When the Federal Reserve Board raises interest rates, the market is expected to experience the following effects: a decline in demand for goods and services, an increase in employment, and stagnation in economic development. Rising costs are feared by the crisis. Higher unemployment is a sign of crisis, which is the method by which higher rates control inflation.

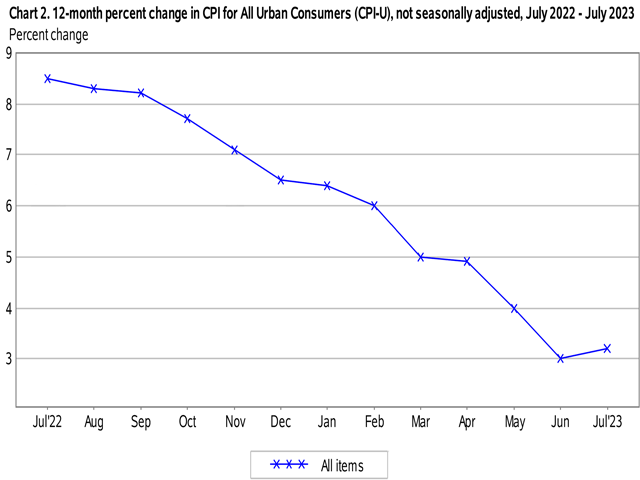

The Fed has raised interest rates 11 days, for a complete boost of five full percentage points, over the past 18 months. Although” core” inflation( minus volatile food and energy prices ) is more like 4 %, inflation has significantly decreased from the 9 % annual rate it reached at its peak and is now around 3 %.

However, unemployment is shockingly low — under 4 %. The sector is still expanding as well.

Therefore, there has been a disconnect between the outcome( inflation decreasing ) and the mechanism by which it was achieved( recession not occurring ). Naturally, this has raised questions about what is happening and what the Fed should be doing right then and has led to confusion.

The focus of this discussion is on two issues: Why didn’t higher levels lead to a downturn? What caused interest rates to fall if the crisis system didn’t work?

The near-term future of interest rates is at stake in this discussion for producers, farmers, and different business loans. Does prices increase? Did they remain high for how long?

The Fed had faith in the process when it began raising rates. Jerome Powell, the chairman of the Fed, has repeatedly warned that price increases will slow the economy. The central bank was ready for a crisis and significantly higher employment because it was so dedicated to eradicating prices.

In a statement from 2022, Powell said,” These are the unfortunate costs of reducing cpi.” However, failing to bring about price stability may result in much greater suffering.

However, thus far, high interest rates have primarily hurt the consumers who must pay them. Few Americans have lost their jobs as a result of them. The anticipated crisis is no longer present.

Or is the arrival merely a minor tardy? A recession, according to one school of thought, is just around the corner. High interest rates haven’t already hit home, but they soon will.

Consider business loans as evidence in favor of this school of thought. Some businesses locked in lower costs for a few years during the crisis. The Fed’s rate increases haven’t yet had an impact on them, but those debts will eventually need to be renewed at significantly higher levels. That will help the economy lose some of its weather.

If the delayed-recession theory is correct, the Fed may soon start lowering interest rates, particularly if inflation stays average.

According to another school of thought, prices is simply taking a break and isn’t actually dying. In the 1970s, that is what took place. After a brief period of decline, prices picked up and soared also higher. Prices will rise and remain large longer if the Fed determines that inflation is still alive and well.

Some propose the following theory to explain how inflation subsided without unemployment rising: In contrast to some inflationary episodes, this single involved too few goods rather than an excessive amount of money chasing them. It occurred as a result of the pandemic’s disruption of supply chains and the scarcity of merchandise. The inflationary motor ran out of fuel once the supply chain flaws were fixed.

To put it another way, despite the fact that they may have contributed, prices wasn’t primarily defeated by the Fed’s price increases. It was the strange supply disruption’s natural unwinding. the unwinding pinch-hit for crisis as a different method of controlling inflation. The Fed will be less likely to raise rates or keep them large if it accepts this idea.

Normally, the Fed hasn’t stated how little, if at all, it invests in any of these concepts. A few weeks ago, Fed chair Powell delivered a significant statement that alternated between sounding aggressive and dovish.

The Fed is even more data-dependent than usual as a result of yesterday’s combination of lower prices and ongoing low employment. If inflation increases or the economy warms up, it will slim aggressive; if unemployment rises or inflation falls, the market will purr like a dove.

Fed politicians are going to have a heated internal discussion if either inflation or unemployment stagnates at the present level, or both do.

The best situation for business debtors is for prices to keep falling, enabling the Fed to win and begin lowering rates. Watch the inflation figures the government releases in the coming weeks if you’re trying to predict the interest rate the bank will charge you second spring.

Urban Lehner, a longtime editor and correspondent for the Wall Street Journal Asia, is now the editor-emeritus of DTN / The Progressive Farmer. & nbsp,

Copyright 2023 DTN / The Progressive Farmer is the title of this article, which was first released on September 12 by the latter news organization and is now being republished with authority by Asia Times. All right are reserved. Urban Lehner andnbsp on Twitter: @ urbanize