Post-US-China truce, wiser for Seoul, Tokyo to take the long road – Asia Times

The Donald Trump administration is pursuing a flurry of activities designed to convey the impression that a wave of trade deals is underway. The announcement of an agreement framework with the United Kingdom was followed by talks between Secretary of the Treasury Scott Bessent and Chinese counterparts.

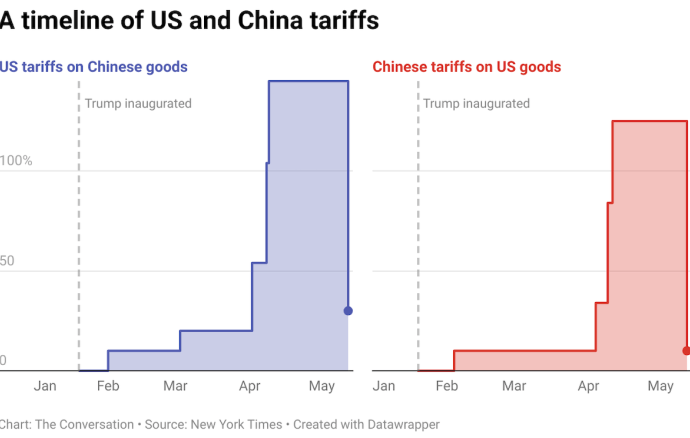

The United States and China agreed to a ninety-day pause in their tariff war, setting rates of 30 percent by the United States and 10 percent by China while negotiations take place. Talks of de-escalating the high-stakes trade war are clearly aimed at dampening the severe reactions of financial and stock markets.

South Korean officials have seized upon this activity as a sign that bilateral talks can yield positive results, particularly the removal of the 25 percent tariffs imposed on autos, steel, and electronics.

Han Duck-soo, the former prime minister who stepped down to pursue an independent bid for president, expressed hope that he could negotiate a “win-win” deal with President Trump.

“There is always some room for cooperation and good communication among policymakers of the United States and Korea. So I feel rather good about expecting some acceptable final results from that,” Han said at a meeting with foreign correspondents in Seoul on May 7. “We will do our best making win-win solutions.”

But there are grounds for deep skepticism about the prospects for success in these and other talks.

Economist and former New York Times columnist Paul Krugman dismisses reports of the US-UK deal and other deals as “smoke and mirrors, an attempt to persuade the gullible that Trump’s tariffs are actually working.” Krugman argues that these talks are “a response to a problem that didn’t exist” and that trade deficits do not reflect unfair foreign trade practices or high tariffs but rather the huge flows of capital into the United States, which reflect the perception of the United States as an attractive place to invest.

Japan’s experience of two rounds of negotiations with Bessent and other senior US officials is instructive. Japanese negotiators emerged from the talks mystified as to what the Trump administration actually wanted. The US side refused to discuss the biggest tariff rate – the 25 percent tax placed on autos, auto parts, steel, and aluminum – and insisted that these were global tariffs not subject to exemptions.

The Japanese government is in no rush to reach an agreement, although it does not want to be seen as backing away from talks. Prime Minister Shigeru Ishiba faces considerable criticism from the opposition for engaging in “tribute diplomacy.” With elections for Japan’s parliamentary upper house coming in July, the ruling party does not want to concede to what are seen as unreasonable demands from the United States.

“It’s not better just because it’s faster,” Ishiba told reporters following the bilateral talks. “For us, while properly asserting our national interests, it’s not good to reach an early conclusion by sacrificing such interests.”

South Korea faces many of the same circumstances. The first round of talks in Washington was similarly inconclusive, and the key issues for Seoul – tariffs on autos, auto parts, steel and aluminum – are also beyond discussion for now. This is unlikely to change even after a new presidential administration is voted into office on June 3.

Secretary of Commerce Howard Lutnick, commenting after the US-UK announcement, acknowledged this reality. “You’ve got to spend an enormous amount of time with Japan, South Korea,” he told reporters. “These are not going to be fast deals.”

