India’s economy: The good, bad and ugly in six charts

Getty Images

Getty ImagesIn January, thousands braved the freezing cold at Delhi’s Red Fort to hear Prime Minister Narendra Modi speak.

His message was “Viksit Bharat 2047”, a promise to make India a developed nation by 2047.

It’s the latest catchphrase from a man known for his penchant for catchy taglines.

“Developed India” is an imprecise pledge, but in the 10 years since Mr Modi first stormed to power, he has been trying to lay the foundations for a period of economic boom.

The prime minister and his government inherited an economy that was teetering on the precipice. Growth was slowing and investor confidence was low. A dozen Indian billionaires had gone bankrupt, saddling the country’s banks with enormous unpaid loans that had crippled their capacity to lend.

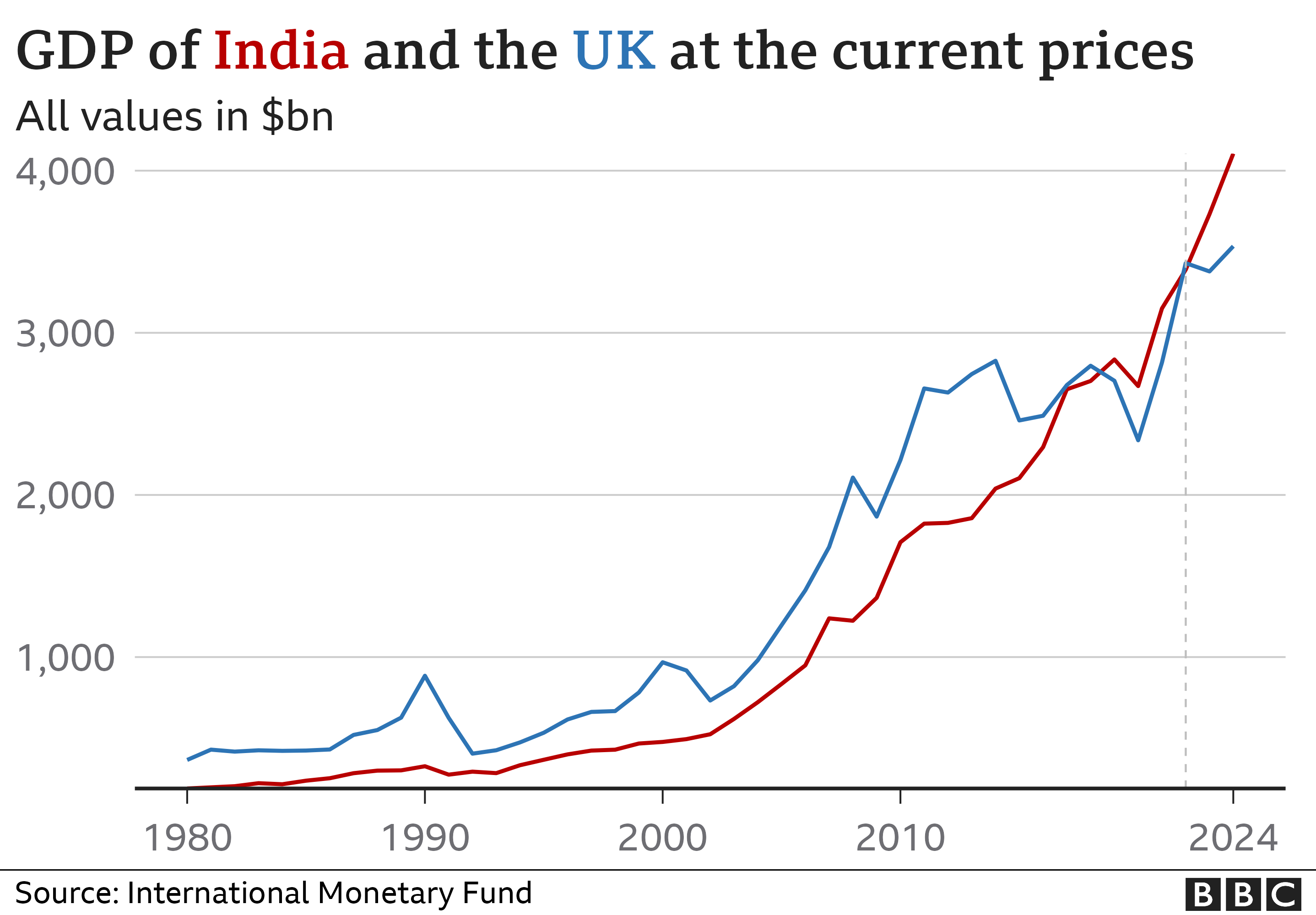

Now, 10 years on, India’s growth is outpacing other major economies, its banks are strong, and the government’s finances are stable despite a painful pandemic. India surpassed the UK as the fifth largest economy last year and according to analysts at Morgan Stanley, it’s on track to overtake Japan and Germany and hit the third spot by 2027.

