- Investments , primarily to Malaysians &, KL- based members, US$ 100k regular payment

- Partnership view by co- engaging with Vertex Ventures, 500 Global, Gobi Partners

Second Walk, an early stage account, created by companies for businesses, is making moves in the Malaysian company picture by backing its second 10 projects in the first year. First Move is injecting considerable capital into the growth of the ecosystem, providing much-needed first funding support during a critical but frequently overlooked phase, with its special focus on earlier- stage founders.

In its inaugural year, the bank has invested the majority of its cash to Malaysians and Malaysia- based members, with an average purchase dimension of RM467, 000 ( US$ 100, 000 ) per business. The fact that 35 % of the members are supported by people underscores the bank’s commitment to diversity and inclusion. Also, First Move has funded first level customer firms in Singapore, Indonesia and Vietnam.

First Move’s latest investments in Malaysia underscore its commitment to effect investing, with a focused strategy on pricing, economic participation, and round economy. These strategic investments aim to promote regional sustainable and inclusive growth.

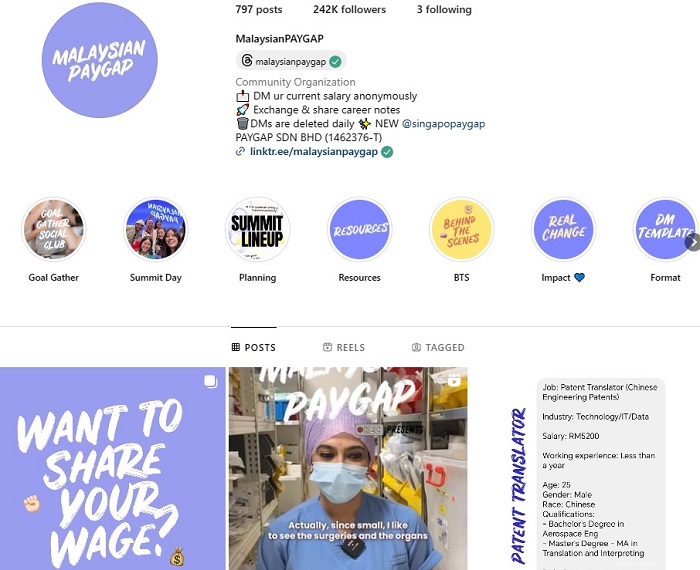

Koppiku hopes to transform the coffee industry by lowering the cost of premium daily items, expanding the supply chain, and fostering more local jobs. In tackling workplace gender and racial disparities, First Move supports the MalaysianPAYGAP initiative, which champions equal pay and career opportunities, contributing to broader social equity.

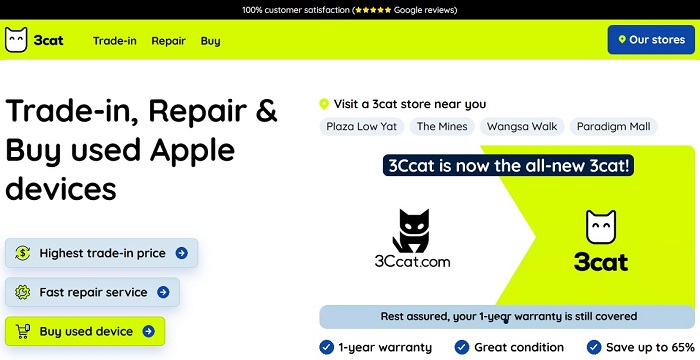

3Cat is leading the charge by enabling device trace- in, repair, and reuse while furthering the circular economy in the sustainable consumer electronics space. This initiative significantly reduces waste and increases the technology’s lifespan. Furthermore, enhancing access to niche markets, First Move’s investment in Collektr connects collectors of unique items, showcasing a commitment to improving circular commerce and fostering community engagement.

First Move multiplies its impact on the Malaysian startup ecosystem by combining early- stage investments with strategic co- investments alongside leading venture capital firms, including Vertex Ventures, 500 Global, Gobi Partners, and more. This approach not only provides startups with essential financial support but also grants them access to a wealth of networks, expertise, and mentorship. This cooperative approach ensures that these brave businesspeople are prepared to face off on a global scale.

” We are excited about the impact in our first year of operation”, said Audra Pakalnyte, Partner at First Move. Our investments in Malaysian startups have attracted international investors ‘ attention and interest as well as fueled their expansion. We are proud to be a part in the growth of Malaysian startups and look forward to carrying out our mission, which is to provide visionary founders with the resources they need to succeed.

First Move’s entry as an early investor complements the ecosystem established by key Malaysian enablers like Khazanah, Penjana Kapital, Malaysia Venture Capital Bhd ( MAVCAP ), EPF, and KWAP, encouraging more entrepreneurs to launch their ventures.

This synergistic approach promotes local talent by providing essential resources, promoting economic growth, and creating jobs, as well as accelerating the development of scalable ventures. Consequently, the broader aim is to reinforce Malaysia’s emergence as a vibrant hub for entrepreneurship, fostering a culture of innovation and technological advancement.

For more information about First Move and its investments, please visit www. firstmovefund.com.