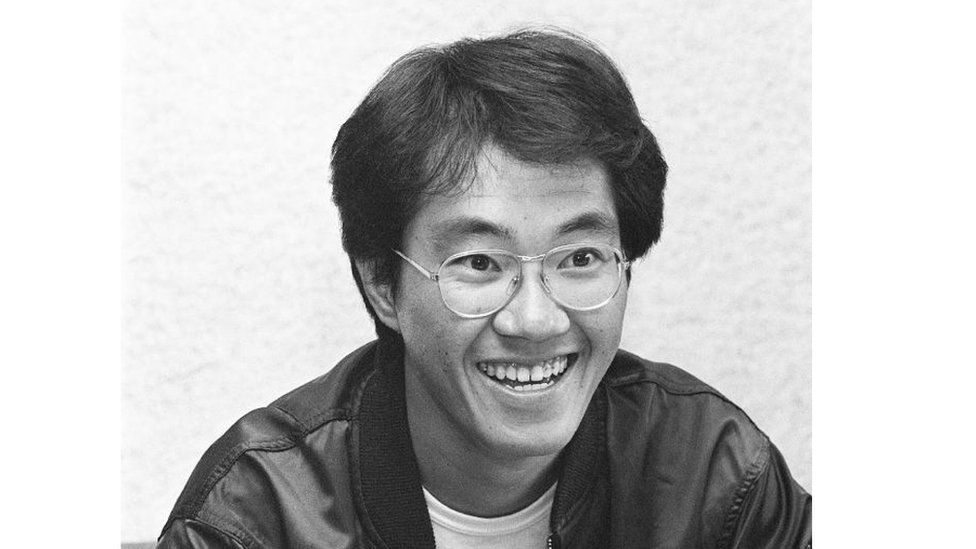

Dragon Ball: Japan manga creator Akira Toriyama dies

Getty Images

Getty ImagesThe creator of Dragon Ball, one of the most influential and best-selling Japanese comics of all time, has died at 68.

Akira Toriyama succumbed to acute subdural hematoma, a type of bleeding near the brain, his studio said Friday.

Dragon Ball is hugely popular around the world and the comic series has also spawned cartoon and film versions.

Fans have paid tribute to Mr Toriyama for creating characters that have become a part of their childhood.

The Dragon Ball comic series debuted in 1984. It follows a boy named Son Goku in his quest to collect magical dragon balls to defend Earth against alien humanoids called Saiyans.

Mr Toriyama had uncompleted works at the time of his death.

He died on 1 March and only his family and very few friends attended his funeral, according to a statement from the Dragon Ball website.

“He would have many more things to achieve. However, he has left many manga titles and works of art to this world,” his studio said.

“We hope that Akira Toriyama’s unique world of creation continues to be loved by everyone for a long time to come,” it added.

Fans offered their sympathies on social media.

“Thank you for creating a manga that represents my youth. Rest in peace, thank you for your hard work,” read a post on X, which instantly got 500 likes.

“It’s too soon, it’s too sad,” another Japanese X user wrote.

“His legacy will live on forever. Thank you for creating the most iconic anime character of all time Akira,” another user wrote.

Born in Nagoya, Japan in 1955, Mr Toriyama broke into the comic book world in the early 1980s with Dr. Slump, which tells the story of a little girl robot Arale and her scientist creator.

But Dragon Ball was his most famous work. To many fans, Son Goku’s journey from a kid who fumbles his martial arts training to a high-flying hero who can shoot bolts of electricity from his hands mirrors their own struggles against self-doubt as they grew into adulthood.

Dragon Ball inspired fan fiction writers and cosplayers who style their hair like the characters’ sharp and pointed locks.

The cartoon version has been dubbed in numerous languages and Dragon Ball action figures are a staple in toy stores from Japan to China and Southeast Asia.

In a 2013 interview with a Japanese newspaper Asahi, Mr Toriyama said he had “no idea” how Dragon Ball became so popular around the world.

He described the series as a miracle, “given how it helped someone like me who has twisted, difficult personalities do a decent job and get accepted by society”.

“When I was drawing the series, all I ever wanted to achieve was to please boys in Japan,” he said, according to news agency AFP.

-

-

31 August 2023

-

-

-

26 March 2022

-