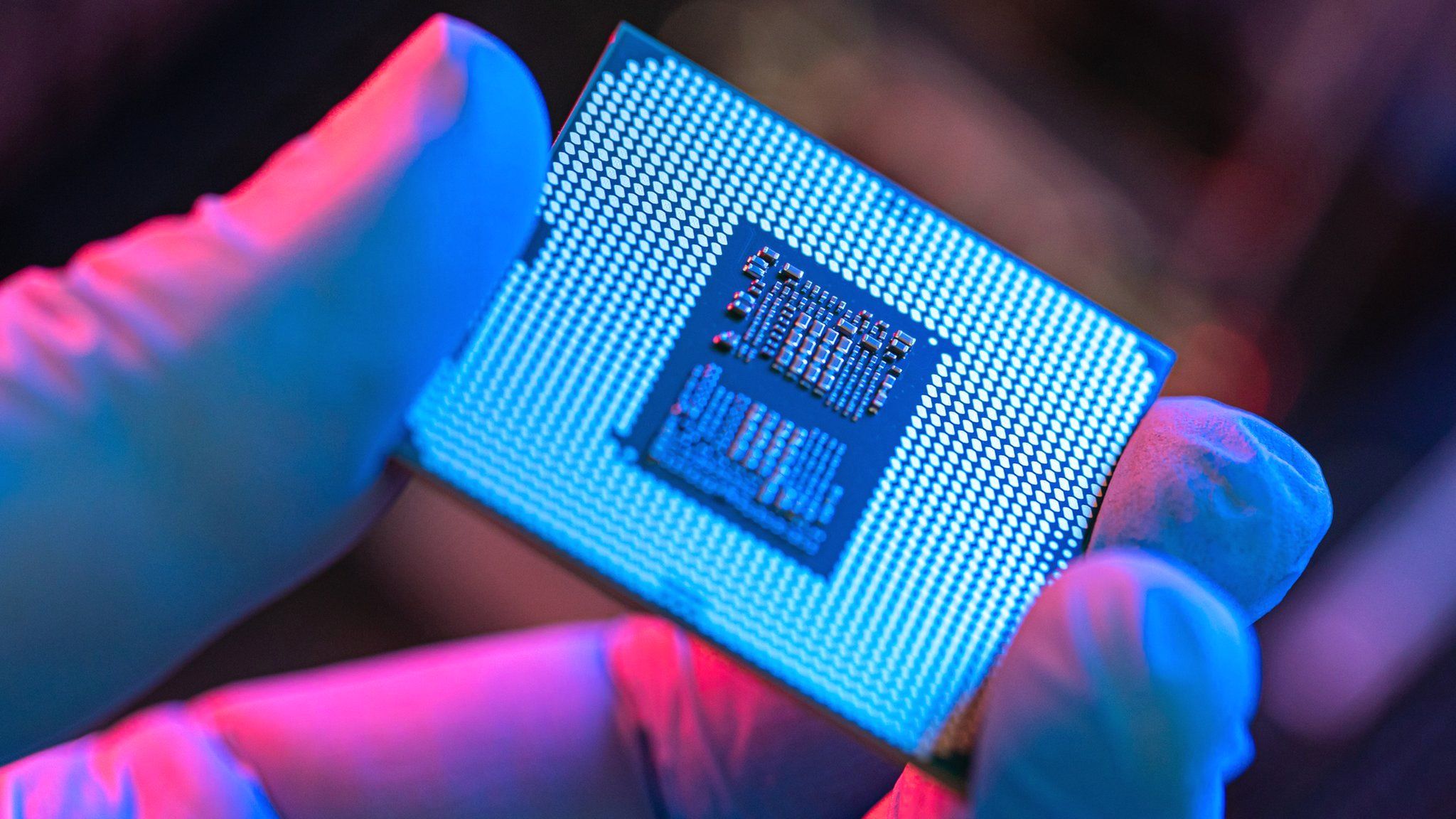

China curbs exports of key computer chip materials

shabby Graphics

shabby GraphicsThe export of two essential materials used to make laptop cards are under tighter control by the Chinese government.

