Ronald Reagan has been quoted in 1978 as saying, “Inflation is as violent being a mugger, as distressing as an armed robber, and as deadly as being a hitman. ’

Reagan had spent the first years of his US presidency combating the inflation issue. Inflation was operating at 9% annually, on its way to nearly 15% two years later on. It was hurting the particular interests of politicians, businesspeople, and the public.

Even today inflation is a nightmare for the policymaker, central banks, political establishments, and the working class.

Recently the Bank of Global Settlements (BIS), the global body that works services for the world’s central banks, stated in its annual review that there is a strong “inherently stagflationary” shock hitting the world economy due to higher commodity prices and supply-chain bottlenecks.

Such transitions to high-inflation environments occurred rarely but had been very hard to reverse. The particular BIS has blamed the current geopolitical condition around the world as the main reason for it.

Inflation is currently at a multi-decade high in major economies such as the US, the particular eurozone, and the UNITED KINGDOM. The BIS offers raised concerns designed for leading economies associated with North America, Europe, and several emerging markets, as inflation has neared a tipping point. In advanced financial systems, inflation is at the highest level within four decades.

Global economic policymakers began responding in earnest this year, with at least 75 main banks lifting interest rates, and the US Federal government Reserve leading the particular pack. But the activity taken so far will not satisfy the BIS.

The latest Customer Price Index launched in the United States exceeded analysts’ expectations at nine. 1% in 06. In Canada, pumpiing is running in its fastest pace since 1983. In the United Kingdom, it is similarly at a 40-year-high.

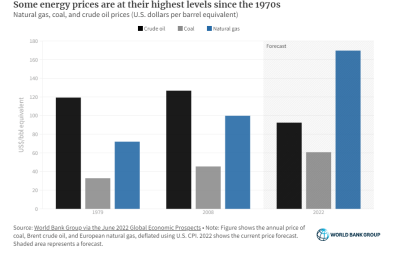

As rates of interest jump, money which has been cheap for years will be more expensive in order to borrow, stoking fears among investors that the global economy can slow sharply and be plunged into unpleasant recessions. The World Financial institution has warned that most countries are headed for a recession plus there may be a return to 1970s stagflation, an interval of high inflation and low growth.

The era of cheap money that lasted more than a decade thanks to near-zero interest rates resulted in a borrowing spree that left developing financial systems with record levels of debt. In some countries, it is equivalent to 60% of GDP or even more.

Consistent record-level inflation offers forced central banking institutions to change the direction of monetary plan from easing to tightening. The number of financial systems defaulting on their financial debt will likely increase in forseeable future. Until now, that risk has been limited to the particular poorest countries, great it is transferring rapidly to middle-income economies.

Is entire world entering stagflation period?

Sri Lanka is a prime example of financial debt distress. Soon, Pakistan is likely to face an identical fate until it gets external assist. Pakistan urgently requirements billions of dollars infused into its foreign reserves to ward off payment defaults.

The country’s central bank said its foreign-exchange reserves declined by US$145 million to reach $9. 8 billion in July, hardly enough for five days of imports, as the Pakistani rupee handled record lows.

Some other nations facing comparable issues are Lebanon, Suriname, Zambia and Russia. Another over the brink of arrears is Belarus.

But the list doesn’t stop generally there. Tunisia appears probably the most at risk among a number of African countries going to the International Monetary Fund (IMF) for alleviation. That country is certainly on Morgan Stanley`s top three listing of likely defaulters. Ghana has borrowed intensely, reaching a debt-to-GDP surge of nearly 85%. Inflation in that African nation is getting close to 30%.

Russia’s ally Weißrussland is seemingly going to the same fate of last month’s default amid Western sanctions over the Ukraine conflict.

Meanwhile, Sri Lanka, Argentina, Venezuela, Zambia and others have also defaulted, and many more are likely to follow. In Europe, Australia, Greece, Spain plus Portugal have announced tax rebates and energy subsidies in order to quell unrest. Within Africa, Nigeria plus Zambia have done exactly the same.

In Asia, the Philippines, Singapore and Indonesia are boosting interpersonal spending and handing out direct cash. But experts feel the scramble to cushion the blow with this kind of measures may expand the challenge, as containing inflation now means putting the brakes on growth, which had already started to fizzle globally.

According to the World Bank’s latest forecast, global growth is forecasted to slow by 2 . 7 proportion points between 2021 and 2024 – more than twice the particular deceleration between 1976 and 1979. Such developments raise problems about stagflation – the coincidence of weak growth and elevated inflation – similar to what the entire world suffered in the 1970s.

The present status of the global economy resembles the 1970s era associated with stagflation in three key aspects: persistent supply-side disturbances encouraging inflation, preceded by a protracted period of extremely accommodative monetary plan in developed financial systems, prospects for deterioration growth, and vulnerabilities that emerging-market and developing economies encounter with respect to the monetary-policy tensing to contain pumpiing.

The particular stagflation of the 1970s era ended using a global recession as well as a series of financial downturn in the emerging-market and developing economies.

The fallout of the current occasions in the global economic climate are unlikely to become different. But it could be avoidable, as some structural differences still exist between the 1970s and the present situation.

The 1970s had been a time of significant structural economic rigidities, many of which have since evolved. Today’s central banks have more sophisticated models than those within the 1970s. Apart from that, they also seem to be luckier, because developing countries like China have the swiftness and agility to meet any production requirement.

But additional fiscal stimulation and sanctions upon Russia may give food to inflation, defeating all the monetary-policy efforts. A pragmatic approach with effective coordination among all stakeholders such as the political establishment is needed to protect the global economy from falling into a long recession.