Paris-headquartered BNP Paribas boasts a history of over 160 years in Asia and today, it draws upon a 20,000-strong team that is active in thirteen markets across the continent.

The regional effort is led by Paul Yang, who ascended to role of CEO for Asia Pacific in December 2020, as the world succumbed to the full throes of the beginnings of a three-year pandemic. As society grappled with widespread affliction, Asia’s key economies responded to rapidly evolving government direction with fervour: leaving borders closed and markets shaken.

However, as you will discover through this exclusive interview, Yang was defiant in his refusal to be beset by external challenges. Proving himself an astute leader at the regional helm, he navigated the uncertain scenario deftly, and would go on to secure solid returns for both full-year 2021 and 2022; as well as robust revenue for the first quarter of 2023.

With a view to steering the bank’s business in support of the group’s Growth, Technology and Sustainability (GTS) strategy for 2025, FinanceAsia sought Yang’s take on Asia as a key international powerhouse, and learned about the milestones of his international career to date.

|

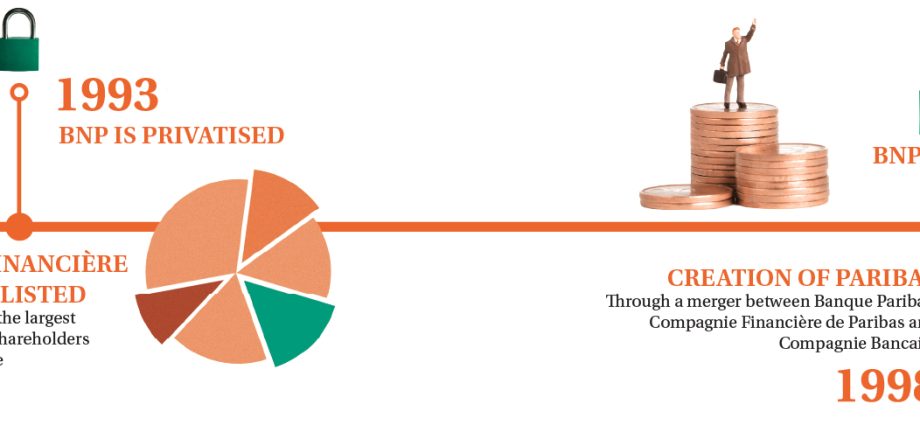

Entering Asia BNP Paribas’ forerunner, the Comptoir National d’Escompte de Paris (CNEP), was set up by France’s finance minister following the hardships endured during the French Revolution; to curb mass bankruptcy in the financial markets; and to stimulate the economy. Following signature of a free trade agreement with the British, the Comptoir sought to develop an international strategy to source the raw materials required to support the flourishment of European industry. To do so, it extended beyond its French national borders for the first time; establishing offices in Calcutta and Shanghai in 1860, independent of foreign partnership. Later, CNEP merged with the Banque Nationale pour le commerce et l’industrie (BNCI) to form the Banque Nationale de Paris (BNP). Capitalising on these regional capabilities, the bank made Hong Kong the centre of its Asian platform. |

Q: Paul, you’ve been based in Asia Pacific for the majority of your career with BNP Paribas. Can you share what has defined BNP’s corporate journey in Asia so far?

A: Well, I wasn’t there in the 1860s, but it’s true that we have had a very long presence in the region. However, I consider “modern” BNP’s presence to be quite recent. It was really the bank’s merger in 2000 that created who we are today, elevating us as France – and then Europe’s – leading financial group and the most profitable bank in the eurozone.

But regarding Asia, we’re proud to be able to say that we’ve been here for a long time, which demonstrates our commitment to the region.

In Hong Kong, for instance, we often deal with multiple family generations of entrepreneurs and tycoons. The same is the case for some of our mid-cap clients – we have dealt with their fathers. We have built a sufficient network in the region to be able to play a key role in executing succession plans and building businesses for the future. It really means something that we’ve been here for so long and to be profitable in all of the 13 markets where we operate.

These days, being relevant to your clients counts. You need a strong balance sheet, presence and scale to guide key them from their home markets into new areas. This is how we started, building our financial institutions group (FIG), then multinational and corporate (MNC) franchises,before further progressing to build scale, solutions, products and platforms.

We have developed a strong Asian presence and over the last three years, we’ve built on connectivity to improve the flows between the various corridors we participate in. We are relevant to key local participants and accompany international clients in reverse, also.

This goes for all facets of our business: whether in the corporate and institutional world, or in consumer finance. We are bigger than the sum of our parts and many things we do have relevant purpose for our clients.

Q: How does the bank’s business in Asia compare to that of the European markets (e.g. France, Italy, Belgium and Luxembourg)?

A: Understandably, our stronghold is Europe and we are significant as well in America. But overall, Asia represents a sizable portion of group business.

The bank’s longevity and strong heritage in Asia Pacific, coupled with our integrated business model places us in good stead to extend and reinforce our presence in this growth region.

