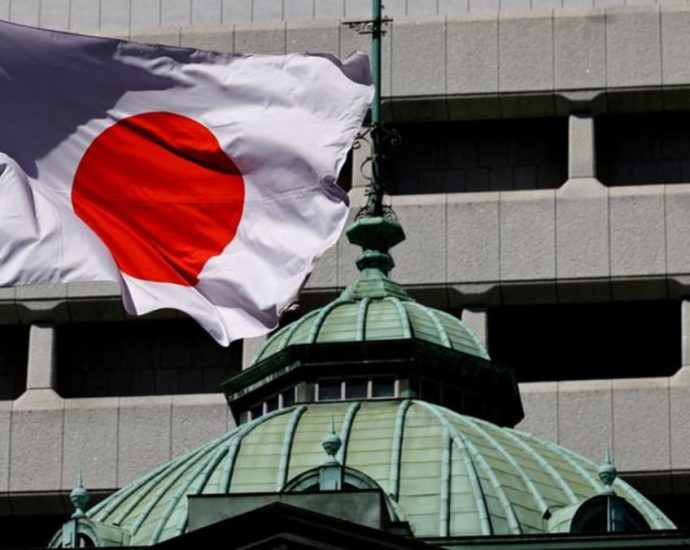

Japan stocks rebound a day after major rout

After falling on Monday, Chinese stocks recovered in early trading on Tuesday night, sending ripples through global financial markets.

After falling by over 12 % the previous day, the Nikkei stock index was trading more than 8 % higher.

The Bank of Japan’s next rate climb in 17 years, which caused the yen to rise against the dollar, increasing the price of Chinese stocks in Tokyo and Chinese goods in public for foreign investors and buyers, led to yesterday’s market rout.

Concerns that the British economy will slow down caused companies to drop on Monday in the US and Europe.

The technology-heavy Nasdaq index earlier in New York opened 6.3 % lower, but the decline over the course of the day came to an end, dropping 3.4 %.

The S&, P 500 fell 3 % and the Dow Jones Industrial Average was 2.6 % down by the end of trading on Monday.

In Europe, the CAC-40 in Paris trimmed earlier losses to end 1.4 % lower while Frankfurt’s DAX and the UK’s FTSE 100 lost about 2 % each.