Specific licenses will be required starting next month to import germanium and gallium from China, the largest metal producer in the world.

Washington’s efforts to restrict Chinese exposure to some cutting-edge microchips are what led to this.

The news comes just weeks before US Treasury Secretary Janet Yellen’s high-stakes excursion to Beijing.

The limitations were required to” safeguard national security and interests ,” according to China’s Ministry of Commerce on Monday.

Government, communications, and semiconductor equipment all use silver metals. They play a significant role in goods like thermal panel.

Semiconductors, which power everything from military equipment to mobile devices, are at the center of a contentious conflict between the two biggest economies in the world.

The US has taken action to limit China’s access to technology, including bits for artificial intelligence and computation, which it fears could be used for military purposes.

No matter where cards are made in the world, Washington announced in October that it would require licenses for businesses exporting chips to China using US equipment or program.

Places like the Netherlands and Japan have joined the efforts.

This came after the Netherlands announced earlier this year that it would limit its” most advanced” chip technology imports.

The controls are anticipated to have an impact on French scrap equipment manufacturer ASML, a significant player in the global chip supply chain.

23 different types of semiconductor production technology may be impacted by the steps, which were revealed in March.

In response to export restrictions imposed by Washington, China has often referred to the US as a” software hegemony.”

Beijing has placed limitations on US companies connected to the British government in recent months, including aviation company Lockheed Martin.

Janet Yellen, the US Treasury Secretary, has issued a warning against severing economic relations between Washington and Beijing. She is scheduled to visit China for four days starting on Thursday.

It would be devastating for us to try to detach from China, she said during a speech before Congress next month.” I believe we benefit and China benefits from trade and investment that is as empty as possible.”

The next senior US official to travel to the nation this year will be Ms. Yellen.

High-level negotiations between the two nations were resumed in June when US Secretary of State Antony Blinken met with Chinese President Xi Jinping in Beijing.

Related Subjects

More information on this tale

-

-

three days ago

-

91 more Singapore-based companies allegedly sending supplies to Myanmar military

” VERY SERIOUSLY ,” GOVERNMENT TAKES ALLEGATIONS.

Dr. Balakrishnan stated in his written response that the update would only be temporary due to the ongoing investigations and that he & nbsp was asking the MPs for their input.

There were no evidence that specific weapons were being transferred to the Myanmar military in the UN report, he added, adding that the government was looking into certain details of the alleged” hands and related products” that were shipped to it through Singapore-based companies. & nbsp,

Instead, he claimed that only spare parts and equipment fell under the category of” arms ,” with no explanation of what these made up.

” Dual – use products” were among the other significant groups of items covered in the report, along with computers, electronic components, and medical products. Additionally,” production equipment ,” which covered things like steel beams and aluminum ingots as well as pipes and valves, was listed. This equipment also included welding supplies and overhead crane.

Members would understand from these descriptions that the items do not always qualify as” arms” or” weaponry” in the traditional sense, he said. Many of them, including computers and clinical supplies, are also out of control. It is challenging to separate particular cautious deals from quite broad categories.

According to Dr. Balakrishnan, the government takes the report” quite really” and has asked Mr. Andrews to provide specific and credible evidence to support efforts.

Nine of the identified institutions, according to him, are no longer recognized by Singapore’s Accounting and Corporate Regulatory Authority, making it impossible for them to conduct business or conduct legitimate business there.

According to Dr. Balakrishnan,” this includes entities that were supposedly involved in the exchange of parts and spare parts for fighter aircraft, products for the Myanmar Navy, as well as radios, study, and electronic warfare equipment.”

He continued by saying that the majority of the 47 companies that were originally identified no longer have business relationships with Singaporean lenders.

According to him,” The lenders will evaluate the remaining accounts and take appropriate action, including increased investigation, to ensure that these entities’ transactions are not suspicious.” Such actions may make it harder for them to carry on with any undesired business.