In this regard, BNP Paribas’ Asia Pacific revenue contribution to the group’s corporate and institutional business is about 20%; and it will continue to grow.

Ultimately, the bank is emerging as a leading player in the region – and this brings us to a better position to aim for larger deals and more ambitious goals.

In this respect, we have grown our market share in our regions – for example, we hold dominance in markets such as Taiwan, Singapore and Hong Kong in the wealth management space, and we have recently launched an onshore wealth capability in Thailand. Asset management is developing; and our insurance business – Compagnie d’Assurance et d’Investissement de France (Cardif), has also been successful.

Where we do not have underlying domestic market strength, we choose to partner. We are humble enough to realise that sometimes it is better to do so. For example, in Asia, on the insurance side of the business we have partnered with local banking distributors. We started exploring this type of partnership around 25 years ago in markets such as Taiwan, Japan and Korea, and we are building up our strength in China, India and Southeast Asia.

The same goes for the retail side – personal finance. In 2005, we became a strategic shareholder of Bank of Nanjing in China and we are now their single largest shareholder with a 15.7% stake.

We have built core business through partnerships, but where we think that we can control the entire business because it’s part of our DNA, is on the wealth management and corporate institutional banking (CIB) sides.

Q: What are the bank’s strategic priorities across Asia over the short and long term?

A: We are a bank that tries to deliver short-term results alongside long-term goals. Long-term relationships are part of our nature from a strategy perspective, and we are not in the business of pursuing rash opportunities when things look great and then making drastic cuts in a down cycle. We have a long-term vision and try to cultivate trust and relationships with this timeframe in mind.

From a short-term perspective, we have targets around our top line to maintain cost discipline and ensure that we invest for the future. We are intrinsically risk-aware and we insist on having a good mix of new blood and older experience, to move forward prudently.

Diversification is key. When you pursue disciplined growth, you avoid temptation, fashion and fad and consequentially, mistakes. Across all markets and products, we want to be positioned as the number one European bank for CIB, the preferred partner for wealth management, insurance and asset management – and we are not far from achieving this goal.

Asia comprises a mix of developed and developing markets. Whether you look at the position we have in Japan, Australia, or Korea – or across more emerging business hubs such as Southeast Asia or China, we are well positioned there for our clients and we generate good returns.

Some of our peers will concentrate their presence at a particular local base, say in hubs. But we do not believe in guaranteeing strong, underlying growth simply by sitting in Hong Kong and Singapore and flying bankers all over the place.

The creation of local platforms is important. We have been building these in a considered manner across Southeast Asia, Taiwan, mainland China and elsewhere for the past decade and we are able to see the results. For example, we recently complemented our business mix with a securities licence in China. Once we have completed the takeover of several prime brokerage businesses from our competitors, we will see an increase in the equity cash portion of our business mix. Then there’s the joint venture (JV) we secured with the Agricultural Bank of China, which is the largest bank in the market by network and with whom we’ll be structuring investment products for retail clients.

Q: Diversification is a theme that has emerged from the pandemic to build business resilience. But are there any particular geographies or sectors that stand out as offering growth opportunity?

A: We’ve seen some volatility in the banking sector, but as a group, our corporate culture has focussed on development in a very diversified way. In terms of resilience, this sets us apart.

If you look at our group results, you will see that around 50% of our business is in the domestic retail and consumer finance market;

a third is in CIB; and over 15% is concentrated on activities such as asset gathering – from private banking to asset management and insurance. Within CIB, there’s also security services, which might not have a great cost income, but involves limited capital consumption and brings recurrent fees.

This percentage mix has been kept stable as we’ve grown across all areas and however you slice and dice our business, you will always see diversification. It’s the same for our client base – we not only serve financial institution clients but also corporates and high net worth individuals (HNWI). These three pillars are quite well balanced and offer us the means to build a sufficient product platform.

Capital market activities, including equity capital markets (ECM), debt capital markets (DCM), fundraising and advisory services can be volatile and event-driven; while another big portion of our business and effort is in transaction banking: following the flow of finance, supply chains, trade finance and cash management activities.

The interest rate surge of the last 12 -18 months has been very much beneficial to the cash management business, while monoliners who rely only on investment banking, have suffered. We have benefitted. Whatever way the world or region goes, we are naturally hedged.

Across the Asian region, our presence differentiates us from the rest. We are more than 2,500 in Hong Kong, have 2,200 in Singapore, plus a solid foothold in Japan where we’ve ranked consistently within the top five thanks to our leadership in the global macro environment, both in fixed income currencies and commodities (FICC) and across equity and credit.

In Australia, we have a dominant position in the custodian business that we started 20 years ago; we do well in China, and then we have strong ambition in India and Southeast Asia. I cannot see any market where there isn’t potential.

Q: How do you aim to grow the Asian business?

