Why Yellen’s reflation pleas fall flat in Beijing – Asia Times

The People’s Bank of China is giving a total new meaning to “monetary knowledge”. Asia’s biggest economy’s central bank is devising a program to provide as much as 500 billion yuan ( US$ 69 billion ) to support innovation in science and technology.

It’s a “relending” system, meaning that the , PBOC , may extend funds to choose institutions that lend , money to qualified sectors in need of financial support. The Communist Party’s presentation of the business on April 7 during US Treasury Secretary Janet Yellen’s attend to Beijing demonstrates why Washington’s hope for significant reflationary stimulus seem implausible to materialize.

China’s 2024 plan combination is inspiring a lively debate among global economics. Some think that the PBOC should use yuan to prevent deflation and study from Japan’s errors from the 1990s. Others believe that fundamental reforms are much more essential to address China’s property crisis, stabilize the economy, and reduce the number of youth unemployment records.

However, President Xi Jinping’s team appears to be in favor of a second strategy: hyper-targeted liquidity infusions, efforts to change growth engines to tech-driven future industries that promote disruption and productivity, and a strategy that is specifically targeted at the areas where the PBOC’s liquidity might be most influential in boosting China’s upmarketness.

New hints from the group led by Governor , Pan , Gongsheng suggest the PBOC is assuming a key role in driving the supply- side renaissance that Xi and Premier Li Qiang pledged –  , And that this retooling effort, certainly aged- school blasts of stimulus, is the priority.

To start, the , fresh program , will channel one- year loans through 21 economic entities, including China Development Bank, Postal Savings Bank of China and various policy banks, state- owned business banks and combined- stock commercial banks. The loans are intended for small and medium-sized technology companies with a 1.75 % interest rate. The money may be re-allocated.

The drive aims to increase support for technology and technology-focused SMEs in both the growth stage and the early stages of development. It will prioritize businesses with the greatest potential to spur China’s transformation, as well as provide funding for a range of equipment renewal projects to promote natural initiatives across sectors.

The PBOC’s minutes from its first-quarter Monetary Policy Committee meeting next week included the hinge. Pan’s group emphasized the need to intensify efforts to implement structural reforms and develop new tools to improve performance in the real economy.

In order to boost demand and support distressed property developers, the meeting highlighted the need to update cover credit policies that are tailored to city-specific needs. In response to China’s economic opening, legislators urged officials to develop a new model for real estate development to lessen boom/bust processes and lessen challenges.

More significantly, officials referred to” mix- continuous adjustment”. That includes addressing longer-term structural issues, and how Pan’s PBOC addresses one of the most contentious topics in contemporary economic technology: whether central banks have a distinct role to play in promoting greater sustainability through increased innovation and productivity.

It’s a sign that Yellen’s hopes that China may accept Washington please- reflate- soon stance is a non- starter. On Saturday, after two days of meetings with Chinese Vice Premier He Lifeng, Yellen said the two had agreed to promote “balanced” economic growth amid US concerns about , overcapacity in China’s manufacturing industry.

The effort, Yellen says,” will facilitate a discussion around macroeconomic imbalances, including their connection to overcapacity, and I intend to use the opportunity to advocate for a , level playing field , for American workers and firms”.

In Guangzhou on Friday, Yellen chided China for pursuing “unfair economic practices, including imposing , barriers to access , for foreign firms and taking coercive actions against American companies”. She expressed concern that mainland factories could produce more goods than the world’s economy could handle. Vice Premier  responded by saying that China wants to” create a favorable environment for businesses and deliver benefits to our two countries and our two peoples.”

Yellen made a point of shouting out Deng Xiaoping’s 1992 visit to manufacturing , and export powerhouse Guangzhou. Yellen hopes the Xi era will level the playing field for Western companies, marking a significant milestone in China’s transition to a market economy.

According to Yellen,” I firmly believe that this will not only harm these American businesses; it will also benefit China by promoting the improvement of the business climate in this country.” She added that many corporate CEOs worry about” the impacts of China’s shift away from a , market approach“.

Yet Yellen’s recent pitch has influenced China to increase its stimulus efforts significantly. And there’s a lost- in- time element to Washington’s latest pleadings.

Change a few numbers, a few dates, and a few names, and Yellen’s remarks will sound similar to those made by Washington in the middle to the late 1990s. It’s not difficult to imagine then-Treasury Secretary Robert Rubin or his successor Lawrence Summers offering Tokyo officials the same counsel.

Japan has been trying to do this for 25 plus years with little success, as Yellen is advocating. The fiscal and monetary floodgates opening up year after year undoubtedly helped to boost the country’s gross domestic product. Tokyo’s only action was to address the signs of the weak demand that contributed to its multi-decade funk, but without bold supply-side reforms.

Japan currently accounts for roughly 260 % of GDP, which is the most of developed nations ‘ debt burden. The , Bank of Japan,  , meanwhile, has kept interest either near zero, or below, since 1999. Six years ago, the BOJ’s balance sheet even topped the size of its US$ 4.7 trillion economy, a first for a Group of Seven economy.

