SINGAPORE – Western nations have taken major steps to cut energy ties with Russia by cracking down on imports of seaborne crude oil and refined petroleum products while imposing a US$60 price cap on sales to non-Western countries in a bid to crimp the Kremlin’s ability to finance its war in Ukraine.

At the same time, nations that sanctioned Russian oil have dramatically increased imports of refined oil products from countries that have become the largest importers of Russian crude since Moscow invaded Ukraine last February, according to a recently released report by the Finland-based Center for Research on Energy and Clean Air (CREA).

The organization tags five non-sanctioning countries – China, India, Turkey, United Arab Emirates (UAE) and Singapore – as “launderers” of Russian oil, which is blended with non-Russian origin crude and re-exported globally, including to the very nations enforcing the price cap and embargo in what CREA describes as a “major loophole” in the sanctions regime.

Isaac Levi, an energy analyst at CREA and the report’s co-author, told Asia Times that the EU’s oil ban and price cap, imposed in December and February respectively, have cost Moscow an estimated 160 million euros (US$175.3 million) per day, but were cautiously designed to allow Russian oil flows onto global markets to keep prices down and avoid supply disruptions.

“Now that the bans are in place, Russia’s revenues are starting to rebound,” he said, describing the loophole as a “legal way” for sanction-imposing countries to buy oil products previously bought directly from Russia, which are now being sold by third countries at a premium. “This process provides higher demand for Russian oil, creating higher export volumes and prices.”

In November, the International Energy Agency (IEA) projected that Russian oil output would fall by 1.4 million barrels per day (bpd) in 2023 following the EU’s ban on seaborne exports of Russian crude. But with more than 90% of Russian crude now finding buyers in Asia, exports averaged 3.76 million bpd in April, 22% above the average pre-war level of 3.1 million bpd, according to S&P Global.

CREA’s report shows seaborne imports of Russian crude oil to China, India, Turkey, UAE and Singapore increased by 140% in volume terms, or 182% in value from the year prior, since the eruption of the Ukraine war. The total value of their imports was 74.8 billion euros ($82 billion) over the 12 months, with the five countries accounting for 70% of Russia’s crude oil exports since the war began.

The line-up of traders dealing with Russian barrels has changed significantly since the war began, said Viktor Katona, lead crude analyst at commodity analytics firm Kpler. “First it was the Western majors that quit the game, then followed the global trading companies, so basically there is very little Western presence in the trading of Russian barrels right now.”

Since the invasion, the EU, G7 and Australia increased their volume of refined oil products imported from China by 94%, India by 2%, Turkey by 43%, UAE by 23%, and Singapore by 33%. The five nations’ exports of oil products increased 80% in value terms and 26% in volume terms to price-cap countries, the report states, with a rise of only 2% in volume to non-price-cap countries since February 2022.

CREA has said it is unable to verify the precise amount of oil products from Russian crude oil that passes through the five “laundromat” countries to nations that abide by the price cap, though it cites the data trends as “evidence that laundromat countries are providing funds to the Kremlin through higher imports for Russian crude on the prior year.”

The trade flows, coincident with the imposition of sanctions, have led to “the inference that the sanctions are being avoided by the export of Russian crude oil to the laundromat countries, where the crude oil is refined into products which are then sold as non-Russian origin products,” said Larry Cantú, an international oil and gas attorney with risk advisory firm Ball PLLC.

In addition to the “laundering” of Russian crude in third countries, Cantú added that the incomplete or false documentation of crude oil shipments and the manipulation of Automatic Identification Systems (AIS) to conceal that a vessel has called at a Russian port are among the suspected practices employed to evade the sanctions.

Irina Tsukerman, a US national security lawyer and the programs vice chair for the American Bar Association’s Oil and Gas Committee, told Asia Times Russia is believed to be adopting evasion schemes used by other sanctioned oil exporters such as Iran and Venezuela, such as the maritime practice of vessels transferring oil ship-to-ship in international waters.

“One of the ways Russia has been able to create an opaque market is by sending out the tankers without a precise destination. That’s how they eventually get to ship-to-ship transfers,” said Tsukerman, who is a geopolitical and business analyst and president of Scarab Rising, Inc, a strategy advisory specializing in security and market research.

“Some of the ‘disguised’ oil is even making its way into the United States as a result of the success of these measures… [Russia] has also engaged in schemes to obscure the real prices it is charging, by putting on paper lower prices that fit under the price cap, as with exports to India, but in reality, charging above the price cap to make profit,” she added.

Cantú noted that trade in products made from Russian crude has become “extremely profitable” since it is more difficult to trace the origins of refined oil products than it is to identify the source of crude oil.

“Consequently, when the sanctions against Russian oil were implemented, the price of Russian crude fell sharply but the price of refined products made from Russian crude did not.”

Tsukerman went on to identify Singapore as “one of the leading trade hubs benefiting from the Russian sanctions circumvention schemes,” with the Southeast Asian trade hub reported to be “one of the locations where that oil is blended with others to begin with, giving traders as much as a 20% profit margin from combining the Russian grade oil with other grades.”

Singapore’s refining industry is one of the largest in the world with a combined processing capacity of over 1.5 million bpd, and it plays a significant role in the global oil market. The business and financial hub is also a leading center for oil bunkering and trading, with the Singapore Exchange (SGX) offering crude oil futures and options, fuel oil derivatives and other energy products.