Like Japan, South Korea’s strategy has been to seek concessions to induce the removal of the tariffs. Offers to cooperate on shipbuilding and energy production have been put on the table. But trade policy experts doubt those gestures will ultimately succeed.

“Many will still try to use this pause period to finalize something in exchange for a moderation to their initial tariff ‘sentence,’” says Michael Beeman, former assistant US trade representative for Japan, Korea and APEC in the Office of the US Trade Representative (USTR).

“There will be value in negotiating since, as I’ve been saying, the threats are a tactic in part — but not in whole. Because at the end of the day, he still wants a new, higher rate on the world,” Beeman, the author of Walking Out: America’s New Trade Policy in the Asia-Pacific and Beyond, told this writer.

The Japanese prime minister explicitly rejected a new, higher rate as a possible outcome. “We are seeking a complete elimination,” Ishiba said on Sunday. “It is not a matter of being satisfied with a certain percentage.”

When engaging the Trump administration, Korea and Japan need to “be patient” and take a longer view, Stanford University Professor Gi-Wook Shin told a recent seminar at Stanford’s Walter H. Shorenstein Asia-Pacific Research Center.

Short-term efforts to appease the Trump administration are unavoidable, but they should be paired with efforts to bolster free trade outside. US discussions of reforming the World Trade Organization (WTO) offer one pathway, though admittedly a complex and drawn-out process. More likely are discussions to expand and strengthen existing regional trade regimes in the Indo-Pacific, including through partnerships with the European Union.

According to the Financial Times, plans to forge a strategic partnership between the European Union and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) have been revived in response to the trade wars unleashed by the Trump administration.

The CPTPP already brings together twelve nations, including Canada, Japan, Mexico, Vietnam, Australia, and the United Kingdom, and covers rules for investment, digital trade, and other goods trade. According to the report, support for linking the two arrangements has come from New Zealand, Canada, Singapore, and, quietly, Japan. The proposal could be discussed at the upcoming meeting of trade ministers at the Asia-Pacific Economic Cooperation (APEC) later this month in South Korea.

“Any efforts to strengthen and widen the CPTPP as a rules-based international trade system are useful,” says a former senior Japanese Foreign Ministry official who led the effort to embrace CPTPP without US participation during the first Trump administration. But the former official adds that he doubts the Ishiba government “has the guts” to do something similar.

The Regional Comprehensive Economic Partnership (RCEP), a looser regional trade grouping with fifteen Asia-Pacific member countries — including China — could also gain a larger role. China has presented itself as a guardian of free trade against the Trump administration’s protectionism, reaching out to the European Union, South Korea, Japan, and Southeast Asia as part of a charm offensive. Discussions of a free trade agreement between China, South Korea, and Japan were held recently, partly in response to Trump’s tariffs.

Chinese officials have also expressed an interest in joining the CPTPP. But there is considerable opposition to admitting China out of fear it would dilute the organization’s established standards, including clear restrictions on favoring state-owned enterprises.

“If you put China into the CPTPP, you basically blow it up,” Elizabeth Economy, a widely respected expert on China at Stanford’s Hoover Institution, told the Stanford seminar. “I don’t think the Japanese have any interest in bringing China into the CPTPP.”

South Korea’s participation in CPTPP faces much less opposition and could offer a means to balance the pressure from the Trump administration. The pathway to membership, however, will need to involve the strengthening of South Korea-Japan relations.

But the South Korean government may be reluctant to take that step, suggests Shin. “I don’t think Korea would be interested in joining a multilateral entity that didn’t include the US,” he said.

Such calculations in both Seoul and Tokyo could shift, however, if attempts to bargain with Washington falter and the global economy slips into a recession. In any case, it makes sense for South Korea to look beyond bargaining with Trump and join the construction of a free trade zone in the world economy.

Daniel C. Sneider is a non-resident distinguished fellow at the Korea Economic Institute of America and a lecturer in East Asian studies at Stanford University.

This article was originally published by KEI’s The Peninsula and is republished with permission.