Four arrested over romance-investment scams

PUBLISHED : 30 Nov 2023 at 04:00

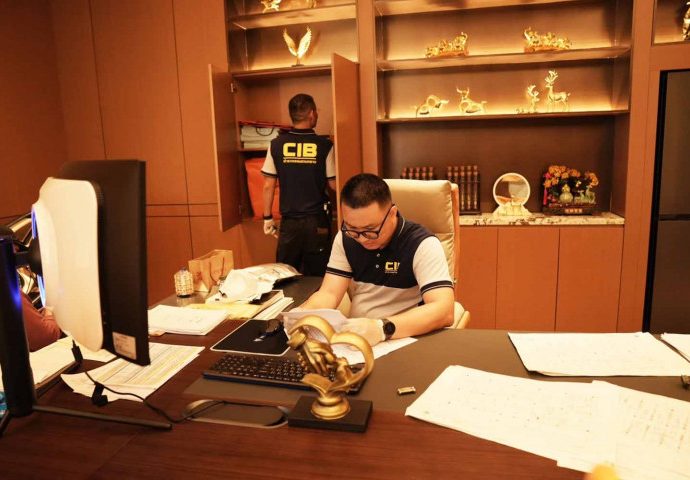

Police have arrested two Chinese and two Thais for alleged involvement in romance-investment scams and impounded assets worth about 300 million baht.

Pol Lt Gen Jirabhop Bhuridej, chief of the Central Investigation Bureau, said yesterday the arrests and seizures were made at five raided premises in Bangkok and Samut Prakan on Tuesday.

He identified the Chinese suspects as Hongling Ruan, 44, and Zhao Yue, 59. The arrested Thais are both women, identified as Lawan Thawee-apiradeepoon and Sawiktree Angkabut.

They were charged with public fraud, computer crime, participation in a transnational crime organisation and money laundering.

Pol Lt Gen Jirabhop linked the suspects to nine other Thai and Chinese suspects arrested earlier.

They allegedly used false Facebook profiles of attractive women to approach victims they lured into romance and cryptocurrency investment scams.

One of the new suspects, the Chinese man Ruang, is the husband of a 28-year-old Thai model Jakkreena Chookhaowsri, alias Kiki Maxim, one of the nine suspects previously arrested with assets worth about one billion baht.

Pol Maj Gen Athip Pongsiwapai, commander of the Technology Crime Suppression Division, said the gang laundered their ill-gotten gains by buying luxury houses and vehicles and investing in lounges and restaurants.

Police have now impounded assets worth 1.3 billion baht, including 19 luxury houses, 14 luxury vehicles and 6 million baht in cash.