Counting on coal: A visual guide to Cambodia’s big bet on fossil fuel

Photo story

An investigation of Cambodia’s three planned coal-fired power plants found the sites stalling as uncertainty continues to cloud the future of coal

Three years ago Cambodia defied the global push for clean energy by doubling down on fossil fuels.

After companies and embassies expressed concerns about coal, the Cambodian government pledged that its plans to develop three new coal-fired power plants would be the Kingdom’s last foray into coal-fuelled electricity.

Since 2020, energy production globally has continued to diversify away from coal, as volatile markets rock the industry and spike fuel prices. Despite surviving China’s funding cuts to overseas coal, the planned power plants in Koh Kong and Oddar Meanchey are in varying stages of inertia, plagued by long delays. Meanwhile in Sihanoukville, the operations of two of Cambodia’s active coal complexes in the same district are raising concerns among local residents.

Southeast Asia Globe reported from each of these locations. While taking more than 4,300 images, Globe spoke to 35 people about the projects; from concerned residents and struggling fisherfolk to plant workers, local officials and energy experts. Read Part I of Globe’s Counting on Coal project and continue to see Part II, an accompanying photo story. Click or tap any image to expand for a slideshow.

Oddar Meanchey province

In Oddar Meanchey, the 265-megawatt, semi-built Han Seng project missed its deadline to go online last year. Falling revenue for the Chinese companies in charge pivoted the project to new contractors, who are sticking with coal but also investing in solar energy production at the same power plant.

“I want electricity to be accessible to everyone in my community, but I am also concerned about the health risks to workers and local people,” she said. Photo by Anton L. Delgado for Southeast Asia Globe.

