Your weekly, almost weekly Noahpinion collection of intriguing news from around the world is now in order.

1. China accepts the fact of the economic system.

I made the argument two weeks ago that China is experiencing a lack of global demand, and that the answer would be to have the central authorities A) loan out banks and local government funding entities, and B) apply fiscal and monetary stimulus. Maybe Xi Jinping reads my site. China is implementing some more significant signal steps:

In a unique staged media briefing broadcast live around the world on Tuesday, the People’s Bank of China led the charge to rekindle mood, opening its stock market and lowering borrowing costs. The next day it kept the good news flowing by , lowering , the interest rate on its one-year money to lenders by the most on history, while the government issued exceptional cash pamphlets and floated new incentives for some homeless graduates…

The 24-man Politburo under the leadership of Xi made a second-quarter-of-a-kind promise on Thursday, adding more growth-boosting goodies, vowing to increase governmental spending, and making its first “declining” pledge to prevent property prices. The wave of policy announcements even revealed a new emphasis on boosting use, saying it was “necessary to listen to the concerns of the people.”…

Foreign companies soon soared. Xi’s state appears to be attempting to bail out the Chinese banking system, which is even more encouraging ( at least if you want China to keep growing ):

China’s largest state lenders may receive up to 1 trillion yuan ( US$ 142 billion ) of money to strengthen their capacity to support the country’s struggling economy. Such a move would be the first moment since the global financial crisis in 2008 that Beijing has injected money into its large businesses.

Injecting money refers to “giving businesses money,” for those who are unfamiliar. It implies a loan.

This is probably even more important than trigger, since getting banks lending once is the key to a sustained recovery. Foreign supporters have long held that the state and banks are one and the same because of the “unitary position” principle, which is applied to the “unitary state” concept.

That concept is probably incorrect. Foreign banks have their own subsidies, and fear getting culled by the state if they fail. Giving them a cushion against loss by injecting them with money helps them gain the confidence to give again.

The last step in this process would be to rescue China’s regional government financing systems, which have grown to be very significant in China’s regional economies. But only bailing out the banks and doing some significant fiscal and monetary stimulus may have a huge impact in terms of shortening and ameliorating China’s recession.

2. The “build something country”

US economic policy has been shifting toward industrial policy. A number of commentators who are opposed to this change have been quick to dismiss the entire endeavor as a result of seeing any signs of trouble. For instance, Matt Cole and Chris Nicholson wrote an op-ed in The Hill in March of this year that was so explosively titled” DE I killed the CHIPS Act.”

Their single piece of evidence for this bold thesis was that TSMC’s fab in Arizona was projected to have significant delays due to a dispute with local construction unions.

In fact, the labor dispute it referenced had already been resolved even before that disparaging op-ed was published. And just one month after the op-ed was published, TSMC was given the official receipt of its CHIPS Act funding and suddenly declared that its Arizona project was on schedule.

Now, less than six months later,  , Tim Culpan reports , that TSMC’s Arizona plant has started making some chips for Apple. They’re producing a fairly advanced chip, and they’re reportedly producing good yields:

The A16 SoC from Apple, which debuted in the , iPhone 14 Pro, was first introduced two years ago in the , iPhone 14 Pro, and is currently being produced in small, but significant quantities at TSMC’s Fab 21 in Arizona. This puts the Arizona project on track to reach its , production target in the first half of 2025.

This is a BFD. The US government’s$ 39 billion CHIPS for America Fund is the star project under the CHIPS Act. The fact that they chose the most advanced chip in terms of both volume and technology shows that Apple and TSMC want to start big…

Currently, TSMC produces yields in Arizona that are, in essence, neck and neck, slightly below what is enjoyed in Taiwan back home. Most important, though, is that improvements are moving so rapidly that true yield parity between Taiwan and Arizona is expected to be reached in coming months.

Everyone has egg on their face now that everyone leaped at the chance to call the CHIPS Act a failure after the initial delay report.

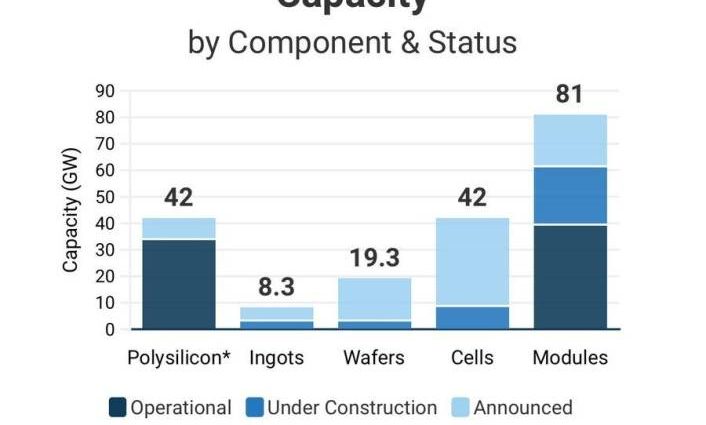

In addition, the Inflation Reduction Act, Biden’s other significant piece of industrial policy legislation, appears to be giving US solar manufacturing a significant boost. Solar manufacturers are  , ramping up production, and the US is getting the ability to build the pieces of the solar supply chain that it had previously outsourced entirely to China and other countries:

Although this is still insignificant in comparison to what China can produce, it means that if a war breaks out, the US will not be able to use solar power.

