South India’s progressive politics vs North’s regressive politics

“You cannot expect any rational thought from a religious man. He is like a rocking log in water.” – E V Ramasamy

Erode Venkatappa Ramasamy, revered by his followers as Periyar, was an Indian social activist and politician who started the Self-Respect Movement. He is known as the “Father of the Dravidian movement.”

Dravidianism or Dravidian nationalism is based on the idea that people living in the southern part of India are racially and culturally different from the North Indian (Indo-Aryan). Periyar claimed that Brahmins of the south were originally Aryan migrants from Northern India, who spoke Sanskrit and brought caste system to South India.

Periyar promoted Dravidian nationalism, which was based on the principle of rationalism, dismantling Brahmin hegemony by abolition of the caste system and revitalization of Dravidian languages.

He rebelled against Brahminical dominance by preaching to people that the Brahmins had monopolized and cheated other communities for decades and deprived them of self-respect. Periyar also led a strong rebellion against the imposition of Hindi as a compulsory subject in Tamil Nadu schools, viewing it as an attempt to establish “North Indian imperialism.”

Periyar’s legacy of self-respect, women’s rights, and caste eradication continues to influence South Indian politics, particularly in the state of Tamil Nadu.

On September 2, Udhayanidhi Stalin, minister of youth welfare and sports development and son of Tamil Nadu Chief Minister M K Stalin, while speaking at a writers’ conference in Chennai, sparked a massive controversy with his remarks on Sanatana Dharma (Hindu religion).

He said Sanatana Dharma is against the idea of social justice and must be “eradicated.” He argued that the idea is inherently regressive, dividing people based on caste and gender, and is fundamentally opposed to equality and social justice. The controversial remarks drew widespread condemnation from the Bharatiya Janata Party, with the BJP terming it a “genocidal call.”

In defense, Udhayanidhi Stalin wrote on Twitter that he never called for genocide, but opposed the principle of Santan Dharma, which divides the people in the name of caste.

He has accused BJP leaders of twisting his statements and vowed legal action.

After the remarks, Paramhans Acharya, the chief priest of the Tapaswi Chawni temple of Ayodhya, Uttar Pradesh, the largest North Indian state, offered the equivalent of US$1.2 million to the one who beheads Udhayanidhi Stalin over his remarks against Sanatana Dharma.

But the bigger question is why North India is becoming so sensitive or radicalized with respect to its religion. A society must be able to understand that every religion has certain flaws, which must be corrected over time.

Certainly, Periyar’s views of making a rational society rather than a religious one based on superstitions and prejudice have played a crucial role in the development of South Indian states.

What North India can learn from South India

Telangana, Andhra Pradesh, Kerala, Karnataka and Tamil Nadu are commonly considered South Indian states. Bangalore, the capital city of Karnataka, is known as the “Silicon Valley of India” and accounts for one-third of India’s software exports. Tamil Nadu is known for manufacturing as it alone accounts for two-thirds of exports of personal vehicles from India.

Andhra and Telangana are known for being a pharmaceutical hub, accounting for 22.5% of all pharma manufacturing facilities in India.

Kerala is famous for its tourism industry. According to 2018 official data, tourism constitutes 10% percent of Kerala’s GDP and provides about 23.5% of employment in the state.

Millions of migrant workers from the North reach the South in search of better jobs, putting an extra burden on the states. Data show that southern Indian states continue to outperform the rest of the country in health, education, and economic opportunities.

Kerala has the highest literacy rate in India. A state’s prosperity is measured on two indicators, gross state domestic product (GSDP) and per capita income. According to Wikipedia, four of the five South Indian states rank among the top 10 Indian states in terms of GSDP. Telangana, Karnataka, and Kerala make it into the top 10 states by per capita income.

Besides a strong industrial and IT base, the southern states have also been blessed with robust banking and finance infrastructure. Apart from public and private sector banks, NBFCs (non-banking financial companies) play a crucial role in lending infrastructure, a vital factor in supporting entrepreneurial spirit.

