‘Trump put’ takes unpredictable hold on global affairs – Asia Times

Donald Trump has not been elected the next president of the United States. He is not even the official Republican candidate. But Trump’s presence in the 2024 electoral race is already dictating domestic and foreign political agendas – without his even setting foot in the White House for a second term.

The idea that presidential wannabes influence politics before an election is nothing new. Candidates shape the domestic agenda to help them win elections or govern afterward.

Other countries also always prepare for the new leader to come. Yet the influence Trump is having right now is more excessive and more disruptive than we’ve previously seen this far out from an election, both at home and abroad.

Trump is exerting unprecedented influence on US foreign policy – for example, in relation to Ukraine. Trump recently rallied his supporters to oppose a joint bill to provide aid to Ukraine and to tighten up controls at the Mexican border in the US Senate.

Democrats were forced to create a new bill on Ukraine aid. The Senate finally approved a bill giving Ukraine US$95 billion. Former Speaker of the House of Representatives Nancy Pelosi has warned that Trump has the ability to empower those Republicans opposed to funding Ukraine to prevent future support. The extent to which Trump’s position was taken seriously speaks volumes about his current political impact on foreign policy.

It is not just the US government that must react to Trump on foreign issues. The rest of the world must react, too. A Harvard University government scholar, Professor Graham Allison, identifies two dynamics at play: the “Trump hedge” and the “Trump put.”

The Trump hedge

The “Trump hedge” refers to countries’ attempts to prepare for a Trump administration. This may sound like common sense, but the problem with hedging in the current climate is that it is difficult to know what you are hedging against with Trump.

He is unpredictable – something he says is a deliberate strategy. If your competitors don’t know what’s coming, they explicitly can’t hedge. And that, Trump suggests, creates an advantage.

But unpredictability makes other countries feel insecure. Trump suggests that big changes could (or perhaps could not) be coming, such as leaving NATO, abandoning US commitments to climate change and setting new trade rules for China and Europe.

The Trump put

How do you make decisions now knowing that the world may transform on inauguration day? The “Trump put” refers to the fact that states are now choosing to delay decisions to see what happens. This delay is not prudence. It is the product of confusion and a feeling that the world is in limbo.

Trump is already creating major disruption this way, and it is not beneficial for international politics.

For example, Trump has always been useful to Vladimir Putin, who may be emboldened now by even the promise of a Trump victory and be unwilling to resolve the Ukraine conflict before then. With Putin’s main opponent threat to the Kremlin Alexei Navalny now dead, this is a bigger concern than ever.

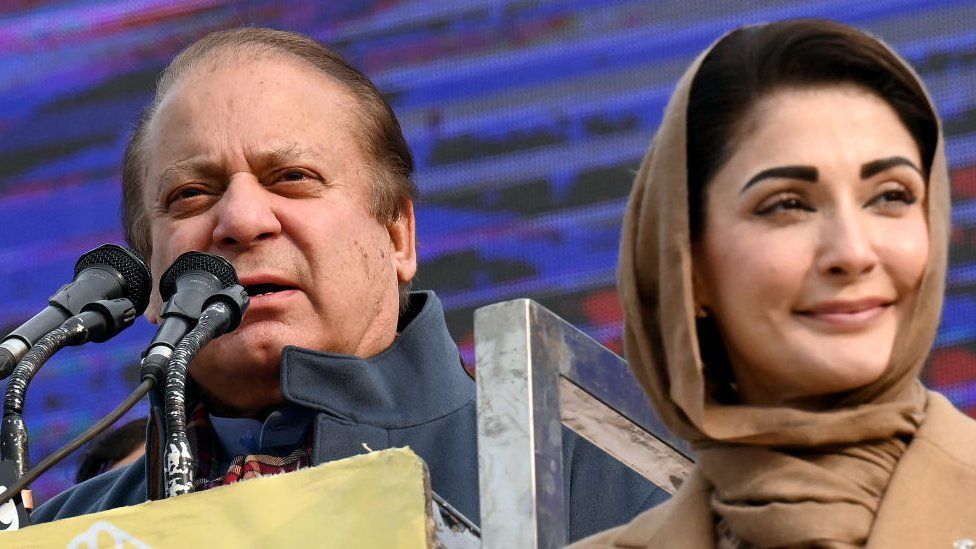

Israel may also feel it can ignore current US proposals for a ceasefire if it knows that the man who moved the US embassy to Jerusalem will soon be in charge.

Meanwhile, NATO is believed to have shifted away from appointing a female secretary-general because of concerns about Trump’s lack of respect for women leaders. And in Canada, there’s talk of the date of the general election being influenced by the Trump campaign.

Back in the US

Trump is also wielding power over domestic legislation with the final say on Republican policies. When Republican House representative Jason Smith put forward a $78 billion bipartisan tax deal earlier this year, he ran the bill past Trump first. While Trump has certainly not won over all Republicans, he is making his mark.

Yet Trump’s influence is more than lining up policy behind a potential new leader. Trump is shaping policy to bolster his chances at the ballot box. The Ukraine bill he stopped also addressed immigration.

Trump rejected the bill to keep immigration alive as a hot-button issue for his campaign and to more easily promise harsher policies – such as revoking so-called “open borders” and instigating mass deportations.

One thing is clear: the US does not get any immigration policy until it suits Trump. Few presidential candidates have been able to claim such authority.

Trump is also pushing a political strategy aimed at clearing him of involvement in the 2021 Capitol Hill attack. Earlier this month, more than 60 House Republicans signed a resolution stating that Trump did not “engage in insurrection.” Trump is influencing at the highest levels – able to shape the election by heading off claims he is not eligible for office.

More widely, the right wing of the Republican party is drawing on a potential Trump victory to ramp up ideological battles in the US. Trump is the right-wing poster child, not least because his Supreme Court appointments facilitated the overturning of Roe v Wade, the historic case that had led to US-wide abortion rights.

Trump is shaping the 2024 election itself. He dominates the headlines for all the wrong reasons (most recently, a $355 million civil fraud penalty). Yet this type of media attention has only served to galvanize his supporters at a time when Joe Biden is best known for his bad memory.

Trump’s most critical influence right now is in making the election all about the issues that he wants to campaign on – and that present him as the inevitable heir apparent to the Oval Office.

Michelle Bentley is a reader in international relations at the Royal Holloway University of London.

This article is republished from The Conversation under a Creative Commons license. Read the original article.