There is undoubtedly an air of optimism in the country. It successfully hosted the G20, became the first to send a rocket near the Moon’s south pole, and has birthed a few dozen unicorns. The soaring stock markets have also had a trickle-down effect on the wealth of its middle class.

On the face of it “Modinomics” – the ruling Bharatiya Janata Party (BJP)’s economic vision for India – appears to be working. But dig deeper, and the picture is more complex. For a vast swathe of the country’s 1.4 billion people who live on the margins of sustenance, it’s not boomtime just as yet.

So who are the winners and losers of Modinomics?

Digital revolution

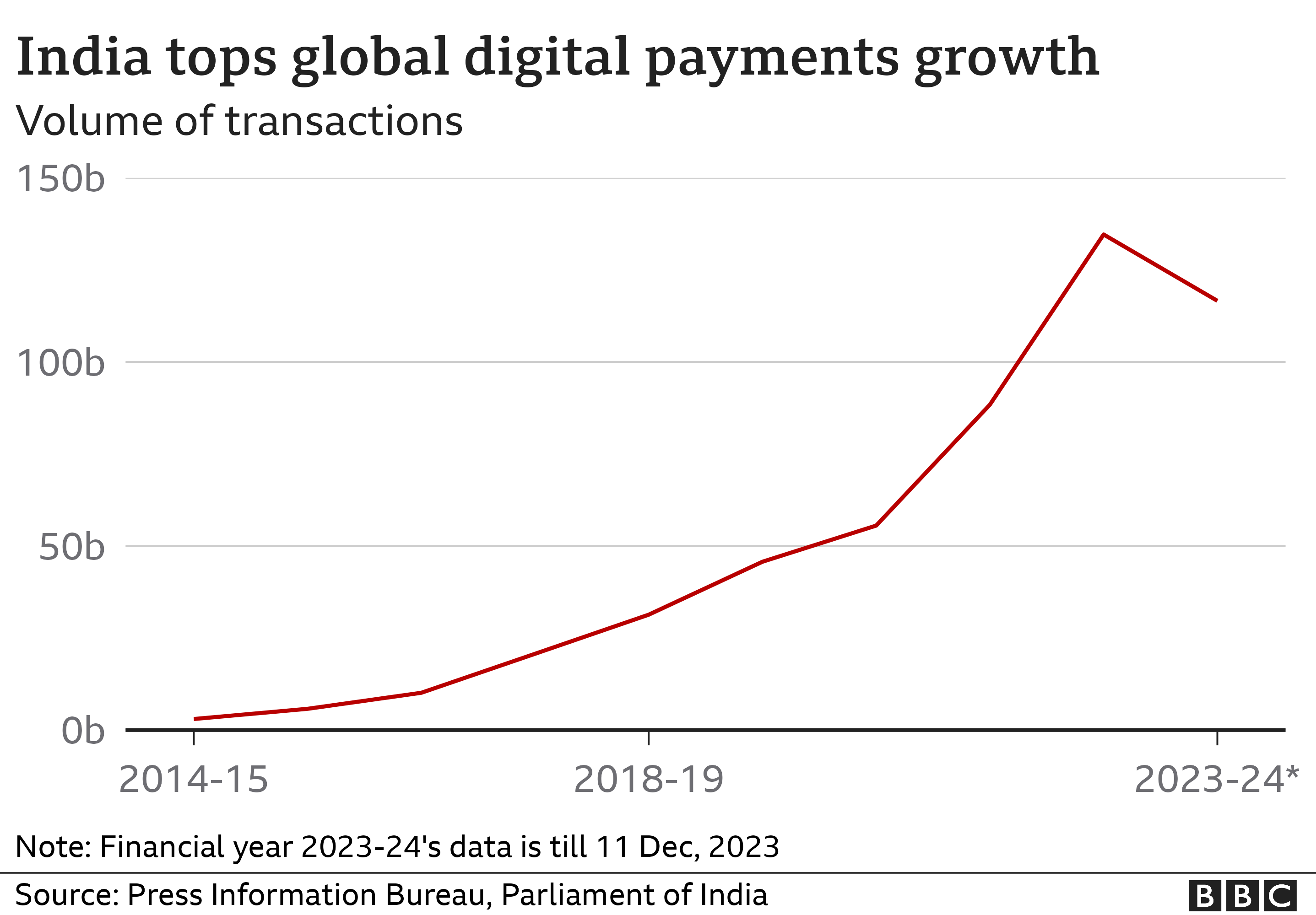

Mr Modi’s push for digital governance has begun to transform the lives of some of the country’s poorest people.

