In 2012, the American political scientist Graham T Allison argued that the US and China were on a collision course for war. Allison claimed that fear of China had led the US to fall into the “Thucydides trap.”

Allison was referring to the Greek historian Thucydides, who chronicled the war between Sparta and Athens. Thucydides famously said: “It was the rise of Athens and the fear that this instilled in Sparta that made war inevitable.”

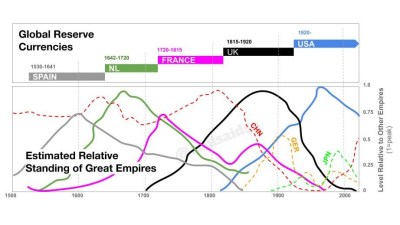

Allison based his somber prediction on a study of similar transitions in history. Of 16 cases of a rising power challenging a ruling power, 12 ended in war, among them the rise and fall of the Spanish, French, and British empires.

The Thucydides-trap theory is not without its critics. Columbia University’s Richard Hanania argues that the theory doesn’t apply to the rivalry between the US and China because China’s ambitions are limited mostly to dealing with domestic issues.

Other scholars, among them Arthur Waldron and Ian Buruma, have argued that China is still far too weak for such a conflict, pointing to China’s “economic vulnerabilities,” its aging population, and exodus of Chinese people out of China.

Encirclement

The latter opinion seems oddly out of touch with reality. The US makes no secret of the fact that it wants to contain China and slow its rise as a global power. It sanctioned Huawei, one of China’s most important companies, and is blocking Chinese access to its latest chip technology.

Moreover, the US has permanently stationed an armada of battleships in the South China Sea that is supported by US military bases in Japan, South Korea and the Philippines, all within striking distance of the Chinese mainland.

The US also maintains a military presence in Thailand and several countries in Central Asia bordering China, while the North Atlantic Treaty Organization has expanded eastward to several countries bordering Russia.

A look at the map explains why Russia and China have concluded that attempts to integrate Ukraine into NATO are the next step in an attempt to encircle China fully. Only the Russian Federation stands in the way of the Western alliance expanding its military footprint to the Chinese border.

Last year, the US openly stated its aim of bankrupting the Russian economy with “sanctions from hell,” and removing President Vladimir Putin from power, presumably with the aim of replacing him with a Yeltsin-like pro-Western leader.

Hardline anti-Russian groups in Washington that are influential in the American foreign-policy establishment would like to go a step further: create enough turmoil to lead to the disintegration of the Russian Federation.

We only have to look at the map of Russia to see the possible implications of a breakup of the Russian Federation.

From Kamchatka in the Far East to Dagastan in the Far West, we would see hodgepodge of governments ranging from theocracies to fascist dictatorships with scores to settle with neighboring countries.

Amid the ensuing chaos, NATO could expand eastward to Amur, Khabarovsk, and Primorsky (Vladivostok), all of them bordering China.

Conversely, the new states could be incorporated into the San Francisco System, the “Hub and Spokes” architecture of alliances that includes Japan, South Korea, Taiwan, the Philippines, Thailand, Australia and New Zealand.

De-dollarization

One can only wonder why it was assumed that Ukraine, one of the poorest and most corrupt countries in Europe, would be able to defeat Russia, unless the war was a pretext for imposing the “sanctions from hell” and destabilizing Russia.

Equally notable, the West completely misjudged the response to its confrontation with Russia in the rest of the world – the Global South, which is all too aware that the members of the anti-Russia coalition are virtually the same as the old colonial powers.

The bold decision to confiscate Russia’s US$300 billion reserves may have been a pivotal moment. It sent shockwaves through the global financial world. If the West can confiscate the assets of Russia, anyone could be next.

Not surprisingly, de-dollarization has become the buzzword in the non-Western world. China, which had more than a trillion dollars in US Treasuries at the beginning of last year, has been selling its US paper at a record pace.

Like China, many countries are using their dollar reserves to buy gold as a hedge against confiscation and inflation. Equally ominous, members of the Organization of the Petroleum Exporting Countries (OPEC) are talking to China about selling oil in yuan. This could undermine the petrodollar, the pillar of US global financial power.

Meanwhile, the BRICS countries are laying the foundation for a multipolar monetary system. The group is expected to announce a new international currency this year that could be backed by gold, oil, or a combination of commodities.

Follow the money

Nearly one year into the Ukraine conflict, the US is tacitly acknowledging that its strategy is failing. Last month, US Secretary of State Antony Blinken, in an interview with The Washington Post, admitted that expectations of a Ukraine victory were “not realistic.”

At the same time, the RAND Corporation, an influential Washington think-tank, published a report acknowledging that the war in Ukraine was not going according to plan and that the US had little to gain from prolonging the conflict.

The RAND article, “Avoiding a Long War,” admitted that a “neutral Ukraine” might be inevitable to end the conflict. The word “neutrality” occurs no fewer than 21 times in its study. A neutral Ukraine had been a key Russian demand from Day 1.

Historians will probably debate for years whether the US has fallen into the Thucydides trap. But there can be little doubt that the US government, in the way it is confronting China, has not acted in the best interest of the American people.

By spending its resources on military containment and using the dollar system as a weapon, the US hastened the process of de-dollarization.

The huge spike in gold purchases by central banks around the world in recent months suggests that a monetary reset is in the air. It would be a once-in-a-century transition.

History shows that each of the five previous reserve currencies lasted on average 100 years. The transition from one to another was typically a time of turbulence.

The dollar is right on cue. It replaced the British pound in the 1920s. In the 2020s it looks set to become part of a multipolar monetary system. As with earlier transitions, the monetary reset will (re) impose financial discipline on the world, at least for a while.

Graham Allison’s concern that the Thucydides trap will lead to war between the US and China is probably overblown. Accidents happen, but Sparta and Athens, and all the other nations that had to surrender their pre-eminence, did not possess nuclear weapons.

Western political leaders have shown themselves to be incompetent and self-absorbed, but they are not suicidal. They are unlikely to risk a nuclear war that could kill millions, including their own loved ones, and change the world as we know it.