Dr. Balakrishnan added that because Myanmar is on the Financial Action Task Force’s list, financial institutions in Singapore have also been exercising increased due diligence for buyers and transactions associated with Myanmar that pose higher risks.

He noted that this includes the time frame mentioned in Mr. Andrews’ report, which is between February 2021 and December 2022, and said,” I would like to re-state flatly that the Singapore government has no conducted any military revenue to the Myanmar government in recent years.”

In fact, Mr. Andrews himself stated in his report that” there are no signs that the Singaporean government has approved or is involved in the sale of arms and related materials to the Myanmar military.”

The government may” continue to work closely and constructively with Mr. Andrews to find certain, verifiable, and where possible judge admissible data to improve our investigations ,” Dr. Balakrishnan continued.

He continued,” Let me reiterate that the government is still committed to carrying out our plan to stop the transfer of weapons and dual-use goods to Myanmar, where there is a significant chance that they could be used to harm unarmed civilians.”

” We will not be hesitant to take action against any person or thing that violates this.”

To decouple or to de-risk â that is the question

As is frequently the case in diplomacy, the communique that the G7 leaders released in May following their meeting in Hiroshima omitted a crucial question: What is the distinction between” de – risking ,” which it expressed approval of, and” decoupling ,” which it disapproved?

These words weren’t defined in the G7 speech. It didn’t even mention that China is the main target of both decoupling and de-risking. For you, that is politics.

The United States, the United Kingdom, Canada, Japan, Germany, France, and Italy’s officials merely stated that they were coordinating their strategies for economic resilience and economic protection” based on diversifying partnerships and de-risking, no decoupling.”

The ambiguity was deliberate, as is frequently the case in geopolitics. Distinctions between the US and some of its allies were quickly covered up. Economic resilience and” economic security” are diplo-speak terms for preventing an excessive reliance on China( and, to some extent, Russia ) for essential goods and avoiding providing those nations with strategically important technologies.

Dispersion, the term that was popular up until recently, appears to mean taking a deeper break from China than de-risking, according to the president of the European Commission. De-risking suggests diversifying, putting an end to the sole reliance on China, more than withdrawing.

But in reality, expansion has also played a significant role in the decoupling to date. The distinction between coupling and de-risking for statement purposes is semantics. Because of this, despite the fact that there are significant differences between the US and its supporters in regards to their reliance on China, they were able to agree to the statement.

These variations are a reflection of their various political circumstances, particularly with regard to Taiwan. The likelihood of a Chinese military assault on the island is growing, to the point where US officials must make preparations despite their best efforts to prevent it.

Friends of Washington don’t. Japan might, at least economically, support the US in the event of an attack. It is imprisoned by its geography and history. A China strike on Taiwan would be much less likely to be perceived as a difficulty by Western allies. They might be persuaded to join a coalition of the willing, but that is not inevitably going to happen.

Therefore, the US is more concerned about giving China military-strengthening technology. It is more concerned about China cutting off vital supplies during warfare.

Federal protection is more important to governments when they are making war plans than economic efficiency. Those who, like many exporting industries like farming, think that financial markets allocate money more effectively than governments and that free trade results in the best financial outcomes may find this difficult to swallow.

However, it explains why some Republican supporters of free markets supported industrial policy efforts put forth by the Biden administration. And why, in spite of warnings from US high-tech firms that restrictions may include long-term financial repercussions, Republicans are firmly behind the Biden administration’s stepped-up efforts to block export of the most advanced semiconductor technology to China.

Although they have some of the same worries about China as the US, Western nations are not nearly as concerned about national security. Emmanuel Macron, the president of France, has cautioned Europe not to become” caught up in problems that are not ours” in reference to Taiwan.

Europeans are unhappy with the high-tech grants and buy-American regulations of the Biden administration because they believe they are deterring purchase from them just as much as from China.

