- Aimed at micro SMEs, of whom 85% are underinsured or uninsured

- Looking to disrupt the space of Gen Z and Millennials entrepreneurs

The insurance landscape for small and medium-sized enterprises (SMEs) in Malaysia has been a challenging one, with a significant protection gap leaving many businesses underinsured or uninsured. Despite contributing 37.4% to the nation’s GDP according to Department of Statistics Malaysia (DOSM), SMEs find themselves struggling to navigate the complex and often expensive world of insurance. DOSM data for 2021 reveals that microenterprises (MSMEs) made up 78.6% (964,495 firms) of the total SME establishments, small-sized firms formed 19.8% (242,540 firms) and the balance 1.6% (19,459 firms) were medium-sized SMEs.

A startling 85% of SMEs in Malaysia are underinsured, exposing them to significant risks and vulnerabilities.

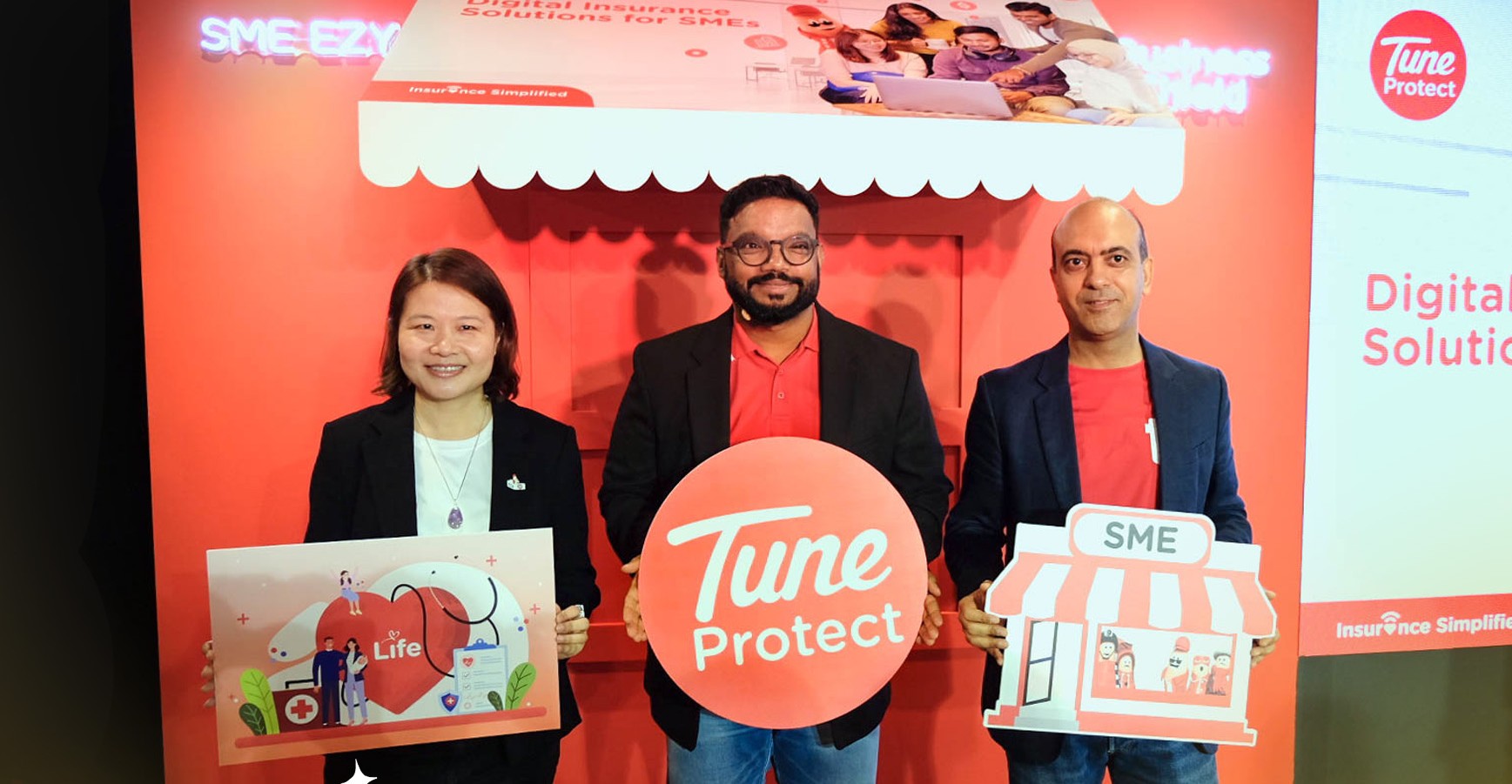

“(SMEs) always say insurance is not affordable. They always say insurance is very complex. They always say I don’t know where to start,” said Rohit Nambiar, Group Chief Executive Officer of Tune Protect. “(However) we believe that by making insurance accessible, affordable, and convenient, we can support the growth and resilience of the SME community, contributing to a stronger and more secure economy.”

According to Rohit, traditional distribution models prioritize larger corporate clients, leaving SMEs underserved and missing out on customized solutions tailored to their unique needs.

Tune Protect’s insurance solution for SMEs

To address the protection gap and provide support for, Tune Protect has introduced digital solutions via its subsidiaries, Tune Protect Life (TPL) and Tune Protect Malaysia (TPM).

TPL has launched employee insurance which offers business owners the flexibility to purchase life or medical/health insurance for their employees through a B2C channel. According to Koot Chiew Ling, Principal Officer of TPL, this offering provides “a flexible and budget-friendly insurance option” for business owners, as well as a three-year fixed premium guarantee for budget planning, offering plans as low as RM75 a year per employee for life insurance or as low as RM300 plus for medical.

Meanwhile, TPM has introduced a one-stop microsite for customized business insurance, designed to offer user-friendly and tailored insurance solutions for SMEs. By walking businesses through the application process, the hope is that it will simplify the process of managing their risk, and let SMEs make informed decisions about their coverage needs.

