I don’t really think you may beat Trump’s tariffs by arguing with them sensibly or by explaining financial concept. I mean, how do you say with something like this?

I’ve resigned myself to the concept that the only way America is going to travel to the large revelation that broad-based tariffs are negative is to experience the adverse consequences first-hand — i. e., to reach the proverbial warm stove. Luckily, I think Americans properly be coming about very quickly:

But regardless, this is an economy website, and so even though I don’t expect it to give some political earnings, I thought I might as well explain why trade imbalances don’t make a country poorer ( though that doesn’t mean they’re Fine ).

Trump’s mistaken perspective of business imbalances

Trump and his officials and sycophants believe that business imbalances constitute America being “ripped off” by foreign nations.  , As I explained in today’s blog, this is why Trump set his price prices at a level that he thinks may reduce America’s trade imbalance with each unique country.

Trump’s perspective of business deficits is based on two fundamental errors. The second is , a basic finance problem. Trump’s officials looked at the formula for GDP and noted that goods get subtracted from GDP.

They didn’t know that this is because goods even get , added , to use and investment, so you have to remove them at the end in order to eliminate them from the amount. The truth is that goods don’t change GDP one way or another.

Trump’s subsequent mistake is based on the idea that imports will be replaced 1-for-1 by domestic production — i. e., if you stop America from importing a cleaning system, an American company will make one more cleaning system instead. That’s certainly one , possible , outcome, but it’s not the only one. American consumers could just go without one washing machine, making everyone poorer.

In fact, Trump and his people probably don’t even realize these are two , separate , misunderstandings. They probably think that their mistaken belief about accounting ( i. e. that imports reduce GDP ) follows naturally from their mistaken belief about import substitution. The two mistakes mutually reinforce each other.

Anyway, because Trump misunderstands trade deficits in these two ways, he believes that when America runs a trade deficit with a country, that country is ripping us off. He thinks imports are lowering U. S. GDP by forcing us to produce less stuff — essentially,  , stealing American production. He thus sees trade deficits as a measure of how much is being stolen from America.

But that’s not actually how trade deficits work at all.

A trade deficit is like buying stuff with a credit card

Suppose you import a washing machine from some Chinese guy named Ruimin. Why would Ruimin give you that washing machine? Nothing is free. Basically, you can pay for that washing machine in two ways. The first way is to give Ruimin something he wants — say, 50 interesting books ( Ruimin famously likes to read ). The second way is to write Ruimin an IOU. 1

The first case is called , balanced trade. You get a washing machine, Ruimin gets 50 books. There’s no trade deficit or surplus.

The other thing that can happen is , unbalanced , trade. In this case, instead of 50 books, you give Ruimin a US Treasury bond. A bond is an IOU. In this case, you’ve contributed to America ‘s , trade deficit , with China. A real good or service — the washing machine — went from China to America, and the only thing that went back in return was a slip of paper (or, actually, a number in a spreadsheet ).

At some point when you hear economists discuss trade, you might hear them talk about the” current account” and the” capital account”. The current account is basically just the net flow of real goods and services, 2 , and the capital account is basically just the net flow of IOUs.

If you give Ruimin an IOU in exchange for a washing machine, it means you’ve contributed to America ‘s , current account deficit, and you’ve also contributed to its , capital account surplus.  , Both of those things just mean “paying foreigners for stuff with IOUs”.

Now you can see why a trade deficit is like buying stuff with a credit card. When I buy a washing machine from Target with my credit card, I’m writing an IOU and I’m getting a tangible thing in return.

Does using your credit card to buy a washing machine from Target mean that Target has ripped you off? No. Does it make you poorer when you use your credit card to buy a washing machine from Target? Nope. You now have less money, but you have  , more stuff. In just the same way, a trade deficit means that the US has  , less money and more stuff. It does not mean America is poorer, or that it has been ripped off by foreigners.

A case where trade deficits can be good

Asking whether trade deficits are good or bad is like asking whether buying stuff with borrowed money is good or bad. The answer is pretty obviously “it depends on whether the purchase was worth it”.

One thing to remember is that not all purchases are for consumption — a lot are actually , productive investment. If an American factory buys a Japanese CNC machine tool for$ 100, 000, and the Japanese toolmaker simply stashes the money in US Treasury bonds, that contributes to the US trade deficit. But if the American factory uses that tool to make and sell$ 500, 000 worth of car parts, it has come out ahead — and America has come out ahead too.