Some Europeans are also wary of US work to obstruct China’s exports of high-tech goods. However, the French government gradually joined the US in limiting French companies’ exports of the most cutting-edge semiconductor manufacturing machinery to China.

In conclusion, Europe prefers” de-risking” because it opposes the US’s desire for financial isolation from China. Because it is properly ambiguous to allow allies to march to various drummers, the Biden administration accepted” de – risking.”

In actuality, but is dissipating. US-China trade in goods set a document in 2022, as did US exports to China, despite all the talk of it over the past few years, the president’s industrial policy changes, export restrictions, and company disclosures of plans to move production up to the US or to Eastern countries other than China.

At$ 36.4 billion, US farming exports to China even broke a record for the fiscal year 2022.

Despite being competitors, National companies’ supply stores are firmly established in China. China is the US’s and approximately 120 other nations’ largest trading partner, including American allies like Japan, South Korea, and Germany.

In some product categories, such as drones and thermal panels, China holds a disproportionately large market share worldwide. It is also an essential provider of countless thousands of other products. China may undoubtedly stop exporting goods to the US in a battle, so it makes sense to reduce reliance on China.

Regardless of which political euphemism is used to identify it, it is unclear how much today’s supply chains can or will be untangled outside of war.

Urban Lehner, a longtime editor and correspondent for the Wall Street Journal Asia, is now the editor-emeritus of DTN / The Progressive Farmer. & nbsp,

Copyright 2023 DTN / The Progressive Farmer is the title of this article, which was first released on July 3 by the latter news organization and is now being republished with authority by Asia Times. All right are reserved. Urban Lehner follows @ urbanize on Twitter.

âLeave my family aloneâ: Shanmugam denies allegations that sonâs firm renovated Ridout Road bungalows

Prior to this, Edwin Tong, the second minister of law, had made it clear that Livspace was no SLA’s appointed vendor and that the company had no business dealings with the agency. He added that, generally speaking, an outside advisor is hired to assess the condition of these properties inContinue Reading

China shipping drones for Russiaâs war effort: report

Despite Beijing’s steadfast denials that it is providing war materials to Moscow, Russia is reportedly importing Chinese dual-use drones for use in the Ukraine war, according to a Nikkei Asia & nbsp investigation. & nbsp,

According to the Nikkei research, between December 2022 and April 2023, Soviet companies imported at least 37 Chinese drones for US$ 103 000 for their” special military operation ,” as the Russian government refers to it in official documents.

According to the research, Russian businesses paid Chinese businesses$ 1.2 million for drone detection and jamming equipment and$ 36, 077 for ten rugged personal laptops with document designating all of the items for use in the” special military activity” to hasten customs procedures.

The Nikkei report also asserts that China exported over 30,000 drones worth more than$ 2 million to Russia between March 2022 and May 2023. Russian import records did not use the phrase” special military operation” until December 20, not long after Russian President Vladimir Putin gave his government the order to increase the supply of war supplies. & nbsp,

China continues to claim that its drones are being used on Ukrainian soldiers, which, if true, might lead to punishment from the West. & nbsp,

According to a China Ministry of Commerce official cited by Nikkei,” China calls on all relevant parties to work up to develop controls, avoid all types of drones from being used on the field in fight areas, and jointly promote global peace and local stability.” & nbsp,

The largest drone manufacturer in the world, DJI, had suspended its operations in Russia and Ukraine, according to Asia Times’ & nbsp report from May 2022. DJI reiterated its position in a number of statements, stating that it was suspending operations while inside compliance reviews were conducted in different regions. & nbsp,

According to the business, it does not offer products to customers who intend to use them for defense or harmful purposes as a matter of policy.

DJI also criticized the unauthorized use of its drones during the Ukraine War, claiming that doing so violated its business values and that it would halt sales in Russia and Ukraine to prevent for use. & nbsp,

While DJI’s main products are little drones used for flying shooting and pictures, Russia and Ukraine are also known to use these aircraft for ambushes, shooting, gun noticing, and reconnaissance. Larger drones that weigh more than 25 pounds you be altered for use in attacks.

