US firms snub ‘de-risking’ to give China another shot â but theyâre finding a new obstacle

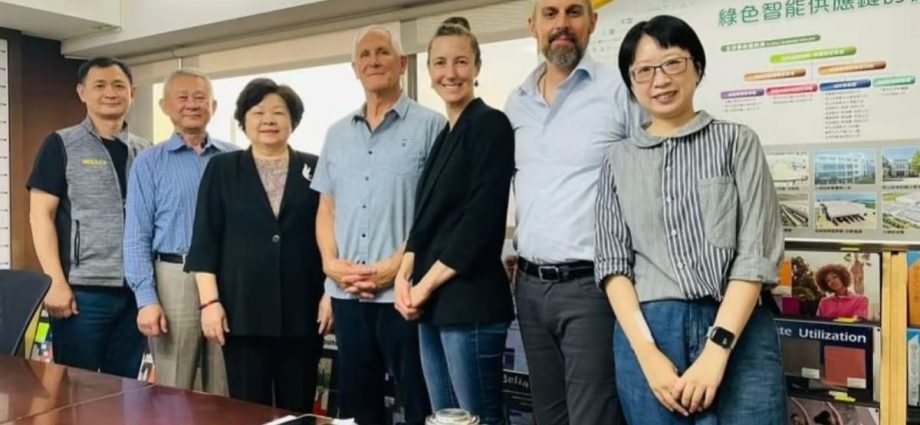

“It could not have been a warmer reception than what we received,” said American businessman Jeff Bowman after spending a week in China last month. Bowman is the CEO of the US materials science company Cocona, with his unique sweat-drying Masterbatch additive for yarn garnering significant interest in the China-basedContinue Reading