China birthrate, robots to move factories to Africa – Asia Times

The development of efficient technology has once more brought attention to American manufacturing.

In February, African rulers submitted a proposal to the UN, calling for the responsible use of nutrients essential for production “green” products, for as solar panels and batteries. The frontrunners argued that because these nutrients are found largely in Africa, Africa may gain more from their oppression, by integrating them into the country’s industrialization.

This renewed attention on industrializing natural resources only serves as a reminder of how poorly American manufacturing has developed since mining in the past. Africa contains half of the world’s iron and chromium, as well as 20 % of its metal and silver. However, the majority of these minerals are raw and are exported, with 85 % of their control occurring in China alone.

It is no wonder, then, that China’s manufacturing business benefits largely from the American nutrients the country processed. However, since the 1960s, African production has gradually declined as of the world full, while that of East Asia, and China in particular, increased in combination.  ,

African leaders have gathered on numerous occasions to voice their desire to collaborate with outsiders to improve the country’s manufacturing industry. This phone has been received positively by the Chinese government.

In particular, in August 2023, the Taiwanese authorities announced its intention to start the Initiative on Supporting Africa’s Modernization. To support Africa expand from its dependency on agriculture and the extraction of natural resources, this initiative makes targeted investments in American manufacturing.  ,

However, China is shifting its manufacturing to Africa even without the government’s approval. Chinese companies are increasingly looking to Africa to try to overtake them in the local market as a result of tight competition at home and in European markets. Data from August 2023 demonstrate that 12 % of Africa‘s production now has Chinese presence, representing one- second of all Chinese commercial activities on the globe.  ,

Reduced appeal of” Made in China”

The rapid decline in China’s community is one of the main causes of Taiwanese manufacturers leaving for Africa. After losing 850, 000 people in 2022 for the first minimize since 1961, the state lost another 2 million in 2023.

According to estimates, people will continue to decline dramatically, reaching 1.4 billion in 2080 and 800 million in 2100. The nation will soon have a lack of consumers who will continue to purchase everything produced by its sizable manufacturing industry, which accounts for 38 % of China’s GDP and 28 % of the world’s total.  ,

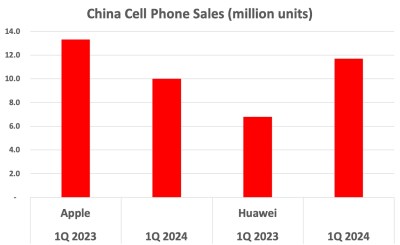

Additionally, concerns about disrupted industry have decreased international interest in China-made products as a result of talk of Western decoupling from China-centered supply chains. In 2023, Chinese imports experienced their first decrease in seven years, and they significantly underperformed projections in March 2024.

The outlook for Chinese exports to its biggest countries is not looking promising, with Trump requesting a 60 % tax on all Chinese exports if he travels to the White House and the Euro looking into ways to respond to alleged Chinese dumping.  ,

With China’s people receding and Western attempts at decoupling intensifying, China is looking less appealing as a main center for manufacturing. For manufacturers, the position of China as a “growth” business comes under risk as the country’s working- time people continues to decline. The Chinese market for manufacturing goods may soon become a drag on the profit-focused due to the country’s persistent consumer pessimism.  ,

China’s robotics- first manufacturing can be easily shifted to Africa

Of course, manufacturing in China has a lower attractiveness than manufacturing in Africa. Because of its projected double to 2.5 billion by 2050, Africa’s population may have a large potential market for manufactured goods. However, it lacks the ready production expertise needed to entice manufacturers out of China with only 1.9 % of the current global manufacturing output.

This industrial “know-how gap” may be quickly addressed by an emerging trend within Chinese manufacturing.

China’s factories are rapidly shifting from labor- intensive to robot- intensive, as the number of available factory workers declines. By 2035, China’s population of working-age people is projected to reach nearly a third of the total, up from its 2011 peak, which was also predicted. By then, the remaining workers will need to work doubly hard to look after the retired elderly and perform the tasks they left behind.

In response to this population trend, in 2022 alone China installed more than 290, 000 industrial robots, accounting for more than half of those installed around the globe. China is making an effort to prevent future labor shortages by increasing the stock of industrial robots by an average of 25 % annually since 2017.  ,

In this context, consider Nio, a darling of the Chinese electric vehicle industry, who is widely touted by the Chinese government as guiding the next-generation of the nation’s manufacturing sector. Through its second factory, Nio has already demonstrated that 100 % automation is possible, while committing to reducing 30 % of the global workforce through technology.

By expanding its business overseas beyond its factory in Hungary and using robotics, it could quickly enter markets like Africa with no production know-how but robust sales.

Manufacturers are less dependent on the legions of trained Chinese factory workers than they were before with the advent of cheap and plentiful industrial robots.

Let’s say a sufficient portion of the Chinese industrial supply chain relies on robotics to perform a significant portion of the manufacturing tasks. In that situation, it is no longer possible to shift the supply chain and a few “robot managers” to Africa, a large and expanding consumer market with a much better chance of growing in the future than China’s.  ,

Made in China’s advantages less insurmountable with technology

Of course, it should be made clear that having factory automation everywhere does not guarantee that Africa will quickly erect a sector the size of China’s.

The Chinese consumer market is the second-largest in the world after the US despite declining consumer confidence and a shrinking population. The country also has reliable electricity, smooth highways, fast- moving customs and efficient worker recruitment processes. These cannot be easily replicated in Africa without significant financial investment, policymaking, and changes in working culture.  ,

However, it is also important to point out that these benefits of Made in China date back only a few decades and are only made possible by personnel’s slow learning and training. In January 1981, China exported goods worth little more than$ 1.5 billion. Compare that to the nearly$ 300 billion that the nation exports each month.

As recently as 2004, China’s entire manufacturing output was a little more than 600 billion USD, a fraction of the more than 5 trillion USD today. China’s factory labor has grown from as little as <a href="https://www.bls.gov/opub/mlr/2005/07/art2full.pdf”>53 million in 1978 to more than 200 million in 2022 as a result of the manufacturing boom. In other words, China’s industrialization started at a much weaker foundation than Africa’s today.

A new industrial economy with a focus on automation may significantly lessen the opportunities for the slow process of human training and knowledge transfer required for scalable manufacturing. With sufficient electricity and internet access, the software behind industrial robots that uses artificial intelligence can plug and play anywhere in Africa. The ability of African nations to catch up with China will significantly increase as the focus of manufacturing shifts from largely immovable human labor to highly mobile robots and software.  ,

It will be more financially viable for Chinese companies to set up automated facilities in Africa as industrial robot fabrication and maintenance become more affordable. Exporting from automated factories in China becomes more illogical as the Chinese consumer market shrinks and the West turns away from Made in China for political reasons. The Chinese are working on industrial robots at home, and they will eventually export them to Africa, enabling automated manufacturing in the Chinese to flourish where they are not yet practiced.

Currently based in Malta, Xiaochen Su, PhD, is a business risk and education consultant. He previously worked in Japan, East Africa, Taiwan, South Korea and Southeast Asia.