The” two sessions” in first March– the National People’s Congress and the Chinese People’s Political Consultative Conference– took no economic activity of importance, to the confusion of pundits who expected dramatic , action from Beijing in the form of financial ease, or consumption stimulus, or a property bailout.

China’s authority was solely focused on transforming its industry through innovative technologies. It asks for and will give no quarter to America’s systems siege, relying on an” all- state work” to reach personal- sufficiency in semiconductors and various key technologies.

In addition to its presently substantial devotion, it announced a 10 % increase in the national knowledge resources and announced an additional US$ 27 billion for a semiconductor business account.

The divergence of views about China’s economy at home and abroad could n’t be more pronounced.

The , Center , for Strategic and International Studies, the , epicenter , of conventional wisdom, wrote on February 29 that” China’s economy is showing multiple signs of weakness. Actual growth seems below the official figures, there is substantial deflation, the housing market has yet to stabilize, and the domestic stock markets have fallen significantly”.

Beijing, on the other hand, emphasizes industrial policy while paying little attention to Western macroeconomists ‘ obsession with demand management.

A few important data reports since the” two sessions” ended , favor , Beijing’s benign view of China’s economic circumstances. Contrary to the deflation meme, China’s core consumer price index showed a 1.2 % year- on- year rise in February following a 0.4 % rise in January. The headline CPI number has a negative impact because the core CPI excludes volatile food prices. Headline CPI also rose in January.

Producer prices are continuing to decline, but this is not necessarily a bad thing because lower producer prices and higher consumer prices suggest higher corporate profits. That has been the historic pattern.

Most importantly, exports in RMB terms rose 10.35 year- on- year in January and February. That provides critical support for China’s high- tech industry, especially solar panels, EVs, telecommunications equipment and electronics.

China already installs more industrial robots than the rest of the world combined, or 52 % of the total, and its use of automation and economies of scale makes it able to produce solar panels, electronic vehicles, and other important products much more affordably than any rival.

But industrial automation, including the application of advanced 5G ( what Huawei labels 5.5G ) and artificial intelligence, is only the beginning. China is pushing for novel technologies, including nuclear fusion, to be developed.

The science budget’s 10 % increase is the largest budget increase ever. To highlight just two major initiatives: the construction of the world’s largest particle collider, which will bring thousands of top international scientists to China, and the accelerated development of thermonuclear fusion as a major energy source of the future.

To combine the capabilities of scientists and business leaders to advance research in nuclear fusion technology, a consortium led by China National Nuclear Corp was established at the end of December, in order to build energy-producing reactors by 2030.

The group comprises 25 central government- owned enterprises and research institutes, including some of the country’s largest energy and steel firms, such as State Grid Corp, China Three Gorges , Corp , and China , BaowuSteel Group Corp Ltd.

Advanced particle physics has a second major initiative. The Higgs factory, known as the Circular Electron Positron Collider, will take ten years to complete, making it the next major hub for particle physics, at a cost of 36 billion yuan ($ 5).

Focus on second- and third- tier cities

The Communist Party of China has a strong political desire to address the enormous wealth and income disparities that resulted from Deng Xiaoping’s 1979 reforms. Xi Jinping’s byword for this priority is” common prosperity”.

The minority of Chinese who live in Shanghai, Shenzhen, Guangzhou, Beijing, and other Tier 1 cities already have a living standard close to that of the industrial countries, while much of the country has  , lagged behind

” Observer” columnist , Chen Feng , wrote on March 6 that Beijing’s goal “is to make the pie bigger by narrowing the gap between urban and rural areas and narrowing regional differences”. China’s infrastructure spending, Chen explained, will focus on raising the level of smaller cities through the expansion of the high- speed rail network and other infrastructure.

According to Chen, “over-concentration of the population also causes the distortion of the allocation of resources and opportunities among regions.” ” Satellite cities, new urban areas, and sub- centers , are some of the solutions, but these ultimately depend on the decentralization of large,  , medium and small cities that are independent of metropolitan areas”. This is a good place to start because there are now more than 2 million cities in China with more than 2 million people.

The Communist Party wo n’t use enormous amounts of state money to rescue property companies that fell victim to the urbanization boom that cost ten times more than the same house in Chengdu’s suburbs.

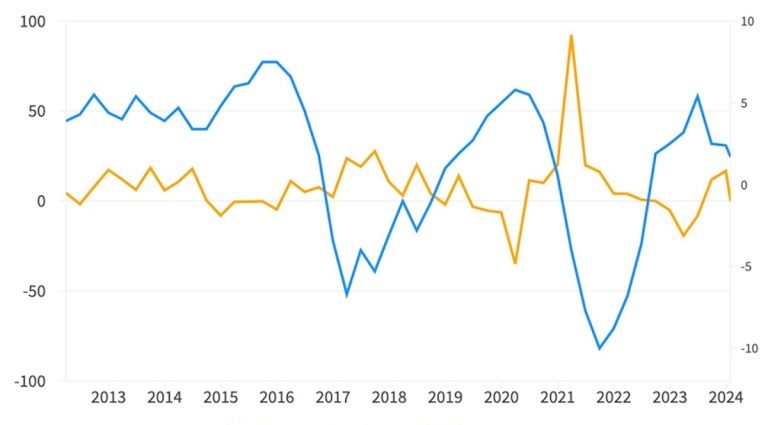

The average price of Chinese property doubled from RMB 6, 200 per square meter in 2015 to RMB 11, 000 in 2021 before falling to slightly over 10, 000 in 2023. But in Shanghai, the price rose from about RMB , 15, 000/square meter to nearly 50, 000/square meter in 2021.

Beijing’s policy is not to support the windfall gains of wealthy homeowners in tier 1 cities. Instead, according to a , March 11 analysis , in” Observer”, the burden of adjustment will be shared among all the relevant parties: property company stockholders, bondholders, banks and homeowners.

The People’s Bank of China is leaning toward state-owned commercial banks to provide more support to property companies and has lowered the long-term bank lending rate modestly in favor of homebuyers. However, this is a Chinese-style negotiation in which no one’s rice bowl is broken and everyone is expected to accept some losses.

( This report first appeared in the March 13, 2024 issue of Asia Times Global Risk/Reward Monitor. )