Jubin Mehta, Chief Executive Officer of Tune Protect Malaysia, highlights that the challenges of complexity, affordability, and lack of customization have been addressed by their one stop microsite solution: “By providing customizable insurance solutions and simplifying the process of managing risk, we not only aim to enhance the customer experience but also to provide our SME community a platform to collaborate with one another.”

Unsurprisingly, affordability is also a focus for this product Rohit explaining, “The first question we will ask you in our website is, ‘How much can you (afford to) buy?'”

“Most MSMEs told us they can pay RM100 a month per employee, no problem. When we turn around and tell them (that) for that we can give you unlimited coverage, they are shocked. “

Disrupting the insurance space of Gen Z and Millennial entrepreneurs

Tune Protect is not done trying to understand the pain points of SMEs and their unique needs, as they are often underrepresented in the traditional insurance landscape. Jubin says, “Today’s products are sold towards mostly large SMEs, not targeted at MSMEs. And this is the most under penetrated segment in the market today”.

Rohit adds, “We believe that with Gen Z and Millennials as entrepreneurs, we are going to disrupt the space and become the preferred choice for SME solutions,” with the aim of turning SMEs from a single-digit percentage contribution to one that commands one-fifth of their total business. As of this moment, Tune Protect’s network of 75 partners gives them access to 150 million customers.

Jubin insists that educating business owners on the importance of insurance is pivotal as many MSME owners may not fully understand their coverage needs or prioritise insurance until they face difficulties.

Rohit also believes that as a digital insurer, it will be easier and more efficient to onboard MSMEs, and in fact prioritises customer experience and Net Promoter Scores (NPS) in their products. Tune Protect’s digital initiatives are designed to fulfil their 3:3:3 customer promise – providing a quick quote within three minutes, a three-hour response time, and claims pay-out within three days upon approval.

Future developments include expanding insurance offerings to individuals as well, as Tune Protect is already a participant in the Bank Negara financial technology sandbox, according to Chiew Ling. The company’s goal is to prove demand exists for individual insurance products and encourage the adoption of digital insurance in the mass market.

“Why are we in the sandbox?”, asks Chiew Ling. “Because we’re actually testing this.” She wants to prove that there is a demand out there in the under-represented space, including MSMEs. “Our target perspective is not so much in terms of how much top-line DWP we get,” she explains. “I’m looking at 70% of our people are actually first-time buyers new to insurance.”

“That sets the basis for me to prove that, hey, I am actually penetrating an untapped space.”