Japan – In a level of the AI increase days, Japan’s Kokusai Electric is building its first fresh in-country shop in 35 years.

In the markets for Chemical Vapor Deposition ( CVD), Atomic Layer Deposition ( ALD ), and other thermal process and plasma treatment equipment used to create nanoscale thin films for the fabrication of integrated circuits ( ICs ) on silicon wafers, Kokusai squares off against Applied Materials and Tokyo Electron.

Following a successful spin-off from the Hitachi Group led by US private equity firm KKR, the business has since resurrected as a leader in semiconductor manufacturing technology.

Kokusai is significantly smaller than Applied Materials and Tokyo Electron in terms of overall sales, but according to market research firm Gartner, it holds significant market share in its key products, accounting for 34 % of batch CVD in 2023 and 70 % in batch ALD.

Kokusai’s target applications include AI processors and other advanced logic ICs, the high-bandwidth memory ( HBM ) used with AI processors, 3D NAND flash memory and silicon carbide power devices.

” As silicon products have become three-dimensional and more sophisticated in recent years”, Kokusai explains,” the edge of chips has become more difficult. This, in turn, has increased need for very difficult accumulation”.

Examples include the continuously increasing number of layers in 3D NAND, the Gate All Around ( GAA ) transistors developed with 3nm process technology, and the Complementary Field-Effect Transistor ( CFET ) architecture being developed by nanoelectronics R&, D organization imec for use at process nodes below 1nm, which were all envisioned at the end of the decade.

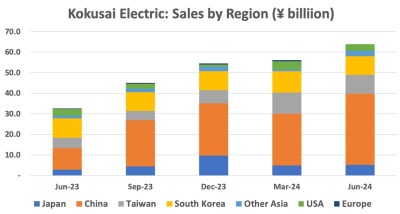

Kokusai has also established a significant presence in the market for advanced reasoning Circuit thermal processing products, first in Japan and China, and then in Europe and the US. In the past four rooms, just over 50 % of the company’s income were in China.

The semiconductor production equipment business started with a single diamond germanium/silicon ingot grabber in 1956, which Kokusai Electric Company, which was established in 1949 as a maker of telecommunications and other electronic equipment, began.

A propagation furnace was created in 1964, and a CVD system was created in 1970 as a result. In 1961, the business was listed on the Tokyo Stock Exchange.

In 2000, Kokusai Electric merged with Hitachi Denshi, a maker of film, communications and analyze tools, and Yagi Antenna to shape Hitachi Kokusai Electric, a unified company of digital conglomerate Hitachi Ltd.

With sales and service centers in Taiwan, China, Europe, and the US, Hitachi Kokusai has grown to become a leader in the production of semiconductor production tools. It has also established companies in Japan and South Korea.

However, it was a difficult mashup of three largely related organizations. US merger business KKR seized 24.9 % of Hitachi Kokusai in a contentious deal with different foreign and Chinese investors in 2017 as part of the reform of the Hitachi Group.

Hitachi Kokusai’s semiconductor production equipment department was spun off, taken over by KKR, and renamed Kokusai Electric Corporation in 2018.

Applied Materials and KKR reached an agreement to buy Kokusai in 2019, but that deal fell apart two years later subject to objections from the Chinese competitive regulator.

The Chinese choice made sense because Kokusai’s product line would match Applied Materials ‘ and boost its market focus. If the parties involved in a package have a significant business reputation in the nation, Chinese authorization is necessary.

Kokusai Electric Corporation was listed on the bottom tier of the Tokyo Stock Exchange in October 2023, earning DealWatch’s” IPO of the Year” accolade. ( The 1995 establishment of the DealWatch Awards helped to grow and expand Japan-related capital markets. )  ,

DealWatch wrote in its assessment of Kokusai that” we cautiously executed the deal in a tough situation with an uncertain business culture and a worsening silicon cycle. This is the first large-scale world IPO in Japan in approximately five years.” We attracted attention from blue-chip outside investors, leading to incredibly strong property value performance”. Kokusai’s IPO price was ¥1, 840, but it jumped more than 30 % on the first day of trading.

By the end of the fiscal year ending on March 31, 2024, KKR owned 43.4 % of Kokusai. In July, KKR sold about half that stake. The most recent shareholder data available shows Qatar Investment Authority at 4.9 %, Applied Materials at 14.7 %, and KKR at 23.2 %.

Since July, Kokusai’s share price has dropped from an all-time high of 5, 940 to 3, 320 yen. Applied Materials made some profit, KKR made some profit, and other investors bought shares in exchange for what it could not have acquired in a takeover. Kokusai has now gotten its independence from KKR after fleeing the Hitachi bureaucracy.

Toyama Prefecture, northwest of Tokyo on the Japan Sea, will now have Kokusai’s new 24 billion yen factory, which will be able to meet its goal of double production capacity in five years, up to March 2026, with twice the efficiency of older facilities. It will also seek to strengthen the company’s R&, D capability.

” To make our operations smarter”, Kokusai’s management said,” we plan to systematically introduce cutting-edge technologies, including IT, IoT]Internet of Things], digitalization, data utilization, automation, and even AI”. The beginning of production is expected in October.

Kokusai is also expanding its service and support operations in the US, Europe, India, Southeast Asia, Taiwan, mainland China and Japan.

Its customers include TSMC, Samsung Electronics, Micron Technology, Chinese DRAM maker CXMT, Intel and other leading semiconductor makers. The key to filling up the new factory will be having the necessary equipment to implement their advanced process technologies.

Follow this writer on , X: @ScottFo83517667