Renewable energy takes hold in China

China’s push for green energy has been among the most consistent across the world, with the government making concerted efforts to accelerate the energy transition.

Today, renewable energy systems that include wind and solar photovoltaic (PV) generation have reached 600 gigawatts (GW) in installation capacity. This accounts for almost 13.5% of China’s electricity consumption in 2021, up from 1.6%, a decade ago. In the first half of 2022, China installed 43.82 GW of wind and solar PV power generation, accounting for 64% of the country’s newly installed capacity.

However, coal still makes up the bulk of power generation in China – 63% in 2021 compared to a worldwide average of 36%. Natural gas accounts for just 3.6% of power generation in comparison to the global average of 23%.

For further advancement of the green agenda, China should do more to integrate renewable sources into its existing electric grid.

There are two critical areas on the supply side where these integrations can be implemented in a scalable manner.

1. Retrofitting coal-fired power plants:

Coal-fired power plants (CFPPs) remain the country’s primary source of electricity generation, although capacity has been declining over the past few years. Instead of phasing them out entirely, retrofitting these power plants can assist in accommodating new renewable energy systems.

Retrofitted CFPPs can bring flexibility to the peak shaving and valley filling approach to the power load, while also lowering costs. Retrofitted CFPPs can also maintain stable operation levels of about 20%, leading to lower carbon emissions, especially when combined with carbon capture, utilisation, and storage (CCUS) technologies.

2. Expanding energy storage systems (ESS)

In China, three main forces are pushing for the development of ESS:

- Performance improvements in lithium-ion batteries leading to a dramatic drop in costs;

- Government policy setting out proportional EES allocation requirements for utility scale renewable projects; and

- Further reform in the electricity market that would indirectly promote healthy demand for ESS.

We estimate that the installed capacity of ESS could reach 66 GWh by 2025, corresponding to a five-year compound annual growth rate (CAGR) of nearly 90%.

Changing energy demand patterns

While supply-side mechanics help promote the use of clean energy, evolving demand patterns are playing an equally vital role.

China has set long-term targets for carbon peaking and neutrality at the provincial and municipal levels. To date, 17 out of 31 provincial administrations have rolled out policy documents relating to carbon peaking and neutrality and these provinces account for almost 60% of the country’s total annual carbon emissions.

They will need to make significant cuts in emission levels, and decarbonising certain industry sectors will be key.

1. The industrial sector: Recycling of four key product areas — steel, aluminum, paper, and plastic products — has tremendous potential to reduce emission levels. Our research shows that if the right moves are made, total carbon emissions can be reduced by 2,865 million tCO2e from 2022 to 2025. This is equal to the carbon sink potential of around 10m square kilometers of urban forest – close to the size of the whole of Europe – in one year.

Corporates have stepped up their responsible waste management efforts. Based on 2020-21 data from all mainland A-share and Hong Kong-listed Chinese firms, we found a 46% year-on-year increase in these companies’ total recycled waste volume, while the average waste recycling rate also improved significantly from 60.5% in 2020 to 69.2% in 2021.

The recycling of steel, aluminum, paper, and plastic will reach a combined market size of RMB1.4 trillion ($195 billion) by 2025, representing an annual growth rate of about 5%.

We believe energy efficiency improvements in motors and waste heat recovery implementation could also bring significant carbon reduction benefits to the industrial sector and have tremendous potential for growth.

2. The building sector: Prefabrication is a method of construction that produces much lower carbon emissions compared to traditional construction.

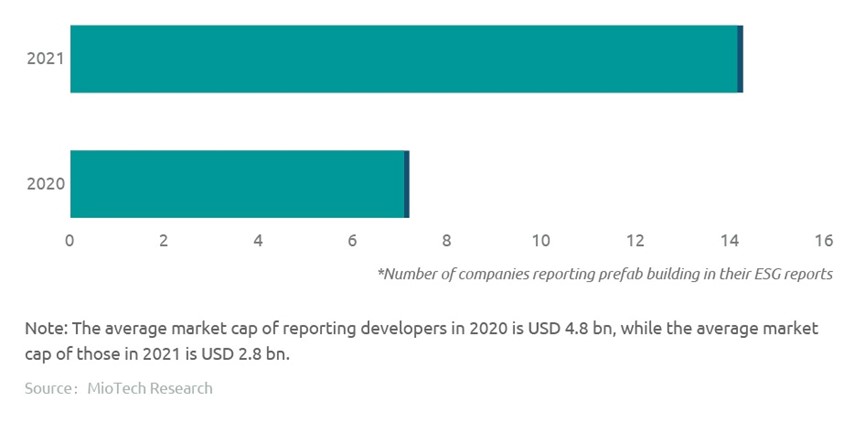

According to MioTech data, there is an increased adoption of prefab by Chinese property developers and engineering companies. In 2020 and earlier, prefab was mainly implemented by large property developers, while in 2021, smaller businesses and regional construction companies have also started reporting their engagement in prefab construction.

Number of property development companies reporting the use of prefab in their ESG reports

We estimate that prefab will account for between 32% and 38% of total new construction by 2025. By 2030, its market size should exceed $700 billion (RMB5 trillion); and reach $1.4 trillion (RMB10 trillion) by 2060.

Building-integrated photovoltaics (BIPV) are photovoltaic materials that are used to replace conventional building materials in parts of the building envelope such as the roof, skylights, or facades. This contrasts with traditional BAPV, or building-applied photovoltaics, where the PV solution is installed on the existing surface of the building.

Compared with BAPV, BIPV is an integrated model with better cost and performance profile. In particular, factory and commercial/office building rooftops offer significant potential for BIPV to scale.

BIPV installations will exceed 46 GW by 2025, up from 1 GW in 2021

Promoting the integration of solar PV with new buildings has been an inevitable trend for property developers in 2021. We saw 57 companies install PV in their commercial/industrial property developments in 2021, compared with only 27 in 2020.

For a deeper insight into China’s Green Leap, please download the full report.

¬ Haymarket Media Limited. All rights reserved.