- International trade restrictions, political uncertainty, and AI management gaps

- 5 original methods for CEOs to get to understand current “polycrisis” setting

International businesses are facing slowing development and mounting challenges to extended- word conservation, according to a fresh report from KPMG International. The findings in KPMG’s Major risks forecast: Bottom lines for business in 2024 and beyond glow a light on the varied, difficult challenges facing companies looking to grow worldwide at a time of increasing divergence on regulation, conflict, technological advancement and social uncertainty.

The analysis of the report highlights the three most pressing risks for businesses right now, known as “bottom lines,” and are likely to have an impact on operations this year and beyond:

- Trade policy restrictions: Global trade restrictions have been on the rise, with approximately 3, 000 restrictions imposed, nearly tripling since 2019. Organizations operating in foreign markets are faced with challenges by this protectionist trade policy trend. These restrictions can lead to supply chains and stifle economic growth and have an impact on market access and supply chains.

- Vulnerability calling for operational resilience: The geopolitical landscape is characterized by increasing vulnerability, driven by various factors such as rapid technological advancements, climate change, and geopolitical tensions. In 2023, a staggering 91 countries were involved in some form of conflict, a significant increase from 58 in 2008. This conflict has a significant impact on the global economy, with estimates that it will have a 12.9 percent impact on global GDP.

- AI governance gaps: With investments in AI rising more than fivefold between 2013 and 2023, AI has transformed the world. While AI presents immense opportunities, it also brings about governance gaps that organizations must address.  ,

Stefano Moritsch, Global Geopolitics Lead at KPMG International, said:” To some extent, the COVID pandemic was a rehearsal for some of the broader risks and profound threats facing companies today. Leaders have improved their resilience, but for the first time in recent memory, they are facing challenges on a number of fronts, including conflict, complex regulation, climate change, and a “patrickwork” of AI adoption across various countries and regions.

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

He also emphasized Malaysia’s need to navigate the changing landscape of AI governance, which will ensure the responsible integration of this transformative technology into the nation’s economic fabric. Businesses must actively shape their own AI strategies while the Malaysian government is developing a governance and ethics code framework. Any regulatory measures will quickly become outdated as a result of the rapid advancements in AI, so businesses must take the lead in AI governance and integration.

” AI presents a significant opportunity to revolutionize Malaysia’s industries. However, it is equally crucial to establish guidelines that address ethical issues and reduce potential risks associated with AI deployment, Johan added.

For organizations to effectively navigate the current “polycrisis” environment, KPMG’s report outlines five initial steps CEOs can take today:

- Conduct a comprehensive risk assessment

- Stay informed and monitor geopolitical developments

- Diversify supply chains

- Enhance operational resilience

- Foster strong stakeholder relationships.

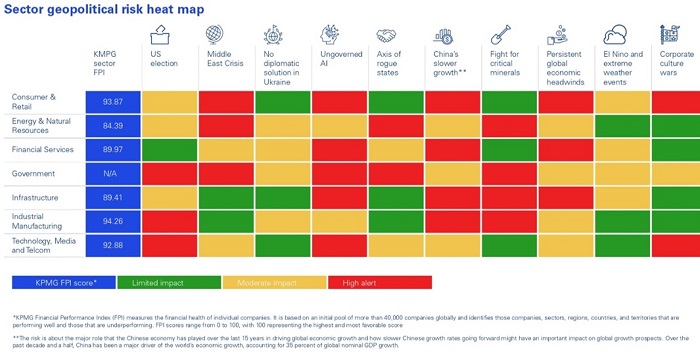

KPMG has also created a heat map that examines the impact of the top risks on specific, crucial sectors. The Middle East’s uncertainty and the increasing politicization of access to minerals and other important resources are the main risks, according to the analysis. Second and third place are the financial services and infrastructure sectors, both of which are impacted by growing economic uncertainty and AI governance gaps.

The energy and natural resources sector also had the lowest Financial Performance Index ( FPI ) score among all sectors, according to KPMG’s analysis. KPMG FPI is a global financial health measure based on data from over 40 000 businesses. A lower score indicates that the sector has underperformed and might experience financial instability. This underperformance highlights the urgent need for businesses in this sector to reevaluate their strategies, manage risks effectively, and adapt to changing market conditions in order to improve their financial health.