Scams top list of cybercrimes in past year

PUBLISHED : 31 Dec 2023 at 04:44

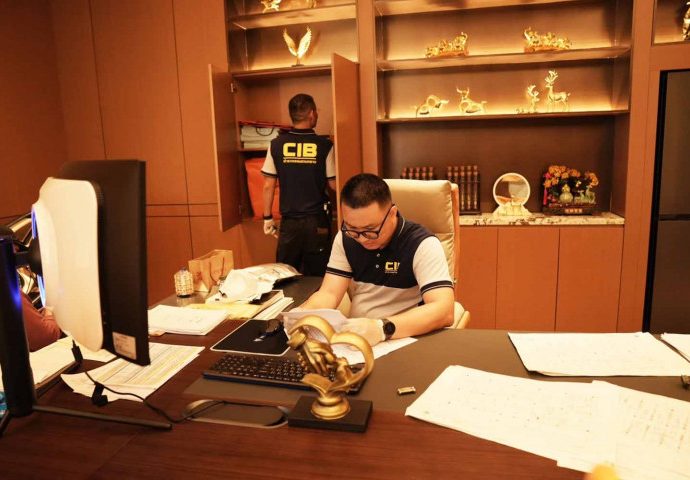

The Central Investigation Bureau (CIB) has highlighted five types of cybercrimes running rampant in the past year, and is warning people to avoid being tricked online.

The first involves call centre scammers, who they say are always coming up with new tactics to deceive people.

Some impersonate state officials who use dubious phone numbers to threaten victims. Some also send SMS with a link to trick victims into giving access to their bank accounts, according to the CIB.

Another involves online shopping scammers who set up bogus retail websites to rip off victims. Some ask shoppers to transfer money online for goods they will never receive. In some cases, the goods shoppers do receive are fake or of low quality and are not what is advertised, according to the CIB.

Another type of scam involves a “hybrid method” where victims are lured into a relationship with a scammer before being asked to invest their money into a false investment scheme. Victims are often left defrauded, the CIB said.

Romance scammers create fake profiles on dating websites to lure victims or use social media to contact them. The scammers strike up relationships with victims to gain their trust before making up stories and asking for money.

There are also job offer scams targeting people seeking employment. Often, victims are deceived into giving money and revealing personal information. Some scammers tout high-paying jobs but ask victims to pay up-front fees. Victims are promised high-paying jobs abroad but they must first pay expensive fees. However, they are never sent abroad as promised, the CIB said.

From March 1, last year to Dec 20, over 314,000 complaints were filed with the police. Of them, 160,819 involved shopping scams, 50,536 involved job scams, 43,193 involved loan scams, 32,501 involved investment scams and 27,620 involved call centre scams.