There may be surprises in store as a result of the Federal Reserve Board’s decision on May 7 to keep interest rates constant.

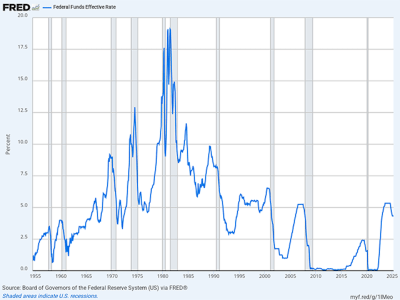

Later this year, the Fed is expected to cut its benchmark interest rate from the current 4.2 % to 4.5 %, according to market expectations. They might be correct.

However, breaks are not the only thing that might happen. The Fed may reduce rates, raise them, or keep them constant depending on what happens financially in the weeks ahead. The Fed’s announcement of the meeting’s agenda for May and Chair Jerome Powell’s remarks underscore how ambiguous the prospect has become.

The Fed would probably leave rates unchanged if the economy after this year appeared to be the same as it is now. The affirmation stated that” the unemployment rate has stabilized at a lower level” while “inflation continues to be moderately elevated.”

If the Fed is confident that inflation is falling below its target of 2 %, it may indeed cut rates. If at those meetings, it is noted that while the unemployment rate is rising, prices may remain increased.

But, those are great ifs. According to the Fed, there are rising challenges that both inflation and unemployment will get worse over the next few months. If that occurs, it might make the Fed have to choose between lowering charges and lowering prices.

According to Powell,” the new administration is putting together significant policy changes in four main areas: industry, immigration, governmental policy, and regulation.” The price increases announced so far have been considerably higher than anticipated. However, all of these plans are also evolving, and the economy’s effects are still largely undetermined.

President Donald Trump, who criticized Powell’s Fed for wanting rate cuts on Wednesday and calling him” Mr. Too Late,” is also criticizing Powell’s Fed. Don’t believe the Fed did succumb to the pressure, despite the mayor’s frequent threats to you Powell, which he may not have the lawful authority to do.

A central banks that appeared to be bowing down to political force would not only undermine its own independence, it would also be undermining its own. It may run the risk of financial businesses crying.

Trump wants the Fed to reduce a preemptive cut before the sector deflates. However, the Fed is unsure whether cutting may make sense because it is unsure whether inflation or unemployment may cause the biggest issue in the foreseeable future. Waiting, no acting, makes the most sense in its financial sense.

The Fed is also at a loss for both expansionary objectives and its own. According to history, changes to predicted inflation reason inflation if consumers and businesses believe prices will rise.

These expectations are nowadays” also anchored,” meaning Americans aren’t anticipating significant cost increases in the future. However, that might change rapidly if rates start to increase quickly. In 2021 and 2022, recollections of charged inflation persist. Expenses can quickly be unanchored.

The Fed won’t be able to accept the fact that tariff-driven rate increases are one-time,” temporary,” rises, as it incorrectly interpreted the supply-chain rate increases the nation experienced during the Covid illness. Powell is aware of how soon he actually raised rates that day.

According to Powell, “our responsibility is to stay longer-term inflation expectations also anchored and to stop a one-time increase in the price level from becoming an ongoing inflation problem.”

The Fed has been given a two mandate by Congress: maximum employment and steady prices. However, the story of economics suggests that central banks should prioritize maintaining steady prices. Without price stability, Powell said,” We cannot reach the long periods of strong labor market conditions that benefit all Americans.”

Farmers, farmers, and other company loans should be optimistic that the markets will turn around and that interest rates will remain low. The interest-rate view is actually becoming more and more questionable, which is consistent with the uncertainty in the economy.

Urban Lehner, a former long-time Asia journalist and director for the Wall Street Journal, is writer professor of DTN/The Progressive Farmer.

This post, which was originally published on May 8 by the latter news business and is now being republished by Asia Times with authority, is entitled: Copyright 2025 DTN/The Progressive Farmer. All trademarks are reserved. Follow , Urban Lehner , on , X @urbanize ,