Although the degree of its aid is still unknown, China has reportedly sent additional military aid to support Russia’s stumbling war efforts in Ukraine. & nbsp,

Paul Haenle asserted in a February 2023 Q & amp, A for the Carnegie Endowment for International Peace, that Chinese state-owned defense companies had shipped jet fighter parts, jamming technology, and navigation equipment to defense firms owned by the Russian government. & nbsp,

Haenle also reaffirmed the Biden administration’s place that China would suffer if it violated international sanctions and sent weapons to Russia, noting that some Chinese businesses had already faced US sanctions for supplying Russia with dual-use technology.

The items Haenle identifies, however, were reportedly ordered prior to the Ukraine War, according to Alexander Gabuev, who also claims that Chinese and Russian defense firms were on the US Specially Designated Nationals and Blocked Persons List( SDN List ) at the time. & nbsp,

Gabuev says it’s difficult to think of anything the US could do to stop the sanctioned Chinese and Russian businesses from shipping bridge across international borders. He points out that the US might react by sanctioning various aspects of the Taiwanese economy, which Beijing might interpret as US using the Ukraine war as an excuse to impose punitive measures meant to weaken a close-peer rival. & nbsp,

Since the start of the Ukraine war, the Chinese government and Chinese businesses have been extremely cautious about doing business with Russia, according to Li Mingjiang, an assistant professor at the S Rajaratnam School of International Studies( RSS ) at Nanyang Technological University in Singapore. & nbsp,

Li does, however, caution that little Taiwanese businesses might be persuaded to sell to Russia in order to take risks. At the official degree, he claims, China does not want to get involved or risk being accused of selling military hardware to Russia for use in Ukraine. & nbsp,

China’s delicate and complex strategy for balancing the Ukraine war with Russia and the West prevents either side from winning to simply or losing too badly. & nbsp,

A resounding Russian battle is the last thing China wants because it would probably encourage the US and its allies to consider a tougher stance against Taiwan, including by providing the self-governing island with more sophisticated weapons.

Therefore, it is in China’s best attention to support Russia in the ongoing conflict in Ukraine. China may be torn between helping Russia and imposing restrictions on its businesses and leaders, though.

On the other hand, a Soviet success might not be entirely in China’s favor. In that situation, Ukraine suffers significant military setbacks, European governments capitulate to rising social and economic upheaval brought on by skyrocketing energy prices, and American support for Ukraine crumbles. & nbsp,

Reestablishing economic and power ties between Russia and Europe, reducing Russia’s existing reliance on China, and maintaining Russia as a major power rival in Eurasia are likely to be discussed in the coming peace talks.

A standoff in which neither aspect delivers a crushing blow could be advantageous for China in the long run. A Vietnamese War-style truce might end the conflict indecisively. & nbsp,

In that case, Beijing will have more influence over the price of Russia’s electricity and natural materials exports, lingering diplomatic boundary disputes in the Far East, and military-tech cooperation as a result of being seriously sanctioned and socially isolated. & nbsp,

In the upcoming fresh Cold War with the West, that scenario would produce Russia a junior partner of China rather than an equal one. & nbsp,

Africa and ASEAN enter partnership to promote digital economies

Areas of integration include finance, decentralized assets, and funding.On October 1st, the second Africa x ASEAN Digital Economies and Fintech quarter begins.In order to promote electronic economies, Africa and ASEAN signed a partnership agreement that identified banking, decentralized assets, and funding as the convergence focus. Officials, organization leaders, and top finance…Continue Reading

Japan shuns the market with chip firm nationalization

The government-controlled Japan Investment Corporation ( JIC ) will acquire TOKYO – JSR, one of the top two photoresist manufacturers in the semiconductor industry, and delist it from the Tokyo Stock Exchange.

