Geopolitical conflicts fueling food, energy insecurity

The Russia-Ukraine conflict has severely affected two commodity supply chains: food and energy, thereby severely stressing the security of those sectors. Present stressors on global food security are a combination of such forces as Covid-19, climate change and geopolitical conflicts.

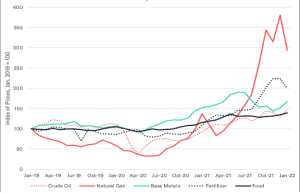

The International Monetary Fund (IMF) has observed how the prices of all primary commodities have grown, albeit at varying rates, since the start of the Russia-Ukraine war.

For example, the price of oil in January 2022 was 67.6% higher than at the same point a year prior. Natural-gas prices, similarly, have expanded by upwards of 200% over the same period.

Aluminum prices reached a 15-year high and food prices are likewise rising, with prices of products such as wheat reaching all-time highs. Average food prices from November 2021 to January 2022 were up 21.8% over the same period of the previous year.

Ukraine and Russia exert significant influence on global food supply chains, exacerbating challenges for low-to-middle-income nations and vulnerable communities already struggling with food insecurity in the aftermath of the Covid pandemic.

About 6 million tons of agricultural goods were shipped monthly to Asia, Africa and the Middle East. In June 2022, this number had shrunk to a fifth of its original value.

According to the UN’s Food and Agriculture Organization (FAO), global food prices have risen by 20%, a significant cause of concern worldwide. It further predicts a rise in the undernourished population by 7.6 to 13.1 million because of the conflict situation in Ukraine and the ripple effect on food prices and supplies.

Every nation within the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) group, with a particular emphasis on India, Myanmar and Bhutan, is heavily dependent on energy imports.

This extensive reliance on fuel trade poses a significant challenge for the region, rendering it susceptible to external economic disturbances. The Russia-Ukraine conflict underscores the critical need for countries to establish more energy self-sufficiency.

| Country | Most Recent Year | Import Percentage |

| Bangladesh | 2015 | 11 |

| Bhutan | 2012 | 18 |

| India | 2021 | 30 |

| Myanmar | 2021 | 20 |

| Nepal | 2021 | 15 |

| Sri Lanka | 2021 | 16 |

| Thailand | 2021 | 16 |

Rising energy prices driven up by the war have triggered inflationary pressures in many developing countries. Though the effects are not significant enough to hold back economic recovery, they still present global affordability and development risks.

Therefore, a combination of pathways must be taken to tackle the ill effects of the global food and energy risks. Naturally, humanitarian aid for the most vulnerable nations and populations should be the primary focus. Targeted subsidies should be prioritized for vulnerable groups of the developing and underdeveloped world most in need.

Similarly, international aid needs to be reoriented toward agriculture to help improve the food self-sufficiency of African and certain South Asian nations. Research shows that these regions have the potential to feed the world yet are still highly dependent on food imports for their domestic needs.

Additional investments should be made toward climate-smart agriculture in the Global South, which is most vulnerable to climate change. An integrated approach must be taken to promote water and nutritional security by acknowledging the water-food-energy nexus.

In the same vein, international markets have been a source of significant volatility in the global oil market. With most Global South nations being price-takers rather than price-makers for crude oil in the global market, multilateral forums should ideally ensure that such developing countries do not bear the brunt of market fluctuations.

Oil price volatility can be addressed through one of two ways. Better market intelligence and better use of market-based hedging instruments can go a long way in helping economies to adjust their demand based on how much importing fuel will set them back according to possible upcoming price movements.

The energy basket of the world could also be pushed to diversify its energy production. Middle Eastern and African oil-producing nations have already displayed an eagerness to explore non-fossil sources of energy generation, primarily due to the price fluctuations brought on by the pandemic. This will reduce the global dependence on fossil fuels and their volatile prices and ease the transition to green energy.

Finally, the ongoing geopolitical events show how fragile the current global supply chain is to shocks and the potentially disastrous effects they can have. This brings about the need for the adoption of better government procurement mechanisms, support for more rational price mechanisms for producing less resource-intensive but more nutritious food, and the creation of better energy market distribution systems.

At the same time, developing better risk management and hedging mechanisms through market-based institutions and instruments is essential.