Singapore Airlines, Scoot to ban use and charging of power banks on flights

SINGAPORE: From April, Singapore Airlines ( SIA ) and Scoot passengers will not be allowed to use , power banks to charge their devices during flights.

They will also not be allowed to charge their power banks using the onboard USB ports, the airlines said in Facebook posts on Wednesday ( Mar 12 ).

People may deliver electricity businesses  , with a capacity of up to 100Wh without authorization, while those between 100Wh and 160Wh require acceptance. Energy lenders above 160Wh are never allowed on planes.

” The SIA Group complies with the International Air Transport Association’s ( IATA ) Dangerous Goods Regulations regarding the carriage of power banks, which are classified as lithium batteries”, said both airlines.

Energy banks must get carried in house cargo on all SIA and Scoot airlines. They are not permitted in checked bag.

Another companies, including , South Korea’s Air Busan, have implemented similar actions.

Taiwan ship EVA Air has banned the use and paying of power businesses during airlines. It advised people to completely charge their gadgets before boarding.

Thai Airways announced on Monday that it would ban the use of electricity businesses onboard its aviation from Mar 15. This was to maintain the “highest level of safety for people and crew”, it added.

In 2023, a power banks caught fire on a Scoot trip bound for Singapore from Taipei. It had , overheated while the plane was on the floor, Scoot said finally.

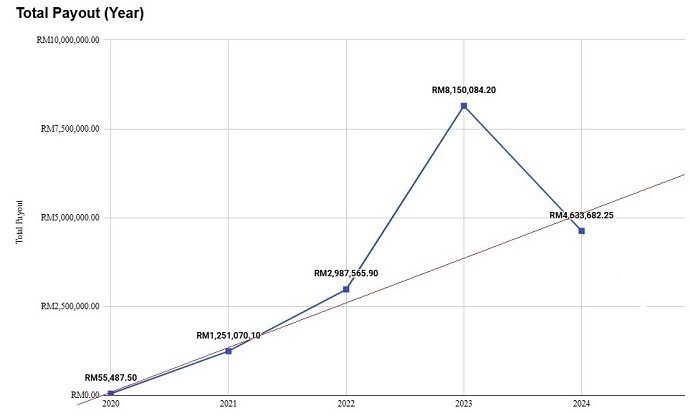

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.