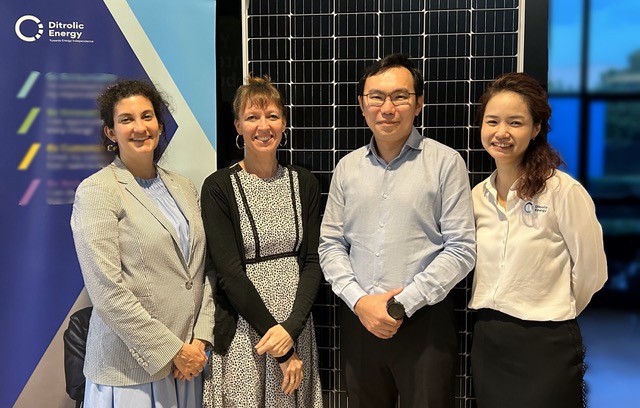

Ditrolic Energy secures investment backing from BlackRockâs climate finance partnership

Partnership expected to develop and build 1GW+ scalable solar portfolio

Intends to make Malaysia its investment hub for key energy transition projects around the Asia Pacific region

Ditrolic Energy Holdings Sdn. Bhd. (Ditrolic Energy) has entered into an agreement with global asset management company BlackRock’s Climate Finance Partnership (CFP), its flagship public-private finance…Continue Reading