Today, Indians in the remotest corners of the country can buy many daily goods without cash, paying as little as 20p for a packet of bread using a QR code on their phone.

Underpinning this digital revolution is a three-layer system of governance, which includes universal identity cards, a payments infrastructure that enables click-of-a-button money transfer, and a data pillar that gives people access to crucial personal documents like tax returns.

Linking hundreds of millions of bank accounts to this “digital stack” has cut red tape and corruption.

Estimates suggest that up to March 2021, an equivalent of about 1.1% of GDP was saved due to digital governance, allowing the government to dole out a volley of social subsidies, cash handouts and also spend on infrastructure building, without running high deficits.

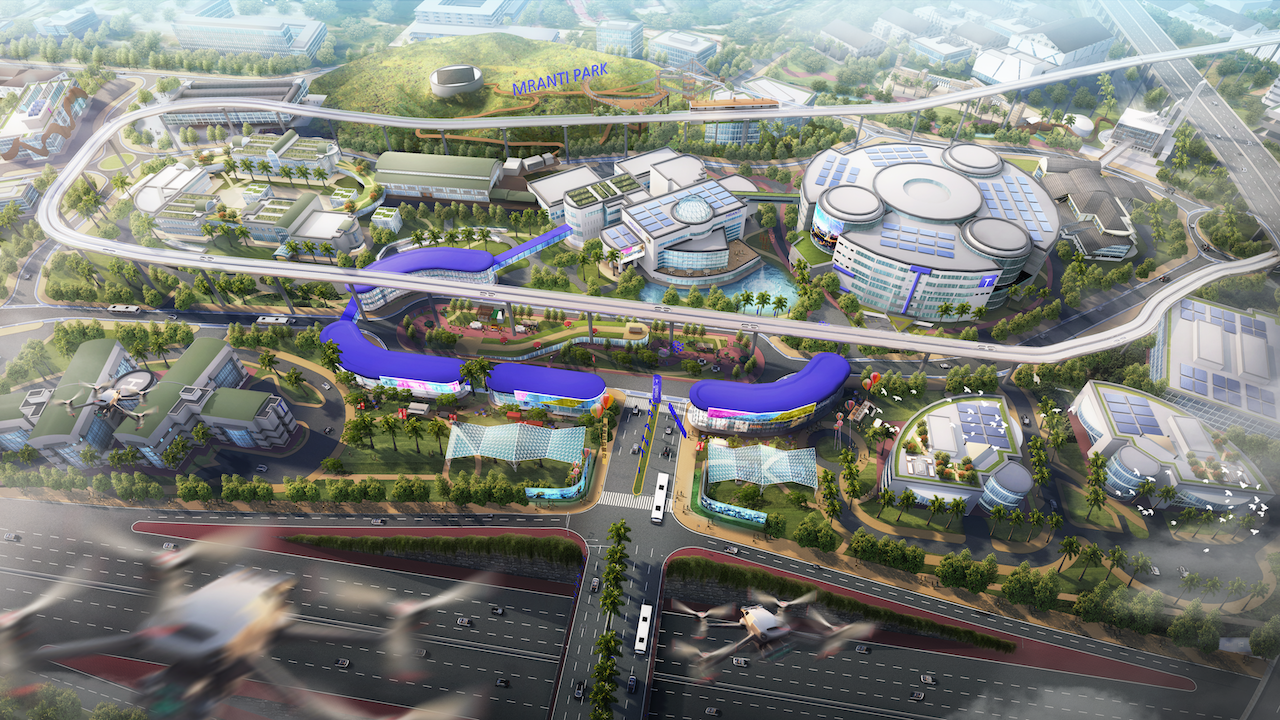

Cranes, cranes everywhere!

Everywhere you go in India there are cranes and JCB machines at work giving its creaky public infrastructure a shiny makeover.

Take a look at this slick first underwater metro in the eastern Indian city of Kolkata.

This video can not be played

To play this video you need to enable JavaScript in your browser.

There’s no doubt this country is getting a facelift.

