Johnson Controls opens new office and innovation center in Singapore

- The area will host the OpenBlue Innovation Center and can provide 450 employees.

- Office complies with Singapore’s 2030 Green Plan, which promotes green growth.

.jpg)

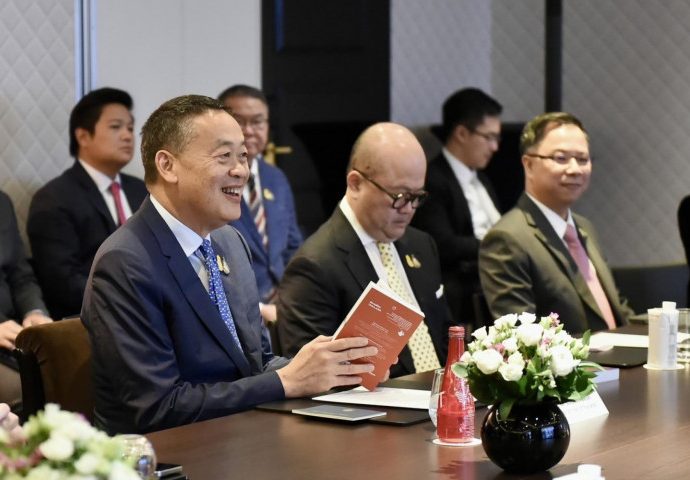

Johnson Controls, a leader in bright, healthy, and lasting buildings, today opened its innovative office in Singapore. The company, strategically located at One- northwest, serves as a living laboratory for collaboration, study, and development, furthering Johnson Controls ‘ commitment to its partners and community across Southeast Asia.

At the new business opening, Johnson Controls chairman and CEO George Oliver stated that” Singapore’s vibrant and innovative ecosystem corresponds with our vision for a more lasting future, where economic development goes hand in hand with economic management and social duty, ensuring a brighter and more resilient future for all.” Our Singapore company represents a fantastic next stage in our commitment to this vibrant and varied nation, he continued.

The area, which covers 3, 535 square meters, did house around 450 employees and house an OpenBlue Innovation Center that will demonstrate solutions for building owners, operators, and industry leaders to create intelligent buildings that are safe, healthy, and green.

Johnson Controls ‘ OpenBlue Innovation Center is a good example of how businesses are working with our ecosystem to advance innovation and technology growth, according to Jacqueline Poh, managing director of the Singapore Economic Development Board. We anticipate the wise and environmentally conscious building solutions that this center will create and provide to the East Asian region, she continued.

One-North’s connected habitat expands the effect of the novel service, encouraging cooperation with local partners, institutions, and industry experts to advance technology and solution integration to bring cutting-edge innovation to the market.

The new business building also supports The Singapore Green Plan 2030, which strengthens Johnson Controls ‘ commitment to advancing the country’s national plan on sustainable development in the face of obstacles like climate change and urbanization, and furthers Johnson Controls ‘ commitment to advancing the wise area change in Singapore and throughout Southeast Asia.

Johnson Controls claimed, in addition to supporting Singapore’s vision for a brighter and more efficient future, it has equipped more than 40 % of the city-state’s commercial properties with wise developing solutions.

With Singapore as our proper hub, Johnson Controls is well-positioned to promote sustainable development, facilitate innovation, and form lasting collaborations that may shape the region’s and the region’s future.