As Japan tightens its ties with US export restrictions on high-end chips and chip-making technology to China, the proper state purchase, valued at 909.3 billion yen( US$ 6.4 billion ), was announced on June 26.

Crucial elements in chip-making supply chains are photoresists, the light-sensitive materials used to type circuit patterns on silicon and other types of chips during the photo-lithographic approach.

A 20-day sweet give period should start by late December after receiving regulatory authorization, with JIC acquiring 100 % possession of JSR in first 2024. Mizuho Bank and the Development Bank of Japan may provide financing for the transaction.

Due to the bargain, investors’ preferences, information disclosure required to analyze market trends, and completely market economics are most likely to suffer.

At the same time, from Tokyo’s perspective, the possibility of a foreign invasion and” environmentalist” owners interfering in Chinese management decisions will be eliminated.

Semiconductors have been identified as a crucial strategic industry by the government as part of Prime Minister Fumio Kishida’s” fresh capitalism” initiative, an ambiguous strategy to promote economic growth, raise wages, and more fairly spread wealth.

In a statement to reporters last month, Kishida stated that” securing an industrial center of transistor technology in Japan is essential from both the standpoints of renewables and economic security.”

The sweet offer, according to JIC,” is designed to help JSR to smoothly and quickly market its bold, moderate – to long-term strategic investments without being constrained by the short – term impact on business efficiency ,” or without financial market discipline.

Additionally, the buy-out will allow JSR to” flexibly pursue structural reforms and restructuring” and” provide an opportunity for industry reorganization and private fund acquisition to strengthen the international competitiveness of[ Japan’s ] semiconductor materials industry ,” according to a company statement. & nbsp,

The transaction, in the opinion of JSR management,” reinforces our solid business foundation and accelerates green growth, and it’s the best strategic option at this point” for allJSR stakeholders.

What then is the real motivation behind the offer? Nearly 90 % of the global market for semiconductor photoresists is controlled by JSR, its main rival Tokyo Ohka Kogyo( TOK ), and three other Japanese companies, Shin – Etsu Chemical, Fujifilm, and Sumitomo Chemical.

The market share of JSR is already predicted to be between 30 and 35 %, while TOK’s share is probably only a few percentage points lower. This industry does not clearly need government support given its prominent position on the global market.

Additionally, JSR doesn’t seem to require any additional funding that JIC might be able to offer. The business has a strong balance sheet, and internal resources are used to cover cash expenditures. In the financial year that ends on March 2024, control hopes to achieve a 9.5 % operating margin.

However, a deep-pocked and like-minded state owner would be of great assistance if” strong strategic investments” entails doubling capital spending.

Mitsunobu Koshiba, chairman emeritus of JSR and an outside chairman of Rapidus, the business founded in 2022 to offer superior logic chip factory solutions in Japan, seems to be one website between federal policy and the buy-out. By 2027, Rapidus, which collaborates with IBM, hopes to achieve mass production at two nanometers( 2nm ).

The” Post 5G Information and Communication Systems Infrastructure Enhancement R & amp, D Project,” run by Japan’s state New Energy and Industrial Technology Development Organization ( NEDO ), also includes Rapidus. Additionally, it collaborates with IMEC, a global nanoelectronics R & amp, D center with its headquarters in Belgium.

JSR is the owner of Inpria, an Oregon-based business that specializes in metal-oxide photoresists( the majority are made of plastics ). By the end of the decade, Inpria‘s resists, which were created especially for EUV printing, are anticipated to pave the way for chip generation at 1nm and smaller.

The advanced cards will be essential to proper industries like quantum computing, automatic vehicles, neuro-morphic devices, and 6G telecommunications. JSR and Inpria collaborate attentively with leading device manufacturers like Intel, TSMC, Samsung Electronics, and SK Hynix.

JSR is more than just a producer of silicon materials. Additionally, compared to 29 % for semiconductor materials, its life sciences division is anticipated to produce 32 % of sales this fiscal year. Electronic components like display, integrated circuit packaging, and plastics are expected to make 11 % of the contribution, followed by other materials of 4 %.