Chrek Pechneng

Koh Kong province

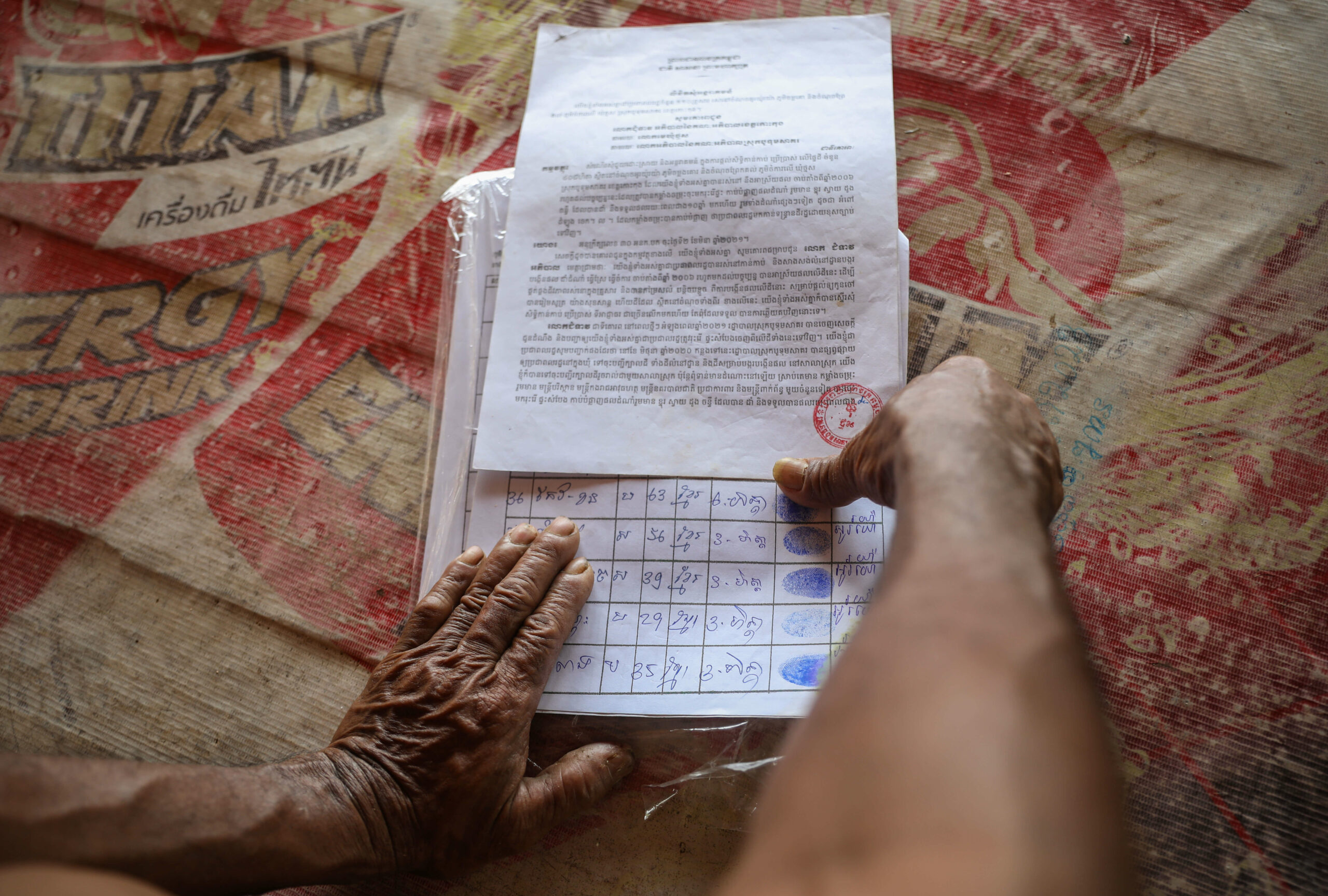

In Koh Kong, the Royal Group of Cambodia conglomerate has yet to break ground on a 700-megawatt power plant scheduled to go online this year. Though former residents continue to allege unfair deals and heavy-handed evictions.

Sihanoukville province

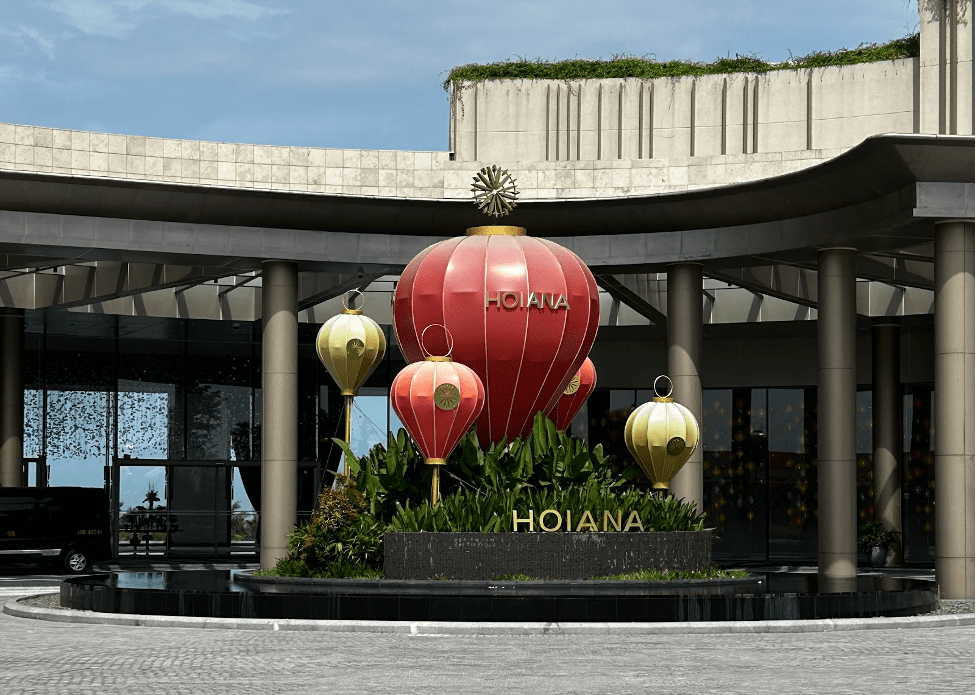

In Sihanoukville, Cambodia International Investment Development Group’s (CIIDG) new 700-megawatt coal project shares a road with the already operational 250-megawatt Cambodian Energy Limited (CEL) power plant complex. Steung Hav residents fear for the effects these two coal sites could have on their health and environment.

Contributed reporting by Andrew Haffner and Sophanna Lay. A Khmer-language version of this story can be found here, with translations by Sophanna Lay and Nasa Dip.

This article was supported by a ‘News Reporting Pitch Initiative’ from the Konrad-Adenauer-Stiftung Foundation in Cambodia.