Clock ticking for Suwichak

The National-Anti Corruption Commission (NACC) is preparing to proceed with a criminal case against the House of Representatives’ former secretary-general Suwichak Nakwatcharachai for his alleged involvement in irregularities in procuring overpriced clocks worth 15.4 million baht for parliament in 2013.

A source at the NACC said a recent board meeting found grounds to the allegation that Mr Suwichak was involved in graft in the clock procurement case.

Mr Suwichak was among parliamentary officials who helped Equipment Co win the bid by fixing the specs of its Bodet clock, even though the company did not register for the clock properly.

The NACC found documents used in the bid, including a performance certification and a contract with a price offer, had been forged.

Moreover, the company did not import clocks from a distributor but rather from Precious Time Trading, which was also competing for the bid.

Mr Suwichak will not face disciplinary action as he had already been discharged from the House.

However, the NACC will file a lawsuit against him with the Criminal Court for Corruption and Misconduct.

Officials face embezzlement probes

Govt agencies lose ‘millions’ of baht

Officials from local administrative organisations (LAOs) in at least seven provinces have embezzled millions of baht from local government agencies, or are suspected of doing so, according to the Central Investigation Bureau (CIB).

The CIB was alerted to the thefts by the Public Sector Anti-Corruption Commission (PACC), which audited LAOs spending nationwide, said CIB commissioner Pol Lt Gen Jirapob Phuridet.

The PACC had detected embezzlement involving accounting officials at LAOs in at least seven provinces, he said. The officials stole the LAOs’ money and wired it to their bank accounts for personal use, he said.

The LAOs is a general term covering the municipal offices and tambon administrative organisations (TAOs).

So far, police have pressed charges against accountants attached to the Lad Yao municipal office in Nakhon Sawan for allegedly making 215 unauthorised withdrawals amounting to 15 million baht from a LAO bank account.

A similar charge was laid against accountants at the Wang Prong TAO in Phitsanulok, who stole 44 million baht from the TAO office.

Pol Lt Gen Jirapob said police have also opened investigations into officials concerning alleged embezzlement at TAOs in five other provinces.

In Nakhon Pathom, accountants and financial officers were alleged to have colluded in siphoning 8.3 million baht via 23 bank account withdrawals from the Nil Phet TAO where they work.

In Saraburi, financial officers illegally took 4.9 million baht from the Nong Hua Pho TAO through 84 withdrawals.

In Chaiyaphum, a local development officer acting as a financial staff member has been accused of illegally withdrawing from the Huai Yai Jew TAO’s bank account 60 times for a total of 5.8 million baht.

In Si Sa Ket, alleged embezzlement worth 540,000 baht was committed by a financial specialist of the Khok Lam TAO.

In Nakhon Si Thammarat, 4 million baht was found to have disappeared from a bank account held by the Na Khliang TAO.

The money was found to have been transferred to accounts belonging to the wife of the TAO’s director for finance and accounts owned by the family’s domestic helper.

Police are broadening their probe by asking Krungthai Bank to run checks on other LAOs.

PACC deputy secretary-general Krit Krasaewes said LAO withdrawals usually require the consent of at least three officials but only one was needed in these cases.

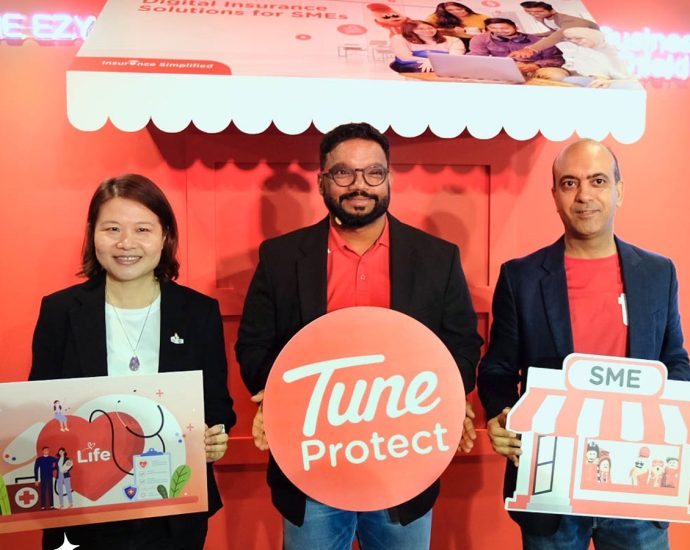

Tune Protect on finding the right key to cover woefully uninsured Malaysian SMEs

Aimed at micro SMEs, of whom 85% are underinsured or uninsured

Looking to disrupt the space of Gen Z and Millennials entrepreneurs

The insurance landscape for small and medium-sized enterprises (SMEs) in Malaysia has been a challenging one, with a significant protection gap leaving many businesses underinsured or uninsured. Despite contributing 37.4% to the nation’s…Continue Reading

North Korea: Residents tell BBC of neighbours starving to death

People in North Korea have told the BBC food is so scarce their neighbours have starved to death.

