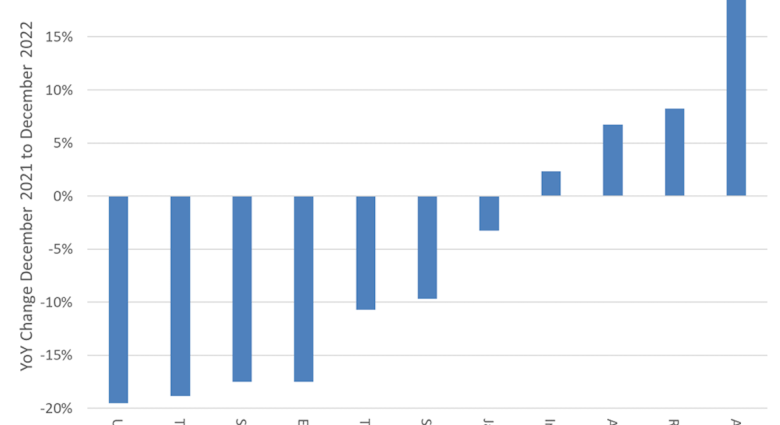

China’s exports to Southeast Asia jumped by 20% in 2022, despite a year-on-year decline in China’s total exports driven by a 19% drop in exports to the US and a 17% drop in exports to the European Union.

Southeast Asia’s 700 million people stand at the cusp of an economic transformation comparable to the rise of the “Asian Tigers” – Taiwan, South Korea and Singapore – during the 1980s and 1990s.

China’s leading position in digital as well as physical infrastructure has created a natural economic partnership with Southeast Asia, which represents a vast pool of young workers to replace China’s aging and shrinking industrial labor force.

Southeast Asia leads the world’s economic growth league, along with South Asia.

Chinese digital infrastructure is a key factor in the burgeoning economic relationship.

In 2020, China exported almost twice as much to members of the Association of Southeast Asian Nations (ASEAN) as it did to developed Asia (Japan, Taiwan and South Korea).

Despite China’s leading position in Southeast Asian trade, US and European investors dominate foreign direct investment in the region. China funded just $13 billion of direct investments in the region in 2021, compared with $40 billion for the US and $27 billion for the European Union.

China appears less interested in gaining control of regional assets than in trade. Southeast Asian nations are sensitive about national sovereignty and reluctant to cede ownership of critical assets to the economic giant to their north.

Overall, Chinese exports to the Global South, including ASEAN, Africa, and Latin America, nearly doubled from pre-Covid levels to an annual rate of around $900 billion in 2022 – double China’s exports to either the United States or the European Union.

India, China’s regional competitor, remains a relatively small market for China compared with Southeast Asia, with about $120 billion of total exports during 2022. Nonetheless, China accounts for about 30% of India’s total non-oil exports and is India’s largest source of manufactured goods.

An ASEAN study published last year concluded:

As ASEAN advances to become the world’s fourth largest economy by 2030, it is undergoing a transition marked by a demographic shift to a younger population, a rising middle class, and rapid adoption of technology. With many mobile-first markets in the region, ASEAN is expected to see rapid increase in the use of technology which would contribute to the growth of its digital economy by 6.4 times, from $31 billion in 2015 to $197 billion by 2025. The digital economy, therefore, is a key factor driving the growth of the region’s economy.

China’s leading position in digital infrastructure is a decisive advantage in trade with ASEAN. China’s strategy centers on creating future markets for its products by providing broadband, cloud computing, and training for Southeast Asian nations.

Huawei Technologies, China’s leading provider of broadband infrastructure, has invested heavily in training in the region – among other channels, through a joint venture of the ASEAN Foundation and the Huawei ASEAN academy established in 2021.

According to a July 2022 report by the Carnegie Endowment on Huawei’s success in Indonesia, by far the largest ASEAN nation with a population of 275 million:

Huawei and, to a lesser extent, ZTE have successfully positioned themselves as trusted cybersecurity providers to the Indonesian government and the Indonesian nation. This has been no easy feat given long-held Indonesian animosity toward China. Many Chinese companies have faced protests over concerns they were taking local jobs. Huawei and ZTE have suffered no such fate. Nor has there been a broad coalition of Indonesian voices against using Chinese technology in critical telecommunications infrastructure. In short, Indonesians care a lot more about Chinese cement plants than they do about Huawei involvement in 5G networks.

Huawei teamed up with Thailand’s Ministry of Digital Economy to open a “Thailand 5G Ecosystem Innovation Center” in Bangkok in 2021, the director of Thailand’s digital development office told a Huawei conference in 2021. In October 2022, Huawei released a white paper entitled “Malaysia as the ASEAN Digital Capital.”

With per capital GDP of just $5,760, ASEAN has enormous scope for growth as physical infrastructure and digital connectivity enable new industries. According to the International Monetary fund, the region’s per capital GDP in terms of purchasing power parity is $16,163, or nearly three times the USD dollar GDP per capita. The purchasing power of foreign currency in local economies is multiplied by the undervaluation of the region’s currencies.

As the US dollar value of GDP converges with purchasing power parity over time, the import capacity of Southeast Asia’s 700 million people will rise. The remarkable growth rates that China has registered in its trade with the region can be sustained for years to come, and the emergence of the new Asian Tigers may be the most important macroeconomic event of the next two decades.