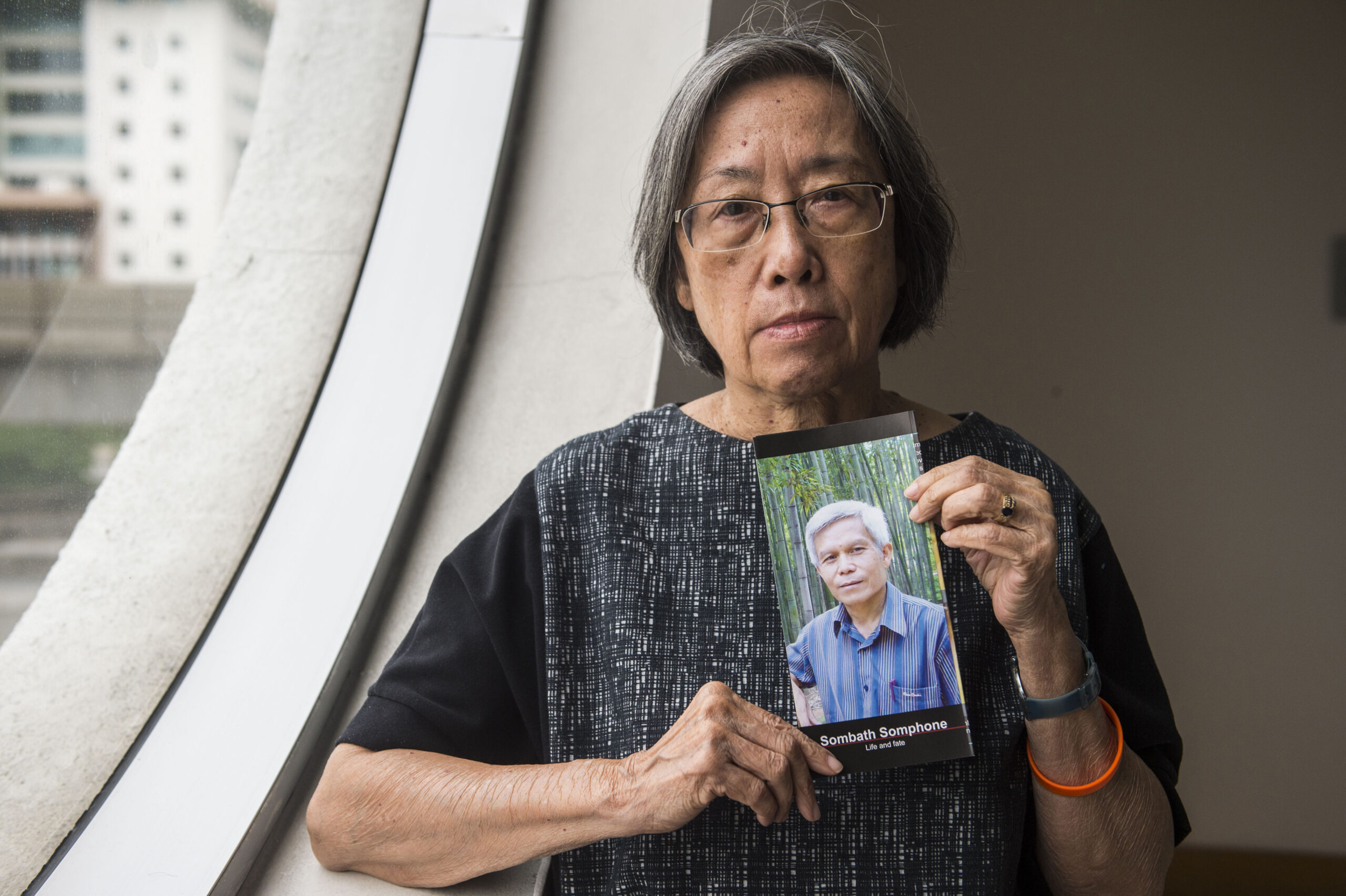

Jes Min Lua: My nine learnings in nine years of entrepreneurship

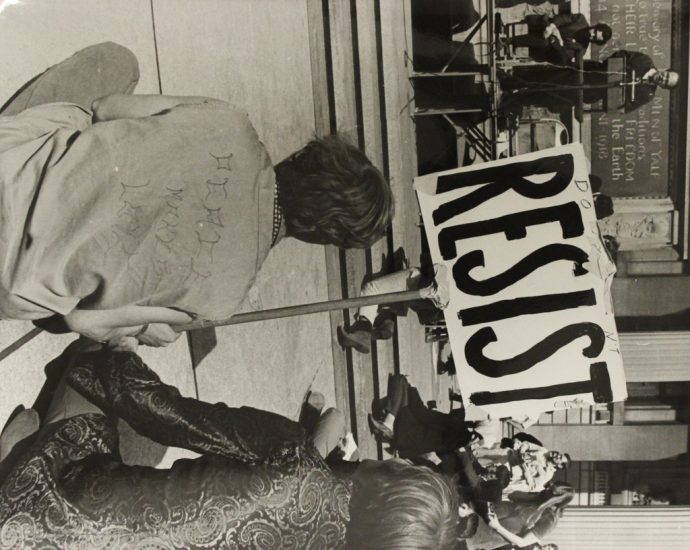

If mission is noble, product useful (and you’re not a horrible person), people will help

Stop obsessing over competitors, losing sleep when they raise $, focus on your journey

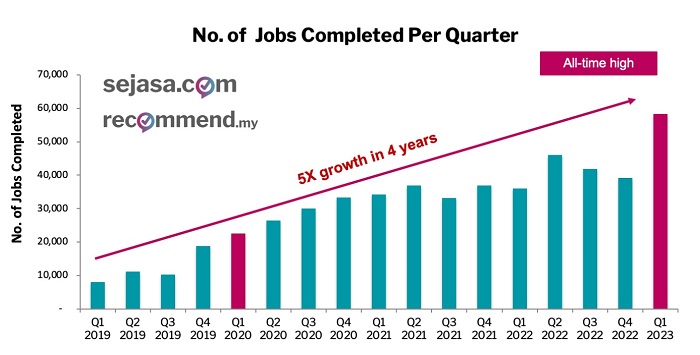

They say cats have nine lives. They explore, climb high things, fall frequently, but somehow always manage to land on their feet, and continue…Continue Reading