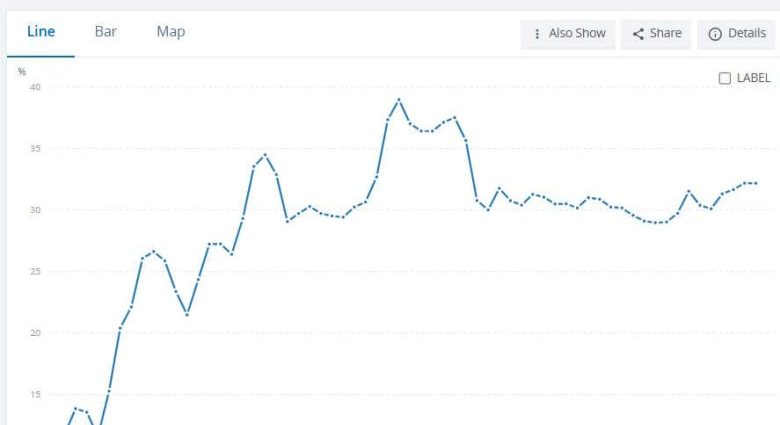

This is what South Korea did when it was rapidly industrializing. Around 1980 and then again in the early 1990s, South Korea ran a trade deficit:

This was a time when South Korea was investing a huge amount in its industrial economy:

As an aside, in the late 70s and early 80s, at the same time it was running a trade deficit, Korea was also ramping up , exports , — not just in dollar terms, but also as a percent of its GDP:

Remember that exports add to GDP, while imports don’t subtract from GDP. So even as South Korea ran a big , trade deficit, trade was  , adding more and more to South Korea’s GDP , each year. A MAGA guy will have a very hard time wrapping his head around that fact.

But anyway, South Korea’s trade deficits at that time were probably worth it, because importing capital goods ( machinery, etc. ) helped them industrialize more rapidly than if they had had to take the time to make all those capital goods themselves. They just bought the machines and immediately used them to make cars and TVs and other useful stuff, much of which they sold to the rest of the world at a profit.

In fact, the US does some of this as well. When we think of U. S. trade deficits, we usually think of , consumption goods  , — cheap Chinese TVs and such. But the US also , imports a decent amount of , capital goods, which American companies use to produce and sell things. The US , did even more of this in the 1990s, when we ran a trade deficit but also had an investment and export boom.

But be careful here:” Using a trade deficit for investment” doesn’t mean” The trade deficit is good”. If companies import a lot of capital goods but see a low return on the investment, it can be bad.

What if trade deficits are used for consumption? Is that good or bad?

Anyway, what about when you use trade deficits to buy consumption goods — those cheap Chinese TVs and Canadian-made cars and such? Consumption goods a majority of America’s trade deficit these days. Is , that , trade deficit good or bad?

In this case, we have to decide whether “buy now, pay later” is good or bad. Remember, a trade deficit is like buying something with a credit card. When America imports Chinese TVs and Canadian cars, and China and Canada get US Treasury bonds in exchange, it means that America now , owes China and Canada money.

At any time, China and Canada can choose to sell the bonds for dollars and use those dollars to buy US goods and services. If they eventually do this, then at that time, they’ll run , a trade deficit with the US.  , In that case, what basically happened is that the US , borrowed from China and Canada, and paid them back later.

This is just like if you buy a washing machine from Target with your credit card, then work to earn some salary, and then use your paycheck to pay off your credit card. Was this bad or good? It depends.

Maybe you could have just waited to get the washing machine until you had the cash in the bank. Or maybe it was worth it to you to get the washing machine now instead of waiting a few months, even though you had to pay a bit of interest on the credit card debt.

Buying consumer goods with debt can be a good financial decision or a bad financial decision. That’s basically what the US is doing when it runs a trade deficit with other countries.

It’s also worth mentioning that just like a credit card borrower, the US might never fully pay its foreign loans back. If the US experiences a burst of unexpectedly , high inflation, the US bonds that China and Canada hold will be devalued. 3 , That’s basically like a partial debt default. Or, if someday an irresponsible US leader comes along and defaults on the debt, China and Canada will see some of the value of their Treasury bonds evaporate into thin air.

So when the US runs a trade deficit with other countries, those other countries are taking a risk. They’re basically giving us a credit card that we can use to buy stuff that they make. There’s always the possibility that we might just declare bankruptcy and never pay them back.

So you could say that in a sense, countries that run trade deficits are more short-term focused, or less patient, than countries that run trade surpluses. Nations don’t really have motivations and personalities like that, but it’s not a terrible way to think about it.

Do trade deficits deindustrialize America?