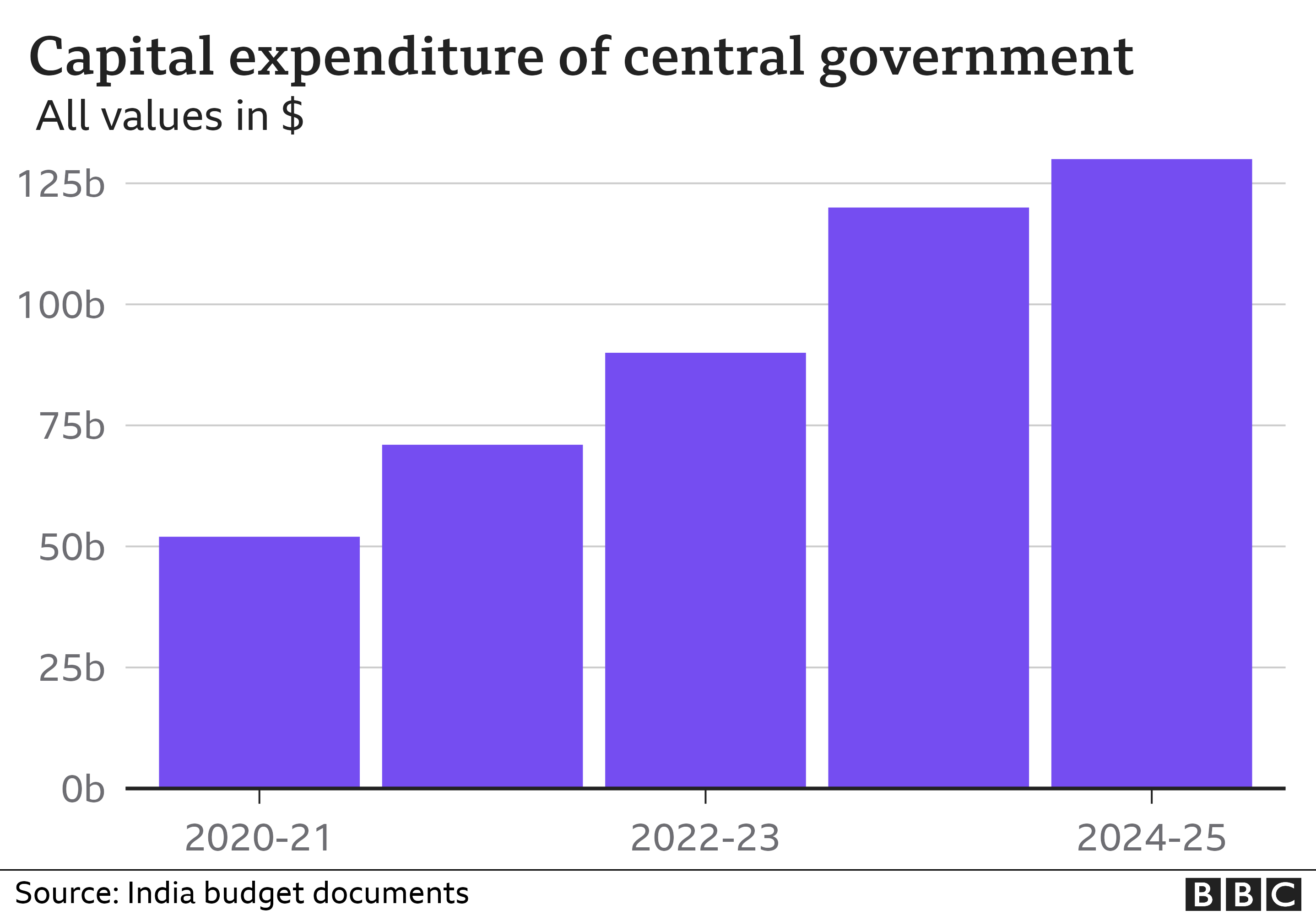

Building new roads, airports, ports and metros has been the centrepiece of Mr Modi’s economic policy. He spent over $100bn annually in infrastructure spending (capital expenditure) in the past three years.

Nearly 54,000 km (33,554 miles) of national highways were built between 2014 and 2024 – which is twice the length of the preceding 10 years.

The government has also considerably eased up the bureaucracy, which has been a major bugbear of India’s economy for decades.

But Mr Modi’s policies haven’t delivered for all.

The brutal lockdowns imposed during the pandemic, the lingering after-effects of a cash ban in 2016, and faulty implementation of a new goods and services tax – a long pending reform meant to streamline the country’s welter of indirect taxes – have had far-reaching structural consequences on India’s economy.

The country’s vast unorganised sector – small enterprises that form the backbone of this country – are still reeling under the impact of some of these decisions.

