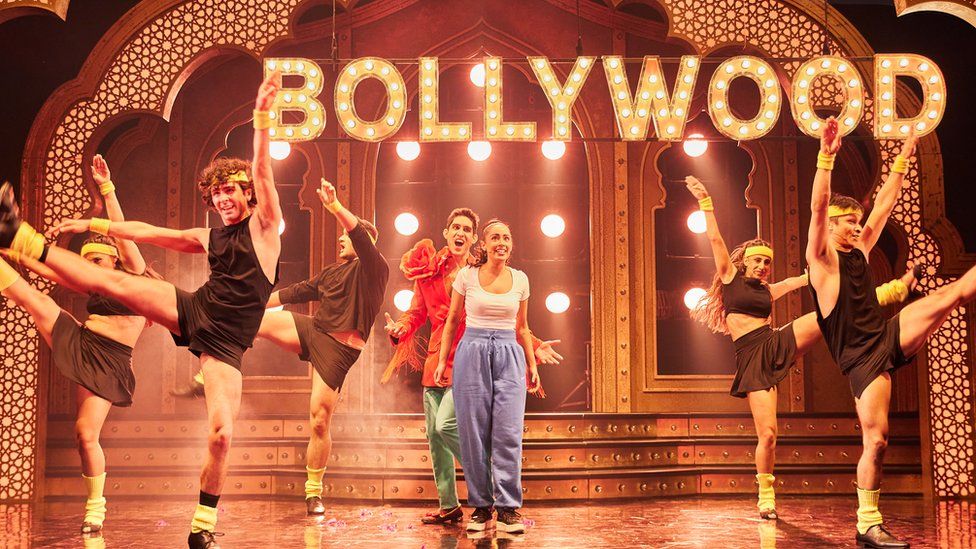

Dance videos of Modi, rival turn up AI heat in India election

Deepfakes and artificial intelligence are increasingly being used in votes around the world, including in the United States, Pakistan, and Indonesia. The most recent video distribution in India highlights the difficulties faced by government. An American IT department screen has been in place for years to restrict access to contentContinue Reading