- Mostly existing investors with new investor, EvolutionX Debt, a SG based debt fund

- Claims independent biz units have hit profitability with over 30% revenue growth

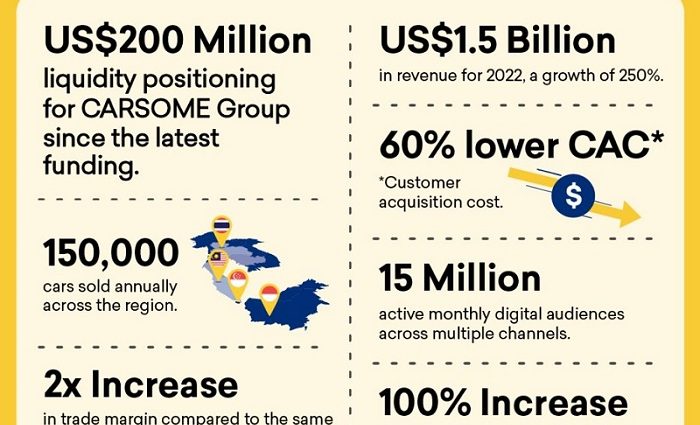

CARSOME Group announced the closing of its latest fundraising round yesterday, without disclosing the amount raised, but shared that the funding has brought its current liquidity to approximately US$200 million (RM927.9 million).

Highlighting its liquidity position is a response to a recent article by a Malaysian automotive blog that questioned its path to profitability and noted its high burn rate.

The round saw broad-based participation from Carsome’s existing investors, including 65 Equity Partners, Seatown Private Capital Master Fund, Qatar Investment Authority, Gobi Partners, and Asia Partners. It also attracted a long-term debt facility from a new investor, EvolutionX Debt Capital, a US$500 million growth stage debt fund by Singapore’s Temasek and DBS in 2021.

EvolutionX’s investment in Carsome marks its first in Southeast Asia. Rahul Shah, Partner of EvolutionX said, “We remain focused in supporting category-leading technology companies in our core markets in Asia which are backed by reputed long-term investors. We are excited by Carsome’s continued focus towards achieving profitability during this year and believe that this collective capital raise will optimise its capital structure and improve the financial strength of the company to support its continued journey towards sustainable profitable growth.”

“Our comfortable liquidity position and strong backing from both existing and new investors place us on solid footing to deliver the first integrated car ownership ecosystem, going beyond just buying and selling cars to include ancillary services across the whole ownership lifecycle, as we steer the company toward profitability as a group,” said Eric Cheng, Carsome’s co-founder and group CEO.

According to Carsome, which said it has sold over 150,000 cars annually, revenue grew 250% to US$1.5 billion in 2022, with the newly established regional retail line CarsomeCertified contributing 35% of total revenue.

In Q1 2023, Carsome claims to have doubled its profit margins compared to the same period last year. More than 80% of the trade margin came from transaction margins, leaving potential upside for ancillary revenue, especially given its increasing focus on ecosystem offerings, including financing, insurance, and aftersales.

As an example of after-sales offerings, Carsome claims that its Carsome Service Centers(CSC) has recorded more than 100% month-over-month growth since its launch at the end of 2022 and is expected to reach nationwide coverage in Malaysia by the end of Q3 2023.

Carsome said it owns the largest auto digital audience footprint of more than 15 million monthly active users through its content and media ecosystem, including the brands under iCar Asia and Wapcar. In addition to achieving over 30% growth in revenue and reaching profitability as independent business units of the Group, Carsome claims its ecosystem companies have also contributed to a 60% reduction in the group’s customer acquisition cost.

As of Q1 2023, its retail line, Carsome Certified, holds a Net Promoter Score (NPS) of 77 points within the used car industry. In parallel, its wholesale business garnered an NPS of 75 points.

The launch of MyGarage, as an anchor feature of the Carsome App, acts as a hub with real-time car valuations, service bookings, and sales inspections. According to Carsome, it will continue integrating ancillary services, including Financing, Insurance, and Aftersales.