And the private sector is not committing big investments. As a proportion of GDP, private investments slumped to barely 19.6% in 2020-21 from a peak of 27.5% in 2007-08.

Jobs blues

In January, thousands gathered outside government recruitment centres in the northern city of Lucknow to go to Israel for jobs in the construction industry. My colleague Archana Shukla was on location.

This video can not be played

To play this video you need to enable JavaScript in your browser.

The desperation of these workers showed India’s jobs crisis is real. And it is crushing aspirations everywhere.

“I’m the first master’s degree holder in my family,” says Rukaiya Bepari, a 23-year-old graduate in the town of Miraj in western India.

“But there’s no industry where I live. So I’m now taking tuitions. It doesn’t pay much.”

Neither Rukaiya nor her brother have had full-time work for the last two years. They’re not alone.

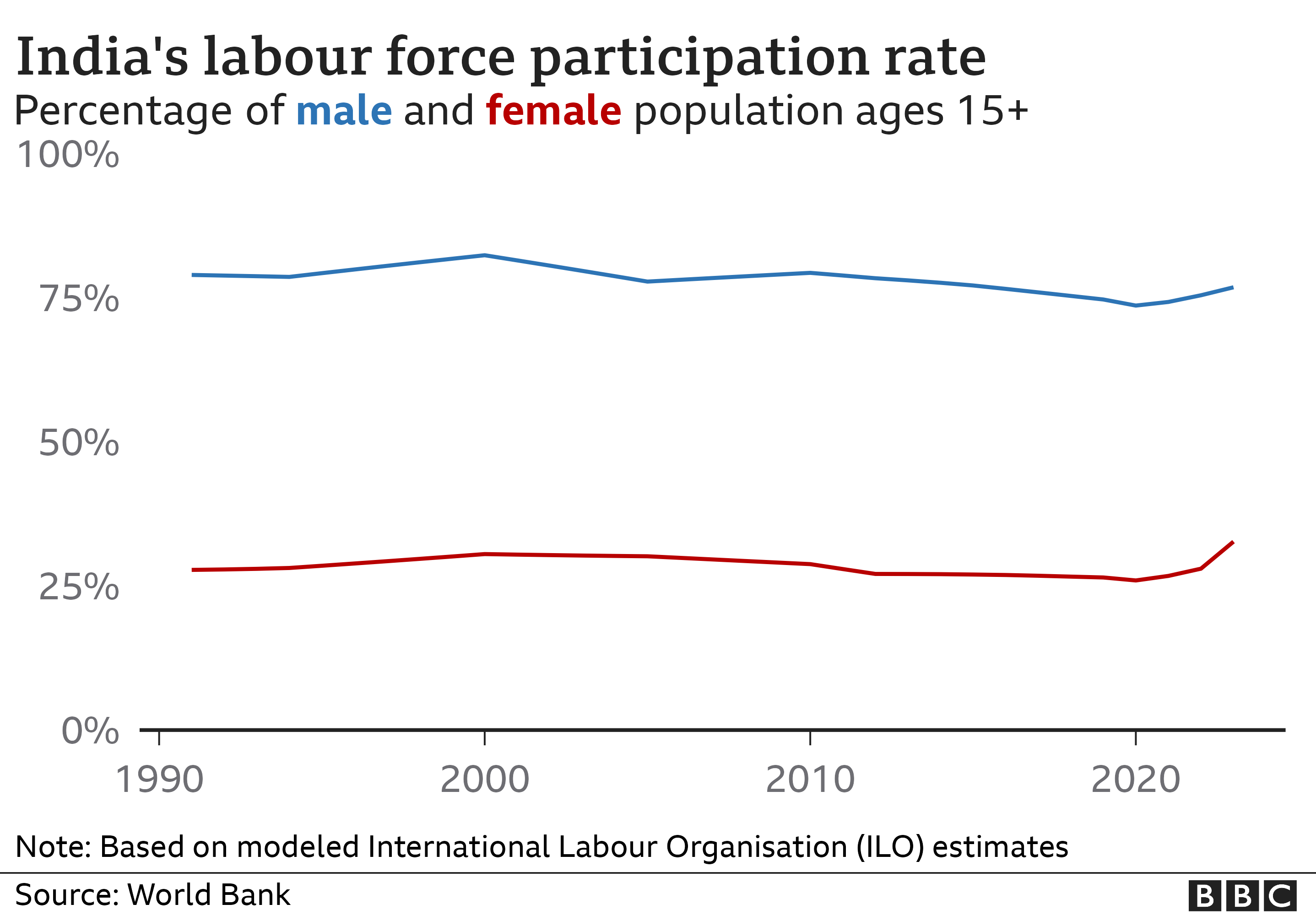

Unemployment among educated youth has doubled from 35.2% to 65.7% between 2000 and 2022, according to latest figures by the Indian Labour Organization, a human rights group.