Exclusive interviews gathered inside the world’s most isolated state suggest the situation is the worst it has been since the 1990s, experts say.

The government sealed its borders in 2020, cutting off vital supplies. It has also tightened control over people’s lives, our interviewees say.

Pyongyang told the BBC it has always prioritised its citizens’ interests.

The BBC has secretly interviewed three ordinary people in North Korea, with the help of the organisation Daily NK which operates a network of sources in the country. They told us that since the border closure, they are afraid they will either starve to death or be executed for flouting the rules. It is extremely rare to hear from people living in North Korea.

The interviews reveal a “devastating tragedy is unfolding” in the country, said Sokeel Park from Liberty in North Korea (LiNK), which supports North Korean escapees.

One woman living in the capital Pyongyang told us she knew a family of three who had starved to death at home. “We knocked on their door to give them water, but nobody answered,” Ji Yeon said. When the authorities went inside, they found them dead, she said. Ji Yeon’s name has been changed to protect her, along with those of the others we interviewed.

A construction worker who lives near the Chinese border, whom we have called Chan Ho, told us food supplies were so low that five people in his village had already died from starvation.

“At first, I was afraid of dying from Covid, but then I began to worry about starving to death,” he said.

North Korea has never been able to produce enough food for its 26 million people. When it shut its border in January 2020, authorities stopped importing grain from China, as well as the fertilisers and machinery needed to grow food.

Meanwhile, they have fortified the border with fences, while reportedly ordering guards to shoot anyone trying to cross. This has made it nearly impossible for people to smuggle in food to sell at the unofficial markets, where most North Koreans shop.

A market trader from the north of the country, whom we have named Myong Suk, told us that almost three quarters of the products in her local market used to come from China, but that it was “empty now”.

She, like others who make their living selling goods smuggled across the border, has seen most of her income disappear. She told us her family has never had so little to eat, and that recently people had been knocking on her door asking for food because they were so hungry.

From Pyongyang, Ji Yeon told us she had heard of people who had killed themselves at home or disappeared into the mountains to die, because they could no longer make a living.

This video can not be played

To play this video you need to enable JavaScript in your browser.

She was struggling to feed her children, she said. Once, she went two days without eating and thought she was going to die in her sleep.

In the late 1990s, North Korea experienced a devastating famine which killed as many as three million people. Recent rumours of starvation, which these interviews corroborate, have prompted fears the country could be on the brink of another catastrophe.

“That normal, middle-class people are seeing starvation in their neighbourhoods, is very concerning,” said the North Korea economist Peter Ward. “We are not talking about full-scale societal collapse and mass starvation yet, but this does not look good.”

Hanna Song, the director of NKDB, which documents human rights violations in North Korea, agreed. “For the past 10-15 years we have rarely heard of cases of starvation. This takes us back to the most difficult time in North Korean history.”

Even the North Korean leader Kim Jong Un has hinted at the seriousness of the situation – at one point referring openly to a “food crisis”, while making various attempts to boost agricultural production. Despite this, he has prioritised funding his nuclear weapons programme, testing a record 63 ballistic missiles in 2022. One estimate puts the total cost of these tests at more than $500m (£398m) – more than the amount needed to make up for North Korea’s annual grain shortfall.

Our interviewees also revealed how the government has used the past three years to increase its control over people’s lives, by strengthening punishments and passing new laws.

Before the pandemic, more than 1,000 people would flee the country each year, crossing the Yalu River into China, according to numbers released by the South Korean government. The market trader Myong Suk told us it had become impossible to escape. “If you even approach the river now you will be given a harsh punishment, so almost nobody is crossing,” she said.

The construction worker Chan Ho said his friend’s son had recently witnessed several closed-door executions. In each one, three to four people had been killed for attempting to escape. “Every day it gets harder to live,” he told us. “One wrong move and you are facing execution.”

“We are stuck here waiting to die.”

For more than three years, North Korea has sealed its borders. People are banned from leaving or entering the country. Almost every foreigner who was inside has packed up and left. The world’s most secretive and tyrannical state is now an information black hole. For months, three people inside North Korea have risked their lives to tell the BBC what is happening.

Watch now on BBC iPlayer (UK only) or at 19:00 BST on BBC Two in the UK

We put our findings to the North Korean government, which told us it “has always prioritised the interests of the people, even at difficult times”.

“The people’s well-being is our foremost priority, even in the face of trials and challenges,” said a representative from the North Korean embassy in London.

They also said the information was “not entirely factual”, claiming it had been “derived from fabricated testimonies from anti-DPRK [Democratic People’s Republic of Korea] forces”.

But Sokeel Park, from LiNK, said these interviews reveal a “triple whammy” of hardship. “The food situation has become more difficult, people have less freedom to fend for themselves, and it has become pretty much impossible to escape.” They support the theory, he said, that “North Korea is now more repressive than it has ever been before.”