The life sciences industry, which is centered on biopharmaceuticals, needs to invest in potential development, product development, advertising, and operational effectiveness. For a portion of JSR’s capital expenditure and management attention, it competes with electrical materials.

JSR control anticipates that JIC will help” a thorough expansion strategy and action plan” for the life sciences. It could be argued that dividing JSR into two companies, which would be easier to do without open shareholder disputes, would provide the most beneficial support.

An impartial electronic materials company could focus on overcoming obstacles from smaller Chinese, South Korean, American, German, and fresh Chinese competitors who are all vying for a larger market share while also staying ahead of TOK in photoresists.

The tender offer will be made for 4, 350 yen($ 30 ), a 34.5 % premium over the asking price just before the buy-out was revealed, and only 4 % below the all-time high set in December 2021.

JSR closed at 4, 110 hankering on June 30, a 27 % increase over the news of the deal. Over the same five days, TOK’s share price increased by 9 %.

For TOK or other material manufacturers, an intense rival with preferential financing would not be great news, but investors may soon have few options.

On the other hand, owners are currently profitable. As one trader stated in a private conversation, he was happy to accept the profit even though his account did not purchase JSR in anticipation of repurchase.

Policy-driven investments was, of course, refuse, as it did in the cases of Japan Display, which stood no prospect against the South Koreans and Chinese, and Elpida, a DRAM manufacturer that Micron bought for incredibly low prices after Chinese banks failed.

Or, coverage success may result in the acquisition and delisting of additional Chinese tech companies, which could be advantageous to current shareholders.

Eric Johnson, Director of JSR, referred to JIC as a” natural source of capital” while speaking on camera for investors and the media. However, the Development Bank of Japan and 24 major private sector companies make up the remaining 96.5 % of JIC, which is owned by the Chinese state.

According to a company speech, JIC defines its function as follows:” We, Japan Investment Corporation, provide risk investment to fields in which most secret owners are reluctant to invest.” While enhancing global fight, we want to encourage business and industry move.

Reluctance to spend, however, does not appear to be an issue in this instance. According to the bank’s website, JSR is followed by experts from 19 stocks companies. 54 % of its shares are owned by foreign buyers.

Additionally, JSR anticipates a transitional buy-out, stating in its” Highlights of the Transaction” statement that the” plan” will” relist” once continuous growth and expansion in corporate value is realized.

This suggests that JSR and JIC anticipate a dangerous and energetic time when the stock market’s short-termism will make it more difficult for the company to keep up with developments in the device market.

That’s in line with the viewpoint of JIC CEO Keisuke Yokoo.

Today, development is moving quickly across the globe, catalyzing contests and business restructuring that cross standard industrial and organizational boundaries, according to Yokoo. We are therefore dealing with a powerful change in the dynamic environment and the structure of business, he said.

However, only time will tell if JSR’s buy-out and withdrawal is the best course of action to safeguard both the future of the business and the objectives of Japan as a whole.

Follow this author on Twitter at @ ScottFo83517667.

Malaysian analytics startup, UrbanMetry, recognized as 2023 Technology Pioneer by World Economic Forum

The list of 100 Technology Pioneers simply includes Indonesian companies.The objective is to make places better for everyone, green, and smarter.Leading estate data analytics firm UrbanMetry, based in Kuala Lumpur, Malaysia, was chosen as one of the” Technology Pioneers” by the World Economic Forum. The 2014-launched startup, led by Koh Cha-Ly(…Continue Reading

Are escalators and moving walkways safe?

An airline passenger had part of her leg amputated this past week after an accident on a moving airport walkway in Bangkok, authorities said.

The accident, involving a 57-year-old woman, occurred Thursday in the domestic terminal of Don Mueang International, the older and smaller of two major airports that serve Bangkok, the capital.

