looking ahead, Fuqaha has set his sights on transforming Katsana into a Software as a Service ( SaaS ) company. This shift aims to leverage the company’s expertise in fleet management and telematics into a scalable, cloud-based solution. By adopting a SaaS model, Katsana can potentially expand its reach while streamlining its operations and lowering hardware reliance.

Fuqaha says,” We’re developing solutions that are quite unique,” giving a hint as to the sophisticated software features that will make up their SaaS offering’s foundation. This change allows Katsana to compete more effectively both domestically and internationally in line with global trends in enterprise technology.

As Fuqaha approaches his tenth year as a founder, his journey has revealed valuable lessons that could be applied to other startup founders. ” Opt for proven business models,” he advises, noting that red oceans still offer plenty of opportunities for those who understand their market and positioning. Startups are frequently encouraged to chase “blue ocean” opportunities. Red oceans frequently have enough space for multiple providers to coexist, each with their own distinctive offering.

Moreover, Fuqaha emphasizes the importance of nurturing existing customer relationships. The phrase” Existing customers are your best sales channel. Spend time with your current customers to become your supporters rather than just developing new features to make your products more appealing. Meet them at kopitiams, send them greeting cards, set up webinars. These are soft approaches that work”, he advises.

In a sector where many are looking for the next big thing, Katsana has found success by focusing on what it does best: offering top-tier fleet management solutions to businesses that are truly in need while also valuing and developing its existing customer base. After all, with a decade of hard-earned wisdom under its belt, Katsana, in the view of Fuqaha, is well-positioned to navigate the roads ahead, wherever they may lead.