In Pyongyang, Ji Yeon said the surveillance and crackdowns were now so ruthless that people did not trust each other. She was taken in for questioning under a new law, passed in December 2020, which bans people from sharing and consuming foreign films, TV shows and songs. Under this Reactionary Ideology and Culture Rejection Act, aimed at rooting out foreign information, those caught distributing South Korean content can be executed.

A former North Korean diplomat, who defected in 2019, said he was shocked by how extreme the crackdown on foreign influence had become. “Kim Jong Un is afraid that if people understand the situation they are in, and how wealthy South Korea is, they will start hating him and rise up,” explained Ryu Hyun Woo.

Our interviews suggest that some people’s loyalty has waned over the past three years.

“Before Covid, people viewed Kim Jong Un positively,” Myong Suk said. “Now almost everyone is full of discontent.”

More findings from the BBC’s investigation into daily life in North Korea will be published on Thursday 15 June

Related Topics

The US makes China an offer it canât understand

Investment Strategy: Closing out MXN/KRW but holding onto oil and gold

David Woo writes that the People’s Bank of China surprised the market by cutting interest rates by 10 basis points, signaling a possible stimulus package and asserting China’s monetary policy independence from the US. Tensions in Ukraine, meanwhile, could benefit long oil and long gold positions due to potential escalation in the conflict.

The US makes China an offer it can’t understand

David Goldman and Uwe Parpart observe that while US Secretary of State Antony Blinken’s planned visit to China remains uncertain, tensions between the US and China continue as the US extends exemptions for South Korean and Taiwanese chipmakers to maintain fabrication plants in China, highlighting the difficulties of isolating China from high-tech goods.

Ukrainian Offensive Stumbles as Russian Defenses Hold Strong, Raising Questions for NATO Summit

James Davis assesses that the Ukrainian offensive against Russian forces is facing significant challenges due to a scattered approach and underestimation of Russian preparedness. Tension and uncertainty are rising as NATO debates security guarantees for Ukraine and Russian forces await an opportunity to launch their own counteroffensive.

The limits to sanctions on China

Scott Foster analyzes the limits of the U.S. government’s ability to interfere with semiconductor companies in China after indefinitely extending the exemption for top semiconductor manufacturers from South Korea and Taiwan. Others like investment fund Sequoia Capital are nonetheless taking measures to reduce political risk.

Man tasered, arrested after allegedly assaulting auxiliary police officer with metal bar

In a 50-second video shared on Facebook, the suspect can be seen pointing a metal bar at officers before moving towards a short flight of stairs.

As the man continues to advance towards the officers, the police can be heard warning him to stop before finally discharging a Taser when the man fails to comply.

The suspect falls backwards and officers are seen running towards him.

The police said the man and the auxiliary officer were both conscious when taken to hospital, with the auxiliary officer sustaining minor injuries.

The metal bar was seized and the 31-year-old was subsequently arrested for voluntarily causing hurt by dangerous weapon, criminal force to deter a public servant from discharge of his duty and suspected drug-related offences.

Police investigations are ongoing.

Racehorse owners, industry to appeal against Singapore Turf Club closure

Five horse owners at the meeting spoke to the media, with all saying that they were not consulted prior to the announcement that the Turf Club was closing.

One of the horse owners in the committee, Mr Joe Giovanni Singh, said their objective was to appeal to the government to ensure that horse racing can stay on or at least get an extension.

“We’ve got a lot of people who are really very, very keen in this … sport. And it’s very sad to see that suddenly out of the blue that we have to close shop in Singapore,” said Mr Singh, who has 15 horses at the Turf Club.

Another horse owner, Mr Hobart Low, who has about 20 horses, said that there were two camps in the meeting – one group that wanted to appeal for horse racing to continue and another that accepted the closure.

He belongs to the group that wants to appeal he said, as the closure “might not have been the right decision”.

“We just want to have a voice first … before we proceed to talk about the exit strategy, what we can do about compensation,” he said.

“Maybe if miracles happen, the government will decide … to hear our voices and look at the whole situation differently.”

Bill Gates in China to meet President Xi: Sources

HONG KONG: Bill Gates, Microsoft Corp’s co-founder, is set to meet Chinese President Xi Jinping on Friday (Jun 16) during his visit to China, two people with knowledge of the matter said. The meeting will mark Xi’s first meeting with a foreign private entrepreneur in recent years. The people saidContinue Reading

Versions of Hong Kong protest anthem no longer available on iTunes and Spotify

The head of Amnesty International’s China team, Sarah Brooks, said in a statement that “a song is not a threat to national security, and national security may not be used as an excuse to deny people the right to express different political views”. Hong Kong returned from British to ChineseContinue Reading

Blinken to seek to ‘responsibly manage’ tense ties on rare China trip

WASHINGTON: Secretary of State Antony Blinken will urge open communication to “responsibly manage” high tensions with China when he pays a rare visit to Beijing this weekend, US officials said. The State Department confirmed that Blinken will travel this weekend to Beijing on the first trip by a top USContinue Reading