There’s also been no significant growth of real wages in India since 2014, according to numbers computed by noted developmental economist Jean Dreze.

India “risks squandering its demographic dividend” – the economic growth potential from a big working-age population – the World Bank’s regional economist said in an interview to the Financial Times recently.

Job creation is a problem Mr Modi has been unable to solve.

Right off the back of his victory in 2014, the prime minister launched an ambitious Make In India campaign to turn India into the world’s factory. In 2020, his government doled out $25bn in incentives to companies across sectors from semi-conductors to mobile electronics in order to enhance India’s manufacturing capabilities.

But success has been elusive.

Yes, the likes of Foxconn – which makes iPhones for Apple – are moving their supply chains to India as part of the global “China plus one” diversification strategy. Other major global giants like Micron and Samsung have also been enthused to invest. But the numbers are not significant yet.

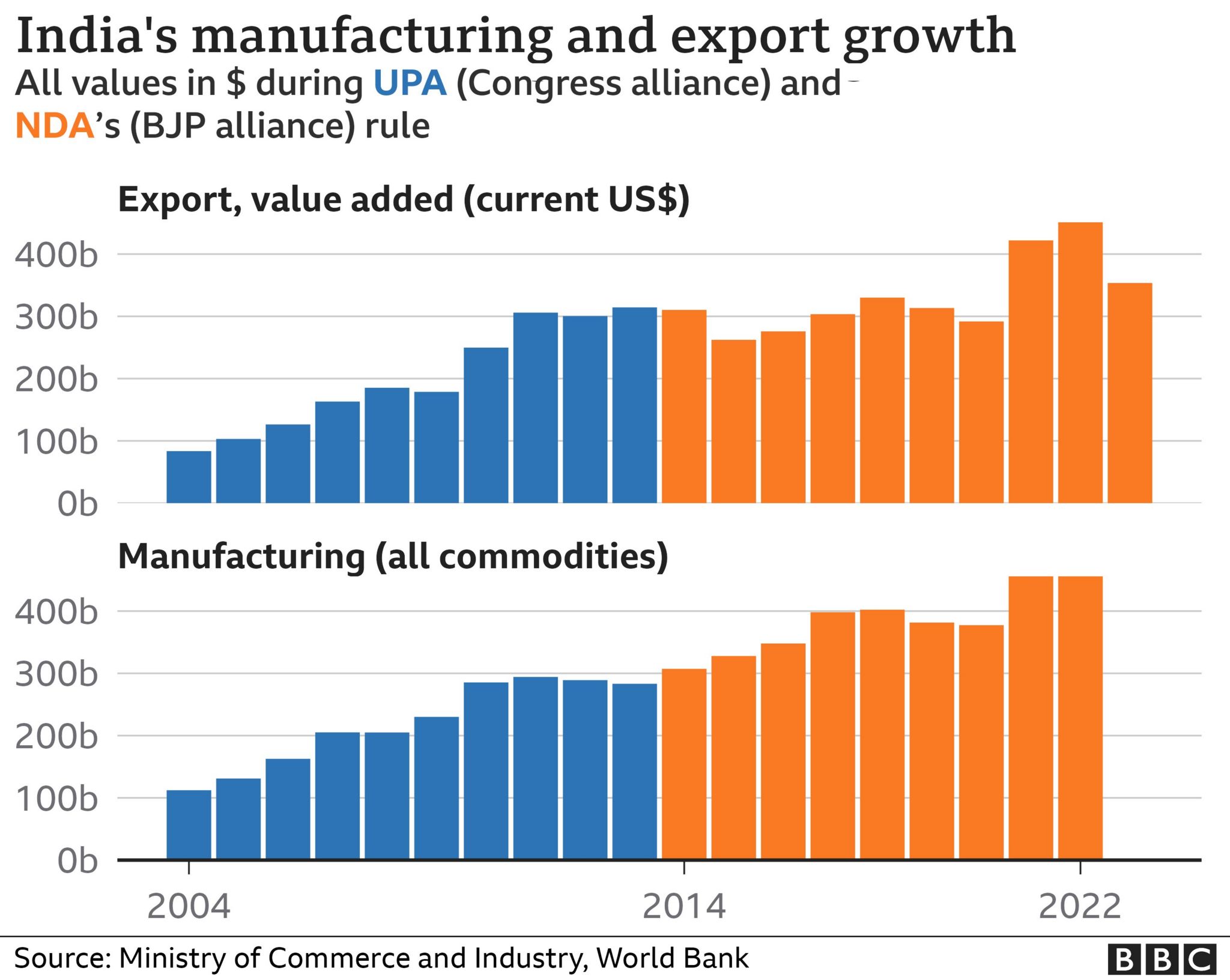

Manufacturing’s share as a percentage of GDP has remained stagnant in the last decade despite these efforts.

