Malaysia’s RHB sets sights on Net Zero by 2050

- Mobilised RM23. 8b in green financial services by the end of FY2023

- 3-pronged approach with clear goals to interpret commitment into action

By releasing a detailed plan to achieve net-zero emissions by 2050, the RHB Banking Group ( RHB) has charted a course for a future that is environmentally friendly. RHB is strengthening its commitment to the environment by developing a new Pillar 2 called” Committed to Achieving Net Zero by 2050″ using its 5-Year Sustainability Strategy and Roadmap ( 2022-2026 ).

This wall expands on the Group’s already-discussed climate strategy by highlighting the group’s main goals for reducing emissions, promoting growth for alternative financial services and supporting businesses committed to graphite neutrality, and integrating green and low-carbon practices into its own operations.

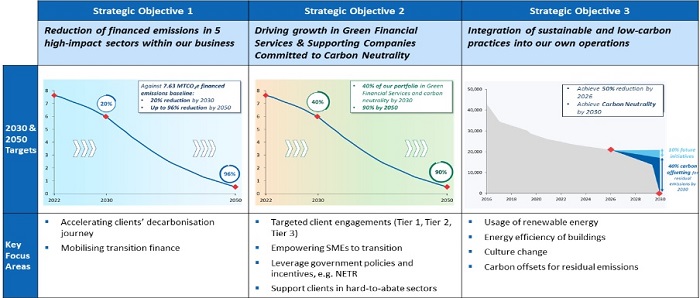

The Group’s pledge to eliminate all carbon emissions acknowledges that the monetary market is a vital component in directing funding toward low-carbon and green activities, and it is in line with Malaysia’s goal of achieving net-zero emissions by 2050. It has developed a three-pronged approach with clear-cut goals to put this commitment into practice.

In its company, RHB aims to reduce financed pollution in five high-impact areas under Strategic Objective 1. These high-impact industries- electricity supply, palm petrol, oil & oil, house & building, and vehicles- represent roughly 60 % of the Group’s economic exposure and over 80 % of financed emissions. By 2030, RHB aims to achieve a 20 % reduction in these sectors, and up to 96 % reduction in financed emissions across these sectors by 2050.

In order to support businesses that are committed to carbon neutrality, the strategic objective 2 is to promote growth in green financial services. By 2030, it aims to have 40 % of the group’s portfolio in Green Financial Services, with a firm commitment to supporting businesses that are committed to carbon neutrality, with a clear and established transition strategy, with a target percentage that will rise to 90 % by 2050.

Strategic Objective 3 aims to integrate sustainable and low-carbon practices into RHB’s own operations. It claims to have achieved a 43 % reduction in operational GHG emissions against a 2016 baseline, encompassing Scopes 1, 2, and 3 ( Business Travel by Road and Air ). By 2030, the Group intends to use internal initiatives and carbon offsets to achieve carbon neutral operations and a 45 % reduction in operational GHG emissions.

“Demonstrating our commitment to sustainability, we have cumulatively mobilised RM23. By the end of FY2023, we would have raised$ 8 billion in sustainable financial services, exceeding our initial goal of$ 20 billion by 2026. Of this, RM11. To help us reach Net Zero by 2050, we allocated$ 3 billion to green initiatives, including renewable energy projects and energy efficiency solutions. Considering our strong achievements to date, we have increased our target to RM50 billion by 2026, ” said Mohd Rashid Mohamad, Group MD/Group CEO of RHB Banking Group.

The bank acknowledges its Net Zero pathway is a commitment to the communities it serves, the environment, and the future, ensuring progress happens for everyone.

It does, however, acknowledge that the journey to becoming Net Zero cannot be done in isolation and promises to continue to work with clients, business partners, employees, and the general public to begin its journey together.

“We shall also collaborate with governmental bodies, regulatory authorities and other parties to have a scalable impact while also being advised on the progress and development of government policies, directives, and incentives in order to fulfill our Net Zero 2050 Commitment, ” Mohd Rashid continued.