Today’s South Indian states are far better than all the other regions of India on every Human Development Index. But the bigger question is what led the South Indian states to march ahead of their North Indian counterparts.

In South India, social revolution always preceded the political revolution. But in the North, it’s just the opposite.

North Indian electorates remain swayed by emotive, irrational appeals by following a herd mentality to vote based on caste and religion, leading to long-term dominance by one party more than a decade.

The Indian National Congress ruled across North Indian states for five decades. Such a monopoly disconnects citizens from government activity and the government takes the people for granted, which results in less development in those states compare to South.

However, South India experiences stable political competition, with alternating parties in power such as the DMK and AIADMK in Tamil Nadu, LDF and UDF in Kerala, BJP, Congress and JDS in Karnataka, Congress, YSR Congress and TDP in Andhra. This healthy competition encourages governments to perform better and promotes citizen participation and activism, unlike the North, where politics tends to overshadow governance.

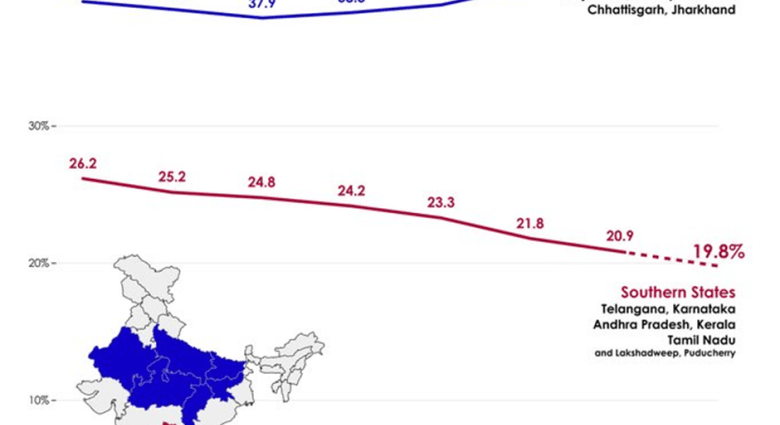

This has resulted in quality of governance and better leadership, which pushed the states on the path of development and prosperity. Effective population control consistently over the decades is a testimony of their leadership.

However, statistics show that South India is not getting enough reward for such good performance from the central government. Even South Indian politicians have expressed concerns about the state of federalism in India.

North’s regressive politics pulling India down

The central government collects taxes from all states and distributes them among states based on Finance Commission recommendations, considering three criteria: needs, equity, and state performance.

Recently the 15th Finance Commission increased weightage for the population criterion to 15% from the previous 10%, which some critics in South India believe is rewarding states with high populations that haven’t controlled population growth or provided better governance.

As a result, states like Uttar Pradesh, which have a large populations but low Human Development Index scores, receive more funding (17.9% ) than states with higher development indices like Karnataka (3.65%), Tamil Nadu (4.08%), and Kerala (1.09%). This appears to reward mis-governance, low productivity, and irrationality, raising questions about the fairness of Indian federalism.

More important, South Indian politicians are denied opportunities at the central leadership despite excellent performance in their respective states. The fact that only three cabinet ministers from South India are in the current Modi government is a testimony.

South India seems to be the biggest loser from this financial arrangement, where South Indians work hard to contribute more to national growth, while the North gets all the rewards for mis-governance and low productivity.

More important, the question arises, how long will South India fund the mismanagement and political shambles in North India, allowing non-performing states to set the country’s agenda? Udhayanidhi Stalin’s statement reflects the frustration with the kind of politics done in North India or Delhi for which South Indians have to pay a price.

Rather than tackling the issue of governance, productivity, HDI, economic opportunity, jobs, and better infrastructure, religion has become the center of the debate for the last nine years. In the real world, one who pays the bills is likely to get most of a deal. Unless we support the principle of prosperous regions always assisting poorer ones.