Note that both the successes in chips and solar are cases where the private sector made most of the investment itself, and the US government simply , prompted , that investment with subsidies.

This contrasts starkly with the US government’s promise to build things itself, and which was stymied by its lack of state funding and its own byzantine permitting process.

A big lesson to be learned from this is that Matt Yglesias is correct, and that the US government has willfully squandered a lot of its state funding since the 1970s. Therefore, the most effective industrial policy, at least right now, is for government to act as the spur for the private sector to invest its own money.

The even more important lesson is that knee-jerk critics of industrial policy need to be a little more prudent and circumspective, or else they’ll keep coming off as silly when industrial policy succeeds. We need intelligent, thoughtful critics who can identify the problems, challenges, and drawbacks that are bound to be found in industrial policy. People who simply pounce on any whiff of difficulty are unhelpful.

3. Justifications for tariffs

The US government is becoming more hostile to Chinese imports all the time. The “de minimis” exemption, which allows Chinese companies like Temu and Shein to send Americans small, inexpensive packages without paying tariffs, has recently been made public by Biden. Additionally, Biden’s administration is putting a ban on Chinese components in any cars that are connected to the internet to prevent potential sabotage, considering an outright ban.

Meanwhile, Trump is going around promising tariffs, tariffs, and , more tariffs , as the solution to a variety of economic ills ( or just because , he really likes tariffs ). Some people are talking about it, but this is not the election’s most important policy issue.

For instance, Kim Clausing, an economist, contends that the US should cut down on tax havens by reducing the incentive for offshoring in favor of tariffs. But I think that while this is a laudable move, it would n’t really do much vis-a-vis China, because China is not a tax haven. The reason Democrats have been favoring tariffs on China, which is , national security, is really missing from Clausing’s proposal.

Meanwhile, Oren Cass has a post at the Atlantic in which he makes a general case for tariffs as a useful policy tool. Some excerpts:

[Economists ‘] first error is to only take into account the costs of tariffs, and not the benefits… [ D] omestic production has value beyond what market prices reflect… [ D] tarifs [d ] omestic production has value… to the extent that they combat those harms, they accordingly bring collective benefits…

Manufacturing does matter, as the effects of globalization have shown. It matters for national security, ensuring both the , resilience of supply chains , and the , capacity of the defense-industrial base. It also has a significant impact on growth…

Manufacturing is the engine of innovation. As the McKinsey Global Institute has  , noted, the manufacturing sector plays an outsize role in private research spending. Complete supply chains and engineering expertise are followed when offshore manufacturing heads. Firms and workers positioned near the factory floor and close to competitors, suppliers, and customers benefit from the tight feedback loop between design and production, which is necessary for improvements in both.

Cass also argues that the harms from tariffs will be limited when foreign companies circumvent the tariffs by building their products in the US. Additionally, he makes note that tariffs do generate more tax revenue.

You’ll hear me saying similar things when I defend industrial policy because all of these arguments are reasonable. But there are two questions here that Cass does n’t really address.

First of all, I believe Cass has largely identified real externalities, but that does n’t imply that tariffs are the most efficient policy tool for addressing those externalities.  ,

Tariffs ‘ effects are limited , by exchange rate adjustment — when you put tariffs on China, the yuan gets cheaper, partially negating the effect of the tariff. Additionally, tariffs on intermediate goods actually exacerbate many of the externalities Cass discusses by preventing domestic manufacturers from receiving affordable inputs for their production processes. For national security reasons, it might be a cost that is worthwhile to pay, but it is a real cost.

And second, Cass ‘ , general , defense of tariffs ignores many of the real, specifc features of Trump’s tariff proposals. Trump would impose tariffs on US allies rather than strengthen national security because it would stifle competition on both sides and prevent them from achieving economies of scale. Additionally, it would strain both sides ‘ defense-industrial bases.

So on both sides of the tariff debate, I still see too much debate about ideal policies, and not enough engagement with the specific policies being enacted or proposed. That said, I think the debate has significantly improved since it was a few years ago, which is good. I always want to see more of Clausing and Cass ‘ arguments made in a reasonable way rather than yell at ideological positions.

