- Transformative actions led to 13 percentage points in improvements

- Four types of transformation actions outperformed peers

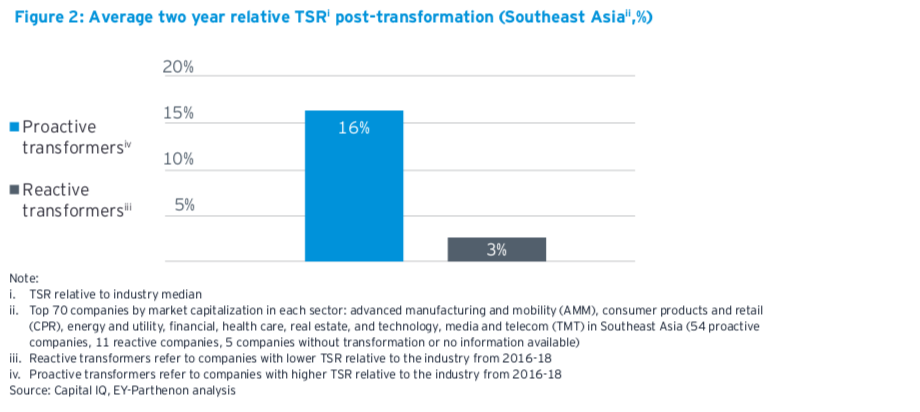

A recent EY-Parthenon report noted that companies that proactively undertook transformative activities throughCovid-19 pandemic saw outperformance by 13 percentage points (pp) based on total aktionär returns, as compared to reactive transformers.

A recent EY-Parthenon report noted that companies that proactively undertook transformative activities throughCovid-19 pandemic saw outperformance by 13 percentage points (pp) based on total aktionär returns, as compared to reactive transformers.

Titled ‘Transformation in Southeast Asia: Four archetypes associated with outperformers’, the firms said in a declaration that transformative actions include but are certainly not limited to environmental, interpersonal and governance endeavours, digital transformation, supply chain management and portfolio optimisation.

It mentioned the report researched the top 70 shown companies by market capitalisation across seven sectors namely superior manufacturing and flexibility, consumer products and store, energy and utilities, financial services, health care, property and technology, press and telecommunications.

The countries in Southeast Asia that were covered in the report consist of Indonesia, Malaysia, Philippines, Singapore, Thailand plus Vietnam, and their performance was examined from between 2018 and 2021.

Sriram Changali (pic) , EY Asean Value creation innovator, said during the pandemic, businesses scrambled in order to adapt to the new normal, and drew upward crisis management strategies to respond to an abece soup of probable recovery trajectories.

“Yet, many of these transformation activities have not translated directly into value creation for your companies.

“Hence, it is important pertaining to companies to understand just how their transformation techniques and their performance impact the success of their own transformation journey and enhance the value of their particular organisation, ” he or she said.

Angela Ee (pic) , EY Asean and Singapore restructuring chief, said, “It [the transformation] could be a multitude or combination of approaches, which include purchases, digitalization or even divestments and restructuring, to help optimise the value of the business enterprise. ”

Angela Ee (pic) , EY Asean and Singapore restructuring chief, said, “It [the transformation] could be a multitude or combination of approaches, which include purchases, digitalization or even divestments and restructuring, to help optimise the value of the business enterprise. ”

The EY-Parthenon study found possible correlations between the companies’ performance and their change approaches.

The study also available that companies gave little attention to the important thing levers of change for better, including balance sheet and financial restructuring.

Changali said initiatives such as digital transformation are generally expensive, with unclear business cases that some boards may struggle to navigate.

“Therefore, it is critical that such initiatives are coupled with cash release through cost optimization, operating capital optimization and financial restructuring, ” he said.

The EY-Parthenon study also highlighted that execution would determine the success of the particular transformation initiative. It said there are 5 imperatives that businesses should note whenever undertaking any transformative actions:

- Align CEO and board to the purpose of the change for better and the value for that organisation;

- Set aspirational focuses on and incentivize achievement over and above what is obtainable in a business-as-usual setting that aligns with the objective of transformation plus linked to clear outcomes;

- Setup execution rigor and get commitment from the top is crucial to keeping accountability;

- Calibrate the trip to balance the expenses with the potential upsides and communicate with important stakeholders along the trip; and

- Build capabilities to improve functional, technical and leadership expertise plus equip employees using the right tools.

Ee said “Transformation is not only for companies within distress. We see that companies that have been resilient during the pandemic have also undertaken transformative actions that helped to position them for long-term success.

“Transformation via business restructuring, be it an operational turnaround or even a financial restructuring can be a vital tool aid value for a company and its stakeholders.

“From refinancing and cash flow enhancements, to the divestment associated with assets and administration of liabilities, there are numerous ways that executives may maintain or produce value in their organisation. ”