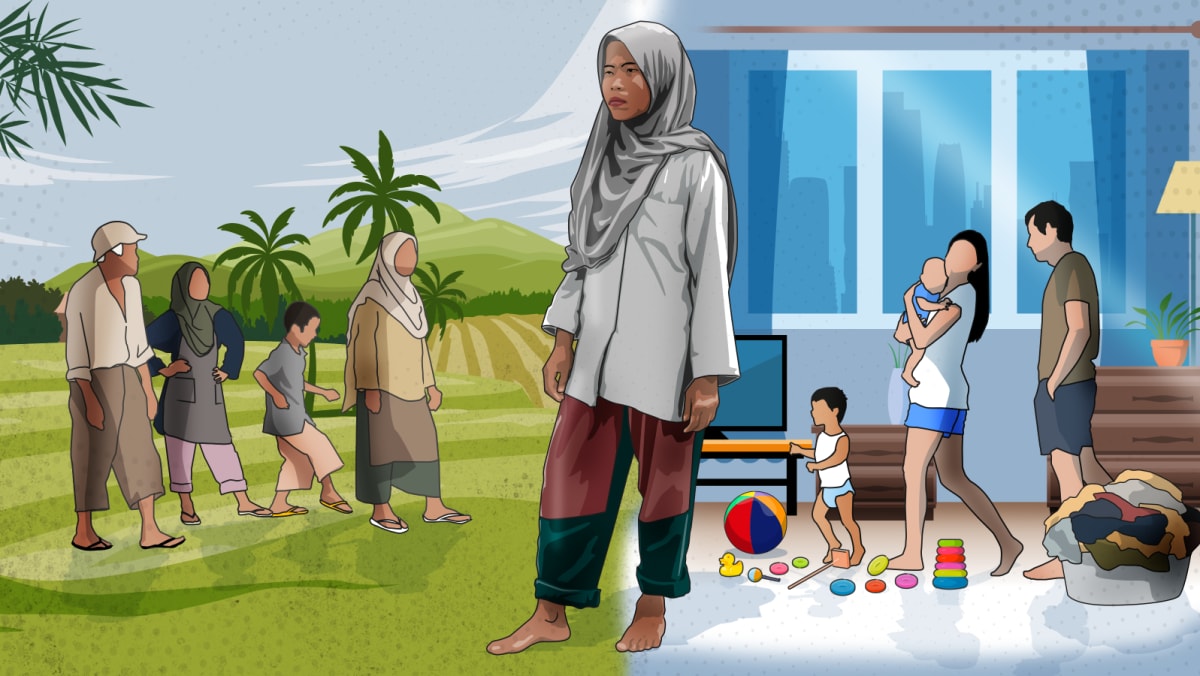

Far From Home: For Southeast Asia’s migrant workers, returning for good can be just as hard as leaving abroad

One evening, a companion reached out to Miranda, offering her to come to a revealing conference organised by a group of original immigrant workers.  ,

” Sharing my story with people who understand or have similar experience helped me cope with the problems I feel inside”, Miranda said, adding that ever since she has been attending related classes and workshops organised by the party: Sandigan.  ,

The group was founded in 2020, at the top of the pandemic, when the Philippines saw an influx of returning immigrant workers because they either lost their jobs or feared that they would not be able to return home as host countries began closing their territories.  ,

Also, support groups in Indonesia likewise began cropping off during the pandemic, particularly in areas with a big migrant worker people.  ,

” Some of these parties started as informal groups of friends and neighbours. Most disbanded after one or two classes but there are those which are still effective today”, said Wahyu Susilo, executive director of Indonesian-based non-profit company, Migrant Care.  ,  ,  ,

In Dadap- a town in the southern region of West Java where almost 80 per cent of its households have at least one member of the family who have worked abroad – for group began as an impromptu snack-making workshop again in 2020.  ,  ,

” A lot of people, get it returning immigrant workers or those who stay in Indonesia, fell on hard times during the epidemic because there were no employment both internationally or at home”, said Elly Kusumah, the representative of the island’s Migrant Workers ‘ Empowerment Group.  ,

” We have a lot of cassavas in our village, so why not try to turn them into cards? We have a lot of fruits, so why not change them into jam”?

As more original workers participated in the program, they began interacting more strongly with each other. Elly noted that many were facing problems readjusting to living in Indonesia. Although Elly was not a migrant employee herself, she sympathised with their sufferings.  ,

” Some felt they were ridiculed by community members because they now speak with a Malaysian voice and sounded like Upin Ipin”, she said, referring to a Malaysian film project common in both Malaysia and Indonesia.  ,

” Another shared about struggling to communicate with their children after being absent for so long. The difficulties varied”.

.jpg)