4. The onset of fatigue

The inert coagulum of a once highly reactive sap is the conservatism of a religion — its orthodoxy. — Eric Hoffer

Let’s talk about wokeness as long as we’re on the subject of identity politics from the year 2010. I wrote a number of posts about this sociocultural phenomenon back in 2021 and this one is the one I summarized here.

My basic thesis is that wokeness is a Protestant-derived American belief system and social phenomenon that has been around since before the founding of the United States, and that it periodically resurfaces for a while when technological and economic changes allow.

And my fundamental prediction is that after the efflorescence of the 2010s, wokeness will fade into a waxy orthodoxy, ruling a shrinking number of university administrations, school boards, and online communities, before reappearing on the scene many decades from now.

Musa al-Gharbi wrote a great post last year that pulled together various data sources to show that the” Great Awakening” of the 2010s is waning. Now The Economist has  , a similar post, with different data sources. Several examples are provided:

[ D] discussion and support for woke views reached their peak in America in the early 2020s and have since declined significantly… Almost everywhere we looked, a similar trend emerged: wokeness increased sharply in 2015 as Donald Trump entered the political fray, increased in the aftermath of# MeToo and Black Lives Matter, reached its highest point in 2021-22, and has since decreased…

In the most recent Gallup data, from earlier this year, 35 % of people said they worried” a great deal” about race relations, down from a peak of 48 % in 2021 but up from 17 % in 2014…In]General Social Survey ] data the view that discrimination is the main reason for differences in outcomes between races peaked in 2021 and fell…in 2022. Young people and those on the left have experienced some of the biggest rises and subsequent declines in woke thinking…

The share of Americans who view sexism as a serious issue or a moderately serious issue reached a record high of 70 % in 2018….

Pew finds that the share of people who believe someone can be a different sex from the one of their birth has fallen steadily since 2017, when it first asked the question. According to YouGov, the proportion of trans people who play for sports teams that match their chosen gender rather than their biological sex has increased from 53 % in 2022 to 61 % in 2024.

The use of the term” white privilege” in television reached its highest level in 2021, appearing roughly 2.5 times for every million words in the New York Times and The Times in 2020…

Mentions of DEI in earnings calls shot up almost five-fold between the first and third quarters of 2020…They peaked in the second quarter of 2021…They have since begun to drop sharply again…The number of people employed in DEI has fallen in the past few years.

This corresponds to my 2021 forecasts. And if I’m correct, this pattern will continue over the coming years, even as conservatives continue to find and highlight instances of wokeness in mainstream culture, including academia, and other progressive areas. Wokeness is an orthodoxy now, and orthodoxies are n’t fun and cool anymore.

However, wokeness is not particularly optimized for being a conservative set of rules and traditions, but rather for being a charismatic activist movement. So I anticipate that its decline will be quick, up until, of course, it resurrects. But that will be when you and I are very old or dead.

5. Unions versus automation

It’s very hard to be a pro-union pundit when , unions make demands like this one:

About 45, 000 dockworkers along the US East and Gulf Coasts are threatening to strike on October 1st, a move that would shut down ports that handle about half the nation’s cargo from ships…

The International Longshoremen’s Union wants to see a total ban on automation of cranes, gates, and container movements used in 36 US ports…

A prolonged strike would almost certainly hurt the US economy. The union members anticipate going on their biggest fight against the automation of job functions at ports, according to Union President [ Union President ] Daggett.

We do n’t think robotics should supplant humans, he said. ” Especially a human being that’s historically performed that job”.…

According to experts, it’s unclear whether automation will cause layoffs in the Ports of Long Beach and Los Angeles, according to a study conducted by the Economic Roundtable of Los Angeles in 2022 that was funded by the West Coast dockworkers union…

However, another study conducted by a professor at the University of California, Berkeley that year, which was commissioned by port operators and shippers, found that paid hours for port union members increased by 11.2 % between 2015 and 2021, the same year.

At the huge Port of Rotterdam, one of the world’s most automated ports, union workers pushed for early-retirement packages and work-time reductions as a means to preserve jobs. And ultimately, a researcher from Erasmus University in the Netherlands discovered that mechanization did n’t lead to significant job losses.

In terms of automation, US ports outperform their counterparts in Asia and Europe. Analysts note that most US ports take longer to unload container ships than do those in Asia and Europe and suggest that without more automation, they could become even less competitive.

The prohibition of automation is only a means of destroying the goose that produces the golden eggs, ultimately causing harm to dockworkers. It also imposes a tax on the entire US economy. If you did n’t like the inflation of 2021, you should want more efficient, high-capacity automated ports. Instead of resuming self-defeating luddism, the US should emulate Rotterdam.

This shortened and reorganized article was originally published on Noah Smith’s Noahpinion , Substack, and is now republished with kind permission. Read the original here  , and become a Noahopinion , subscriber , here.