A: In the past, we have grown organically – even when we looked to secure Deutsche Bank’s prime brokerage business in 2019, it was not a typical acquisition. They were trying to expand in terms of platforms and wanted to lighten up their equity business. Meanwhile, in July 2021, we acquired another 51% of Exane, the top-rated equity research business, following a successful 17-year partnership where we had held 49%.

Both deals demonstrated ambition and keenness to complement the building blocks of our equity business.

So yes, our focus is organic over external growth. We feel it’s better to rely on organic opportunity.

Q: Which developments excite you across sustainability?

A: We’ve been involved in sustainability for over a decade, having started our sustainable finance forum (SFF) in Singapore seven years ago. I’m happy to see that what was a niche market is now very much mainstream.

I would say we have been dominating the ESG thematic, especially when it comes to corporate social responsibility (CSR). We’ve exited from carbon-heavy energy, have moved towards renewables, and we are working to lighten up our upstream exposure. It’s pleasing that every year we do more, whether green bonds, sustainable loans or other structures. We are among the top three banks in the space and even if we cannot manage to stay number one, our efforts make a positive impact across society.

Last year, we created a group of more than 150 bankers, the Low Carbon Transition Group (LCTG), to support our clients’ energy transitions. We’re experienced, so are not having to start from scratch and can support those corporates who might not know where to begin.

We recently held an electric vehicle (EV) conference where we gathered more than 300 clients, corporates and investors in Hong Kong. The topic sits well with what we want to do in the sector around mobility as an engine for growth and we think we can bring value-add to our clients.

EV adoption figures are impressive. In 2019, they accounted for 2.2% of the global total in cars sold, and rose to 13% last year. In China, the penetration figures are double. We’ve seen how this market can surprise everybody regarding adoption of new technologies. China did it with internet access, the smartphone, payments, and now EV. It’s exciting.

Q: You started in the IT department, held positions in Paris, Taipei and Hong Kong, before taking on Asia Pacific leadership at the height of the pandemic. What has shaped your career?

A: You’re right, I took the helm of the region in the middle of the pandemic. I was very fortunate to have been based in Asia for more than 20 years, so I knew the people, the teams, key clients and our platforms, which helped tremendously. During the pandemic, we adopted new technologies and forms of digital communication to stay close to our clients. We succeeded and the vast majority of our clients did also.

I think I’ve been lucky. I started in IT – I’m not sure I was good enough to stay in it, but my first business trip was to Hong Kong. I loved the place and dreamed of how amazing it would be to be based there. Thirty years later, here I am.

Like everybody, I’ve worked hard, but I was very fortunate, and at times, daring. When I wanted to switch from IT to credit, people said “No, Paul. We like you very much, but please don’t do something stupid. You already have a promising future.”

My response was to ask for a chance. I was curious to learn and probably would have gone elsewhere if I hadn’t been given opportunity. Fear around not succeeding makes you try harder and you don’t want to disappoint the people who see something in you.

A few years in, I moved from credit to corporate banking, where I was offered a great job in China – everybody wanted to be in China, but interestingly, it was a bit early – nobody was ready to do much there. So, I transferred to Taiwan to lead the corporate banking team and learned management on the ground. Doing quite well, I was later promoted to head of the territory and then after, moved to Hong Kong. That was 18 years ago!

For me, it’s been a combination of hard work, opportunity, luck and meeting the right senior people to support my development.

One memory that stands out was when the bank appointed a Hong Kong local to lead Greater China. It was a big move, as previously, the standard was someone French and male, but a Hong Kong woman took on the role and I worked for her for many years, learning from her insights. She believed in me and offered me the support to grow.

Q: What’s been the biggest highlight of your career to date?

A: This is difficult! But a key milestone was being given the opportunity to move from IT to banking. I’ve always liked a challenge – from coding, to implementing new tech systems and platforms, to what I do today.

I’ve seen many different things in my career and I have always been very curious. I’ve really cherished every opportunity I’ve had.

I’ve been very happy in the organisation and even today, it’s meaningful to partner with faces old and new. Back in 2004-2005, I had the opportunity to build a partnership in China. After much research, we invested in the Bank of Nanjing, which, two years later, was the first City Commercial Bank to list. There are many board members who I know well. It’s great for both them and me – it’s nice that our professional focus involves making core connections. It’s meaningful.

Q : If you weren’t in banking, what do you think you’d be doing?

A : Very early on, I think we all wanted to be football players! For France or Argentina – the recent World Cup rivals!

Sometimes I reflect and think I would have been pretty good at teaching. But whatever alternate path I would have taken, it would have involved international opportunity.

I grew up first in Taiwan before moving to France and it was at that point that I knew that I wanted to see the world and find opportunity to do so.

Of course, these days, when I look at my daughter evolving, I can see that there is a lot of opportunity ahead for her, more so than when I was young.

¬ Haymarket Media Limited. All rights reserved.