Elevate Programme graduates see capital market as viable fundraising channels to catalyse growth

- Graduating firms ‘ goals are to promote growth and expand their markets.

- Aims to help SMEs, MTCs build capabilities for cash business funding

.jpg)

The first cohort of Capital Markets Malaysia ( CMM), an affiliate of the Securities Commission Malaysia (SC), has completed its 2024 Elevate Program. This program aims to help the executive leadership of high-performing small and medium enterprises ( SMEs ) and mid-tier companies ( MTCs ) who want to accelerate growth. It teaches them how to effectively navigate and use fundraising options via the capital market.

CMM created the 10-day Elevate Programme to assist SMEs and MTCs in developing the skills and competencies necessary to meet the specific nuances of investment sector fundraising, whether through an Offering list or private equity investment, with the SC and Bursa Malaysia serving as strategic partners. In particular, the program’s goal is to help senior leaders describe their development vision by fostering investor confidence in their capability for scaling up.

SME and MTCs are essential to our business, and Navina Balasingam, General Manager of CMM, said it is important for us to facilitate available ways to raise funds that are necessary for these companies to grow. The Elevate Programme at CMM was created specifically for this purpose. Through this program, we hoped to help businesses that are prepared for the upcoming growth stage.

She continued, saying that if done correctly, this program will be crucial in developing a vibrant and dynamic network of businesses seeking to list or invest in private capital, while positioning Malaysia’s capital market as a top choice for both fundraising and investing.

This effort supports the nation’s ambitions, as underscored by the SC’s recently unveiled’ Catalysing MSME and MTC Access to the Capital Market: 5-Year Roadmap ( 2024–2028 )’, which sets out a goal of increasing MSME and MTC capital market fundraising by more than five-fold, from US$ 1.4 billion ( RM6.3 billion ) in 2023 to US$ 9.2 billion ( RM40 billion ) by 2028.

SNS Network Technologies, which listed on the ACE Market in September 2022 and completed its move to the Main Market in June this year, are significant graduates from previous Elevate groups, as well as YX Precious Metals Bhd, which listed on the ACE Market in 2022 and has begun the process of transferring to the Main Market.

The most recent Elevate Programme group graduated from the” Demo Day,” where participants presented their equity reports to potential investors and investment bank, putting the lessons learned from the four-month program into exercise. Apart from engaging with buyers, the companies obtained market-relevant, meaningful comments, enabling them to further enhance their plans and strategies to better status their businesses as beautiful investments. The college companies represent a diverse range of industries, including manufacturing, medical, financial, systems, and services, among others, all of which aim to amplify their growth direction and business reach.

The participating companies include Fipper Marketing Sdn Bhd, Gourmet Ingredients Sdn Bhd, Great Pyramid Sdn Bhd, i-Chem Solutions Sdn Bhd, Kasut U Sdn Bhd, Imetal ( M ) Sdn Bhd, and Tera Va Sdn Bhd, to name a few.

A equally diverse group of leaders of high-performing SMEs and MTCs is convened for the next Elevate Programme group, which is scheduled to begin in September 2024. Organizations seeking to meet potential groups may attend https ://www.capitalmarketsmalaysia.com/elevate-programme/ for more information on the project.

.jpg)

.jpg) His back was against the wall by that point, so the timing could n’t have been better. It was not an easy time, he admits. There was little to no money being made, and the statement” We were running out of money then” was true.

His back was against the wall by that point, so the timing could n’t have been better. It was not an easy time, he admits. There was little to no money being made, and the statement” We were running out of money then” was true.

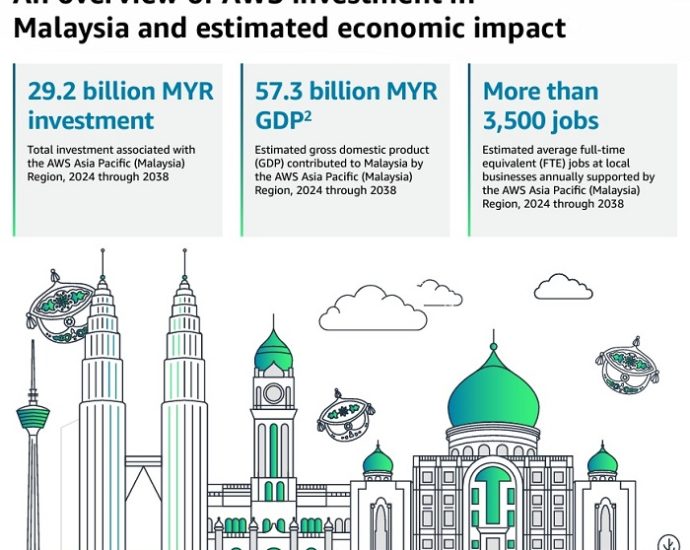

The new AWS Region in Malaysia, led by Prasad Kalyanaraman ( pic ), vice president of infrastructure services at AWS, enables organizations across Asia Pacific to fully exploit the potential of the world’s most extensive and reliable cloud, assisting customers in deploying advanced applications with a wide set of AWS technologies like AI and ML. With today’s release, AWS is happy to support Malaysia’s modern transformation and help promote its function as a local hub for AI”.

The new AWS Region in Malaysia, led by Prasad Kalyanaraman ( pic ), vice president of infrastructure services at AWS, enables organizations across Asia Pacific to fully exploit the potential of the world’s most extensive and reliable cloud, assisting customers in deploying advanced applications with a wide set of AWS technologies like AI and ML. With today’s release, AWS is happy to support Malaysia’s modern transformation and help promote its function as a local hub for AI”.

![[Back, left to right] Eric Mui (VP & general manager), Heidi Leung (global head of Customer Success), Lewis Law (head of Growth), Xenia Chu (chief of staff), Adrian So (director of Product), [Front, left to right] Joy Liu (global Head of Marketing), Henson Tsai (CEO & founder), Gao Lei (chief technology officer) [Back, left to right] Eric Mui (VP & general manager), Heidi Leung (global head of Customer Success), Lewis Law (head of Growth), Xenia Chu (chief of staff), Adrian So (director of Product), [Front, left to right] Joy Liu (global Head of Marketing), Henson Tsai (CEO & founder), Gao Lei (chief technology officer)](https://www.digitalnewsasia.com/sites/default/files/images/SleekFlow.jpg)