The final question here is whether importing stuff from other countries causes America to make less stuff. Maybe if you buy some tomatoes with your credit card, it’ll mean you grow fewer tomatoes in your own garden as a result. And then when it comes time to pay back the credit card debt, you might have forgotten how to grow tomatoes. That’s basically what deindustrialization is. 4

Obviously, there are some cases where a trade deficit doesn’t cause deindustrialization. For example, in the case of South Korea in the 1980s and 1990s, we saw that trade deficits helped to , industrialize , the country and ramp up manufacturing. Something similar probably happened to the US in the 1990s.

But OK, we’re not talking about those historical cases, right? We’re talking about the trade deficits that the US has run in the last 25 years, mostly with China but also with a bunch of other countries. Those trade deficits were , mostly , America borrowing to consume, not to invest. The question is whether they resulted in America losing its manufacturing industries.

The answer, at least with regards to China, is “yes”. Autor et al. ( 2013 )  , famously find that “import competition ]from China ] explains one-quarter of the contemporaneous aggregate decline in US manufacturing employment]between 1990 and 2007 ]” . , Bloom et al. ( 2024 )  , find that Chinese import competition caused a big reallocation from manufacturing to service jobs on the West Coast and in big cities, but in the Midwest it mostly just caused wage declines and job losses. And , Acemoglu et al. ( 2014 )  , write:

In this paper, we explore the contribution of the swift rise of import competition from China to sluggish U. S. employment growth. We find that the increase in US imports from China, which accelerated after 2000, was  , a major force behind recent reductions in US manufacturing employment , and that, through input-output linkages and other general equilibrium effects, it appears to have significantly suppressed overall US job growth…Our central estimates suggest net job losses of 2.0 to 2.4 million stemming from the rise in import competition from China over the period 1999 to 2011. ]emphasis mine ]

You can just kind of eyeball this by looking at the raw data. Until 2001, when China joined the WTO and started exporting tons of cheap stuff to America, US manufacturing employment had held up pretty well over the years ( despite falling as a percentage of the total ). In the 2000s — the decade of the big Chinese import surge — it just fell off a cliff:

It’s worth noting that it wasn’t  , the trade deficit per se , that caused these job losses. Even if trade between the US and China had been balanced, Chinese import competition would probably have cost some US manufacturing workers their jobs, because A) some of the US exports would have been services instead of manufactured goods, and B) the US probably would have exported more capital-intensive goods, thus shifting away from the labor-intensive goods that China was good at making back in the 2000s.

But yes, the US trade deficit with China was huge, and caused significant deindustrialization. And the continued US trade deficit with China might be holding back US reindustrialization, both through import competition, and through China crowding US companies out of export markets.

So if you think manufacturing is important above and beyond its contribution to GDP ( as I do ), then the trade deficit with China is probably an important thing to address. But that doesn’t mean Trump’s tariffs are the right way to address it. I know that this is repeating stuff I’ve written in a lot of other posts, but this really bears repeating.

First of all, by making imported components more expensive, Trump’s tariffs are weakening US manufacturers — that’s why , auto workers , and , steelworkers , in the US are being laid off right now and why measures of manufacturing activity and sentiment are all , heading down. Second of all, Trump’s tariffs will ultimately reduce America ‘s , exports, not just its imports, both through exchange rate shifts, and through retaliation by other countries. That will hurt American manufacturing.

Tariffs on China might have been one part of a bigger strategy to improve America’s competitiveness in manufacturing. But broad tariffs on all of America’s trading partners, like the ones Trump just rolled out, are highly likely to accelerate America’s deindustrialization— even if they also reduce trade deficits. Ultimately, what’s important for the US isn’t to reduce imports — it’s to increase exports. Trump’s tariffs will only hurt that goal.

Notes

1 In practice, no one actually barters when they trade — no one actually trades books for washing machines. But when two countries have  , balanced trade, it means that they pay each other in currency that gets quickly used to buy some real good or service.

Ruimin gives you a washing machine, you swap some dollars to another Chinese guy for some yuan, you give the yuan to Ruimin, he uses the yuan to pay his doctor to treat his bad back, the doctor swaps the yuan for dollars, and then the doctor uses those dollars to buy 50 books from some other guy in America. That’s how balanced trade actually works.

2 It actually includes a few other things, but let’s keep it simple.

3 This is because the principal and interest on those bonds is specified in , US dollars, and inflation makes a US dollar worth much less in terms of real physical goods and services.

4 This could matter because A) you might need to grow your own tomatoes for a food fight, or B) forgetting how to grow your own tomatoes might make it harder to pay back your debt in the future. OK, so it’s not a great metaphor.

This article was first published on Noah Smith’s Noahpinion , Substack and is republished with kind permission. Become a Noahopinion , subscriber , here.