Growth in exports was also faster under Mr Modi’s predecessors.

“Even if India’s manufacturing grows 8% per year till 2050 and China’s stagnates at the 2022 level, India’s manufacturing size in 2050 will still not match that of China’s in 2022,” says Prof Vidya Mahambare of the Great Lakes Institute of Management.

Lack of a large scale industry means half of India’s population still depends on agriculture for their livelihoods – which is increasingly becoming unprofitable.

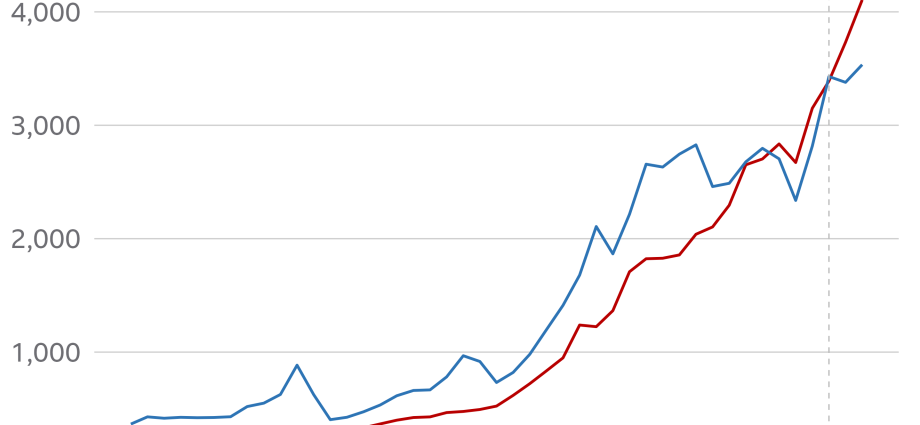

Two speed recovery

A direct impact of this? Squeezed household budgets.

At 3%, the growth in overall private consumption expenditure – the money people spend on buying things – is the slowest in 20 years.

And household debt has touched an all-time high, even as financial savings plunged to their lowest levels, according to new research.