It’s unclear precisely what happened. Local news media initially reported that the woman’s leg had been pulled into the walkway’s machinery after she tripped on her suitcase. But her family said Saturday that she had been walking normally when part of the walkway collapsed.

What’s clear is that her leg was amputated up to the kneecap after the accident. Thai authorities are now trying to determine if the accident resulted from human error or equipment malfunction.

Walkways: widely used and seldom feared

Such walkways are known as “moving walks” to government regulators and construction companies in the US and “travellators” elsewhere. Moving walks are often talked about in the same breath as escalators because they use similar technology and move at about the same speed — generally 100 feet per minute, or about 2kph.

The main difference is incline. An escalator sits at about 30 degrees, but a moving walk’s incline is typically no more than one-tenth of that. Many moving walks are flat.

Escalators and moving walks ease the movement of billions of people through airports, shopping malls and other public spaces each year. The National Elevator Industry, an industry group in the United States, estimates that about 105 billion passengers ride escalators annually — the world’s population, multiplied by 13 — in the United States alone.

Escalators and moving walks are widely seen as very safe. But, like virtually any form of public transportation, they occasionally malfunction.

In Australia, for example, inspectors in the state of Queensland found two recent examples of moving walks that were operating with a missing pallet, the technical term for the metal slats that separate passengers from the whirring machinery below.

And in Thailand, a passenger at Don Mueang International Airport reported losing a shoe to the machinery of a moving walk in 2019, Thai news media outlets reported this past week.

How likely is an accident on an airport walkway?

Data for the safety of moving walks is scarce. But if we go by escalator-safety data, the answer is “not very”.

An average of 2 deaths per year in the United States involve escalators, lower than the figure for lifts, according to a 2013 review of US government data by the Center for Construction Research and Training, a nonprofit group in Maryland.

The risk of injury is higher: About 10,000 escalator-related injuries result in a trip to the emergency room in the United States each year. But even that figure is exceedingly small if you consider the sheer volume of escalator and moving walk trips that people take every day.

The moving walk where the accident occurred this past week had been used at Don Mueang International since 1996, the airport’s director, Karant Thanakuljeerapat, told reporters.

Don Mueang carried more than 13 million domestic passengers last year, and nearly twice as many in the years immediately before the coronavirus pandemic, according to government data. So, over nearly three decades, a moving walk there could have carried many tens of millions of passengers.

This article originally appeared in The New York Times.

US says it looks forward to working with new govt

The United States is looking forward to promoting trade and investment, and education diplomacy with Thailand’s new government, according to Ambassador Robert F Godec.

Speaking in Bangkok on Thursday during a US Independence Day event, he said US-Thai relations are almost 200 years old, and the US has worked with various Thai governments.

The ambassador highlighted two priorities — trade and investment and education — as areas he wants to work on when the new Thai government is in place.

He said Thai exports to the US had expanded by 50% in the past few years, and the US is one of the largest markets for Thailand.

Imported products from Thailand include machinery, rubber, optical and medical instruments and agricultural products, he said.

Moreover, the first shipment of 864 kilogrammes of Thai pomelo was shipped to the US on Monday for the first time, he said.

Hundreds of US companies have invested in Thailand with billions of dollars, he said, noting Amazon Web Services, the cloud computing division of Amazon.com Inc, announced last year it would invest US$5 billion (177 billion baht) in Thailand over the next 15 years to strengthen its infrastructure.

“There are still additional opportunities for us that we can continue to build an economic partnership that helps provide 200,000 Thais jobs from all the American investments, and I think we can take that number higher, and I think we can continue to build more trade and investment partnerships,” he said.

Furthermore, he said that many people across the globe come to work in the US, especially in technology, and Thais are also welcome to work in this industry, and there are a lot of opportunities waiting for Thais.

On education, he emphasised the notion of education for everybody, particularly for young people.

He said that there would be a lot of opportunities for both Thailand and the US to explore, such as having more exchange students from both countries ranging from secondary to graduates.

The cooperation also includes academic and research exchanges and collaborations.