All this excess wealth covered the underlying economy’s deepening gaps. It took the onus off government after government to do the needful: cut red tape, internationalize labor markets, catalyze a startup boom, increase productivity and empower women. It lessened the need for corporate CEOs to experiment, change, and take risks.

When the Liberal Democratic Party won back control of the country in 2012, things got worse. With bold plans for a supply-side shakeup like Japan Inc. had never seen before, the LDP did so. Instead, the three governments have since allowed the BOJ to take the lead with more easing measures.

This includes Prime Minister Fumio Kishida’s government today. Look no further than the BOJ’s refusal to increase interest rates beyond 0.0%- 0.1 % on March 19. So tepid was the BOJ’s “rate hike” that day that the yen is 1.8 % weaker now.

No matter how much Yellen & Co. is receiving from China, Beijing must stay away from this formula for economic mediocrity.

International Monetary Fund head Kristalina Georgieva urged China to prioritize future-oriented industries over smokestacks during a trip to Beijing last month.

” Domestic consumption depends on income growth, which in turn relies on the productivity of capital and labor”, Georgieva explained. ” Reforms such as strengthening the , business environment , and ensuring a level playing field between private and state- owned enterprises will improve the allocation of capital. Higher labor productivity and higher incomes will be achieved when human capital is invested in: education, life-long training, and reskilling.

Such upgrades, Georgieva stressed, are “particularly important as China seeks to seize the opportunities of the AI ‘ big bang.’ Countries ‘ readiness for the artificial intelligence world is already a problem for today.

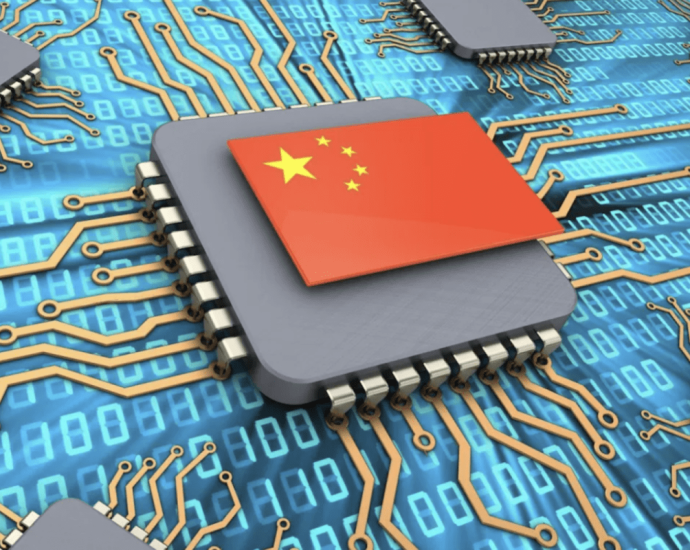

This has long been Xi’s plan. Efforts to champion high- tech industries, particularly cutting- edge manufacturing and , service sectors, are centerpieces of the party’s” Made in China 2025″ project.

The plan is to lead the global charge on semiconductors,  , biotechnology, aerospace, renewable energy, self- driving vehicles, artificial intelligence, green infrastructure, logistics and other areas.

It is “absolutely necessary to support the efforts to modernize the industrial system and accelerate the development of new productive forces,” according to Xi’s team’s statement at the National People’s Congress last month.

More recently, Xi’s party unveiled a list , of state- owned enterprises and conglomerates that will spearhead this fresh wave of , future- oriented sectors , that will raise Japan’s economic game. Priority areas include AI, neuroscience, nuclear fusion and quantum computing.

The State-owned Assets Supervision and Administration Commission will be in charge of the business. According to Lin Xipeng, an analyst with China Merchants Securities, it has been “given a clear mandate that developing emerging and future industries is a crucial task.” ” While cultivating start- ups and units within their ecosystems, SOEs will also tap external investment and merger opportunities”.

Enhancing the quality of growth rather than just increasing the quantity has always been a top Xi priority. A major priority for moving there is increasing the percentage of GDP driven by technology. According to a recent Bloomberg Economics study, the high-tech sector’s contribution is projected to surpass that of real estate by 2026.

According to economists Chang Shu and Eric Zhu,” the high-tech sector has the potential to become a much more significant source of growth.” Tech is seen driving demand worth nearly 19 % of GDP by 2026, up from 14.3 % last year. Just over 20 % of GDP is driven by the property sector.

The PBOC’s lending program could help hasten the transition, particularly if Xi and Li ensure that this initial , 500 billion yuan to support science and technology is just the beginning.

Malaysia, the Philippines, Indonesia and Thailand”, said Victor Chua ( pic ), founder and Managing Partner of Vynn Capital.

Malaysia, the Philippines, Indonesia and Thailand”, said Victor Chua ( pic ), founder and Managing Partner of Vynn Capital.

.jpg)