BYD overtakes Tesla: implications for global investors

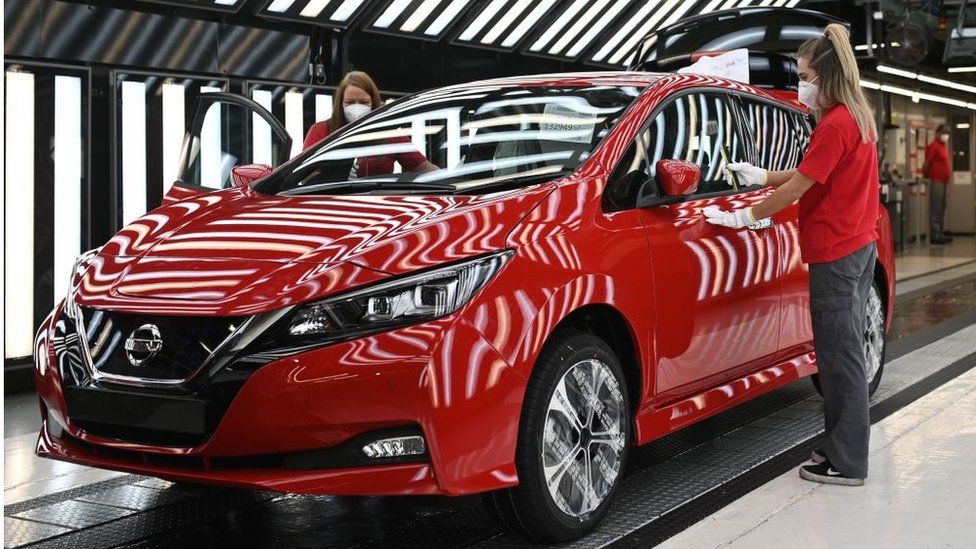

Elon Musk’s Tesla, a trailblazer and industry leader in the electric vehicle industry, has been dethroned for the first time by Chinese manufacturer BYD as the top-selling EV manufacturer worldwide.  ,

A closer look at the broader implications for international investors ‘ involvement in China in 2024 is required in light of this change in dynamics, which is characterized by BYD recording higher sales than Tesla in the previous quarter.

Tesla’s quick ascent to fame in the EV industry has come to be associated with creativity, cutting-edge technology, and Elon Musk-like leadership.  ,

But, BYD’s new ascent to the top spot in EV sales gives the sector a fresh perspective. Although Tesla has been a leader, BYD’s success highlights the rising global demand for electric cars, particularly in China, the largest automarket in the world.

BYD’s success can be attributed to its proper focus on the EV industry, which makes use of its power engineering experience and a wide range of products, including electric cars and trucks in addition to passenger cars.

The company’s comprehensive strategy for electric freedom has been well received by both consumers and businesses, putting BYD at the top of the global EV business.

The growth of international buyers ‘ interest in China is one significant consequence of BYD’s surpassing of Tesla.  ,

A positive culture has been created for home businesses like BYD to prosper as a result of the Chinese government’s dedication to promoting the green market and its strong policy support for the EV industry.  ,

Buyers are likely to become more interested and confident in allocating funds to the Chinese market as they see the success of Taiwanese companies in the world market.

Beijing’s visible commitment to leading the world in electric vehicles is consistent with efforts to make the transition to environmentally friendly and sustainable transportation.  ,

Chinese automakers are extremely expanding their footprint in foreign markets, opening up new opportunities for investors looking to gain exposure to the rapidly expanding EV industry. The government’s influence in the sector is not limited to local consumption.

Additionally, BYD’s success features a larger trend in Chinas ‘ technical skills and its ability to compete with recognized international players. In addition to catching up to their American counterparts, Chinese businesses are even redefining market dynamics through innovation.

China’s status as a formidable power in research, development, and technology is challenged by this change, which also challenges the conventional view of the nation as an industrial hub.

The changing panorama of China’s EV market emphasizes the significance of growth for international buyers.  ,

Investors must carefully weigh the risks and benefits associated with allocating money to Chinese assets as the Chinese industry matures and presents compelling expense opportunities. While there is still a chance for high profits, it is crucial to comprehend the regulatory environment, market relationships, and company-specific factors.

It is apparent in my opinion that BYD’s overtaking Tesla as the best-selling electric vehicle manufacturer in the world signals a significant change in global automotive industry dynamics, which investors will notice.  ,

I think it will probably pique more people’s attention in funding Chinese property this year.

Nigel Green is the CEO and founder of the deVere  Group. @nigeljgreen on Twitter, follow him.