Singapore has been publicly critical of Russia’s invasion of Ukraine, imposing targeted sanctions and restrictions on Russia covering export controls on military and certain dual-use goods, as well as measures prohibiting financial institutions from dealing with designated Russian banks. The island nation has not, however, banned the import of Russian oil or petroleum products.

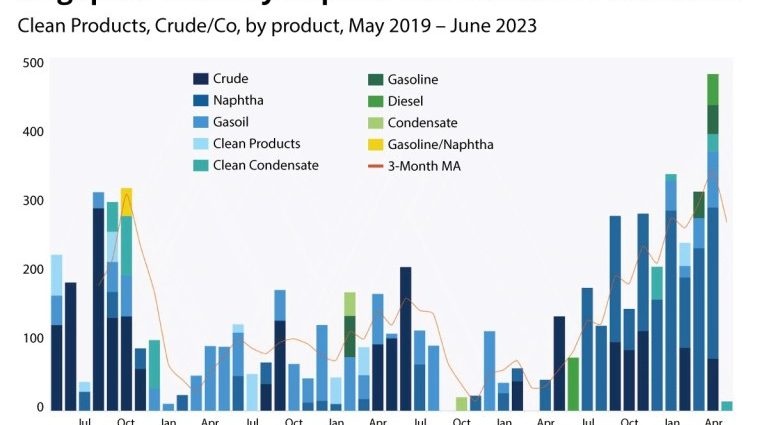

Besides refining Russian crude oil, Singapore has sharply increased its imports of refined oil products from Russia in recent months, with April seeing the highest volume since January 2019, said CREA’s Levi. “This increased inflow has not been matched by a corresponding increase in exports, so Singaporean refiners have in fact been squeezed by the inflow of refined products from Russia,” he said.

“Refineries in Singapore may be profiting from importing lower-cost Russian crude oil and refining this to then either sell the oil products domestically or exporting these oil products. Singaporean traders and refiners are not only tarnishing themselves morally but also taking a commercial risk by doing business with oil producers closely connected to the Kremlin and its war crimes,” Levi added.

Moral hazard and commercial risks aside, Singaporean businesses are conducting themselves legally and are not apparently breaking any laws in this trade. Authorities in the city-state have said local companies will have to consider and manage any potential impact on their business activities, transactions and customer relationships when dealing with Russian crude oil and refined products.

Minister of State for Trade and Industry Low Yen Ling told parliament in February that while Singapore is “not a participant of the EU ban, companies and financial institutions in Singapore have been informed of the ban imposed by the EU and other countries, via circulars issued by relevant government agencies.”

In addition to Russian diesel imports hitting their highest volume in more than a year, official data showed Singapore’s imports of Russian naphtha, which is used in gasoline blending and also a key ingredient in plastics and petrochemicals, nearly tripled in the first quarter of 2023 to 741,000 tons, up from around 261,000 tons in the fourth quarter last year.

Demand for oil storage tanks in Singapore has also reportedly increased, which analysts see as an indication that Russian fuel is being blended and re-exported globally, clearing the way for ship insurance and financing that would otherwise be banned under sanctions. “Because the whole product is no longer of Russian origin, some oil companies have accepted it,” Tsukerman said.

“The demand for Singapore’s onshore tanks as well as offshore floating storage has been on the rise. A six-month lease for Singapore fuel oil or crude oil storage rose by as much as 17-20% in costs over the course of last year,” the veteran lawyer and analyst added. “This points to the fact that Russia’s oil – and petrol blends meant to obscure its origins – are likely flooding the markets.”

Skeptics of the West’s efforts to deny the Kremlin an energy export windfall may interpret the existing loopholes and evident sustained Western demand for Russian oil as proof that Russia is, in fact, too big to sanction. CREA, however, argues that the price cap countries continue to wield strong leverage to ratchet down the price cap level and close the exploited loopholes.

Under the price cap system, companies shipping Russian oil outside of Europe are only able to access EU insurance and brokerage services if they sell the oil at or under $60. According to CREA’s report, 56% of Russian crude oil shipped to the five “laundromat” countries has been transported by vessels owned or insured by the price cap nations from December 2022 to February 2023.

The Helsinki-based research organization suggests the price cap countries use their clout in insurance and shipping industries to ban imports from refineries receiving any Russian crude, deny imports of refined oil products of Russian origin, as well as ban maritime services in perpetuity to vessels used to transport Russian crude without complying with the price cap.

“The penalty for violating the price cap policy is exclusion from insurance and financial services for three months. This amounts to a slap on the wrist compared with the initial proposal, which was exclusion in perpetuity. The punishment should clearly be toughened,” said CREA’s Levi, who said he was not aware of any companies that have yet been caught in the dragnet for sanctions violations.

Mike Salthouse, head of external affairs at marine mutual liability insurer NorthStandard P&I Club, told Asia Times that the vessels which we insure “are aware of the requirement to obtain an attestation [of compliance with the price cap] from their contractual partner before lifting the cargo. Whilst it is difficult to be sure, the attestation system appears to be effective.”

Russia, which has banned deals that involve applying the price cap mechanism, and its partners are now “investing in ships, that are flagged, classed and insured in jurisdictions beyond the reach of the EU and G7 […] to avoid price cap constraints,” he added. “Of concern is that the safety and inspection regime is likely to be less rigorous and the insurance less reliable than we have been used to.”

Follow Nile Bowie on Twitter at @NileBowie