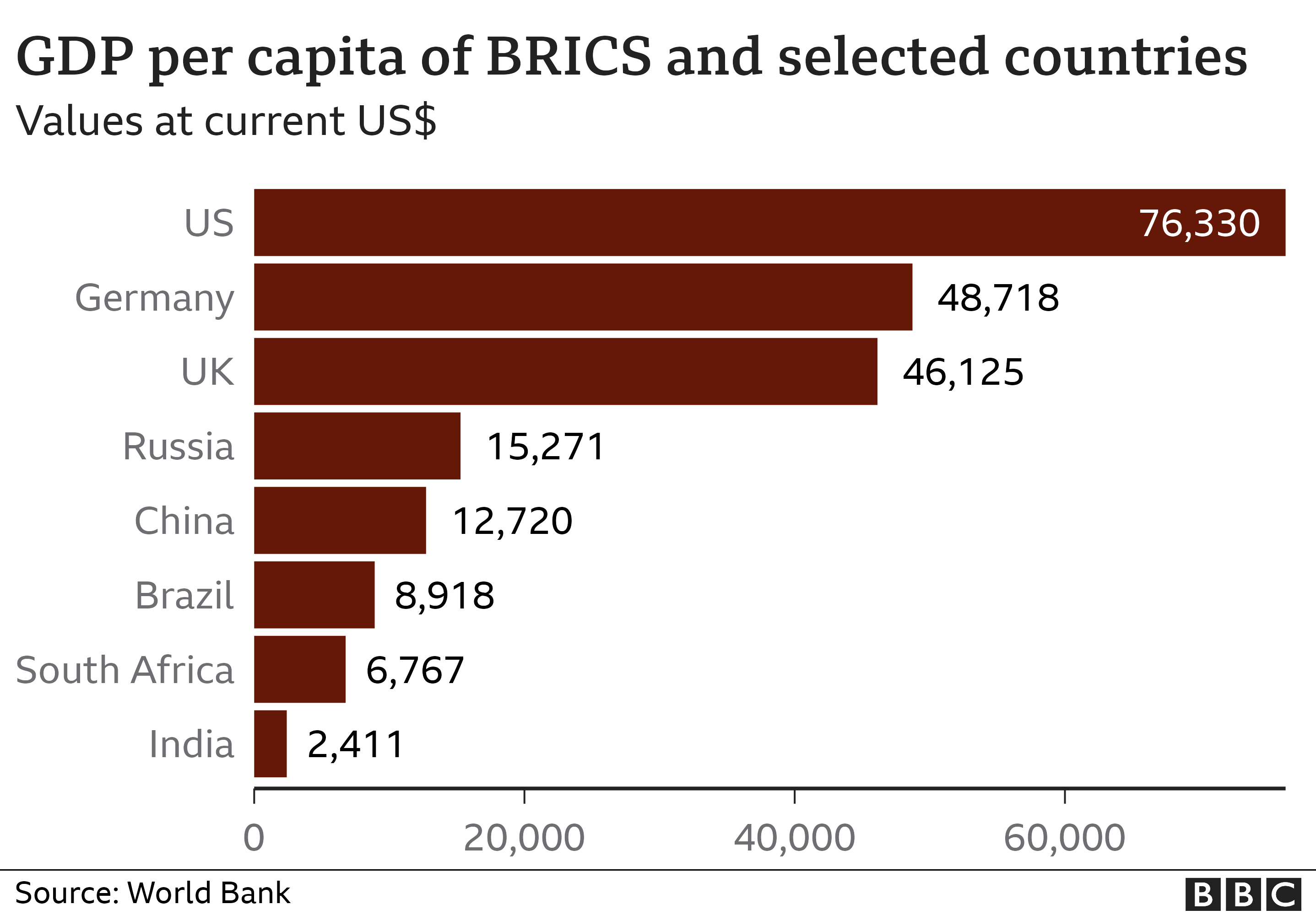

Many economists argue that the nature of India’s economic growth post pandemic has been uneven, or “K-shaped” – where the rich have thrived, while the poor continue to struggle. India may be the fifth largest global economy at an aggregate level, but on a per person basis, it still languishes at the 140th rank.

And inequality has widened to a hundred-year high according to research from the World Inequality Database. No surprises then that election campaign discourse recently has been rife with chatter around wealth redistribution and inheritance taxes.

A three day pre-wedding ceremony of Indian billionaire Mukesh Ambani’s son recently offered a glimpse into the country’s new gilded age. Mark Zuckerberg, Bill Gates and Ivanka Trump were in attendance. Rihanna shook a leg with Bollywood’s biggest celebrities, while the Ambani women flashed diamonds and jewellery once part of the Mughal empire’s collection.

Luxury brands making cars, watches and liquor have been growing faster than India’s more mass-market companies, according to Arnab Mitra, who researches Indian consumer brands at Goldman Sachs.

Viral Acharya, a professor at NYU Stern, says a handful of the biggest conglomerates have grown “at the expense of the smallest firms”.

The super-rich, he says, have benefited from sharp tax cuts and a conscious policy of creating “national champions” in which prized public assets like ports and airports have been preferentially given to a few companies to build or run.

Latest court revelations show many of them have also been India’s top political donors to the ruling BJP.

India’s decade?

All combined, this presents an inconsistent picture of India’s economy. But for all its problems, the country is on the runway for take-off, say experts.

“India’s next decade could resemble China’s path (of hyper growth) from 2007 through 2012,” analysts from Morgan Stanley wrote in a widely discussed paper.

They add that the country has many advantages – a young demographic, the geopolitics of global de-risking from China and a clean-up of sectors like real estate. Other megatrends like digitalisation, a transition to clean energy and growth in global offshoring will propel future growth, say experts.

The infra push is also something that will have long-term payoffs. By making improvements in roads, power supply and turnaround time at ports – India is finally “creating an environment in which manufacturing can flourish”, says DK Joshi, CRISIL’s India economist.

But along with the focus on “physical capital”, Mr Modi needs to pay heed to creating “human capital”, says Dr Raghuram Rajan, the former governor of India’s central bank.

Indian children aren’t learning as well as they should to face up to the world of artificial intelligence. A quarter of those aged 14 to 18 can’t read simple text fluently, according to a report published by the non-profit Pratham Foundation.

Covid-19 dealt a major blow to students, who couldn’t attend school for nearly two years. But the government has continued to underfund education, and healthcare.

In its first decade, Modinomics appears to have delivered for a select few. But for many the jar, as it appears, is still half empty.

“We will grow old before we grow rich” if growth isn’t faster and more equitable, says Dr Rajan.