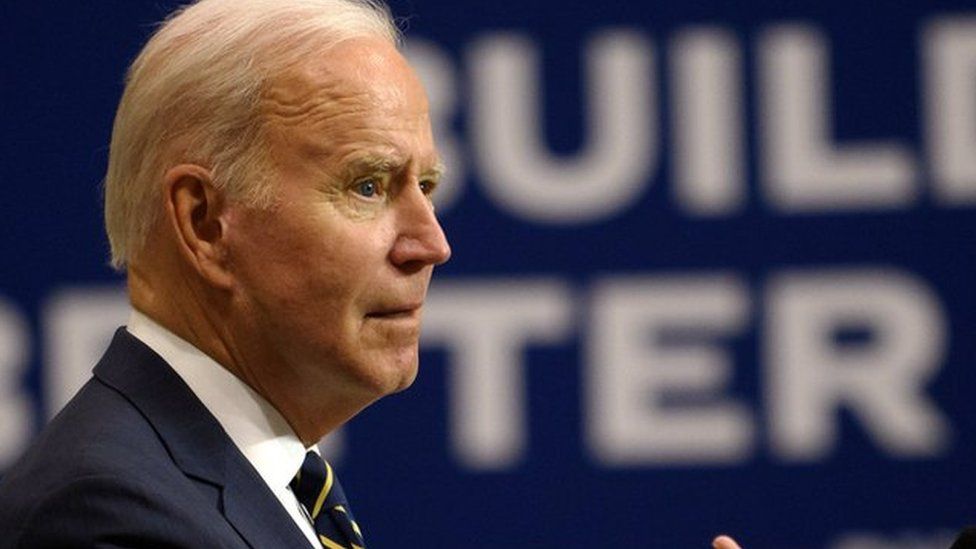

American President Joe Biden is imposing more stringent tariffs on imported metal, solar panels, electric vehicles, and other products.

The actions, which include a 100 % border taxes on Chinese energy vehicles, were intended to protect US work, according to the White House.

China has previously criticised the ideas, which were signalled in progress.

According to analysts, the tariffs were mostly symbolic and designed to bolster voter sentiment during a difficult election time.

They come in response to former president Donald Trump’s condemnation of Mr. Biden’s campaign for president, who has argued that his opponent’s assistance for electric vehicles would “kill” the US auto industry.

On Tuesday, Mr. Biden pledged to stop China from “unfairly controlling the market” for chargers, computer chips, and basic medical supplies for electric cars.

” If the pandemic taught us everything- we need , to have a stable supply , of essentials , around at home”, he said.

According to the White House, the taxes that were announced on Tuesday will impact exports worth an estimated$ 18 billion.

As well as a rise from 25 % to 100 % on electric vehicle tariffs, levies on solar cells will increase from 25 % to 50 %.

The tariff rate increase for some steel and aluminum products will increase from 7.5 % or less to 25 %.

Under Mr. Trump, the measures expand extensive borders fees that the US imposed on Chinese goods, citing unfair trade practices.

During the Biden administration’s assessment of the steps, the government received virtually 1, 500 remarks, the vast majority of them from business owners arguing that they were driving up prices for daily Americans, and asking them to be removed.

Yet as frequent US inflation has had an impact on his approval ratings, Mr. Biden’s decision to leave the tariffs in place and start expanding them into new areas is a testament to the dramatic change in industry views for both of the US’s long-held interests in terms of global business.

Former US business national Wendy Cutler, who is now vice chairman of the Asia Society Policy Institute, claimed that Americans were willing to accept more expensive cars in exchange for helping to protect US businesses and work.

” We’ve seen this movie before- with renewable, with steel and]aluminium], and when it comes to cars and other items the United States needs to getting ahead of the curve”, she said.

” It’s all about trade-offs, and we might see cars getting more expensive in the near future, but we want to have a competitive industry here in the long run.”

White House officials denied that the selection had been influenced by local politics during a press briefing.

They claimed that Beijing had not shown any signs of abstaining from US-friendly practices, including regulations requiring European businesses to share information in order to steal it and subsidies that have made it possible for businesses to pump out goods far beyond anticipated need.

” They’re flooding the market”, Mr Biden said. ” It’s never competing- it’s cheating”.

In contrast to how the taxes were handled by Mr. Trump, the White House claimed that they were targeted and did not anticipate that prices would result.

The former chairman, who previously called himself a “tariff man”, has campaigned on a proposed across- the- table 10 % tax on international goods, which may jump to 60 % for goods from China.

He has also criticised Mr. Biden for supporting electric vehicles, which he claims will devastate US car manufacturers and important employers in states like Michigan, which will be crucial for November election debates.

Both candidates “going down the same path” of higher trade barriers and “looking inside” rather than “examining what we can do on the plan before that would really make our sectors more aggressive,” according to Erica York, senior analyst at the Tax Foundation.

She referred to the administration’s “promotion of the tariffs as strategic” as an “euphemism for protection for sectors that are politically significant for this administration.”

Instead of choosing what makes the most sense economically or what is least expensive for US consumers, “it comes down to a political economy calculus.”

Sales of electric vehicles made in China are already at a record low due to the US’s already high tariffs on them.

However, Washington has been closely watching as Chinese companies ‘ sales in Europe and other nations rise.

According to White House officials, making the transition successful and long-lasting in the long run required making sure that green technologies were n’t dominated by one nation.

The business world is waiting to see if similar steps will be taken in Europe, according to Natasha Ebtehadj of Artemis Investment Management, despite the fact that moves aimed at electric vehicles are likely to have few real-world applications.

New tariffs- at a glance

-

semiconductors- from 25 % to 50 % by 2025

-

certain steel and aluminium products- from 7.5 % to 25 % in 2024

-

electric vehicles- from 25 % to 100 % in 2024

-

lithium batteries and critical minerals- from 7.5 % to 25 % in 2024

-

solar cells- from 25 % to 50 % in 2024

-

ship to shore cranes- from 0 % to 25 % in 2024

-

rubber medical and surgical gloves- from 7.5 % to 25 % in 2026

Other than a risk of stifling their adoption, the European Union and the UK are also discussing ways to reduce imports of Chinese-made electric cars.

In the run-up to an election when both candidates are not actually pro-China, she said,” It’s not really a surprise to investors or to Chinese companies.”

It’s possible that more interesting will be what happens in Europe given the relatively small volume of imports to the US.

Since Mr. Trump imposed tariffs on roughly two thirds of Chinese imports in 2018, which was estimated to have cost the US$ 360 billion.

Beijing responded with retaliation after the measures, which reached a détente in early 2020 when Mr. Trump lowered some tariff rates while China made a pledge to increase its purchases from the US.

The tariffs have since resulted in more than$ 200 billion in new border taxes for the US government, which has resulted in a significant change in global trade patterns.

American citizens have paid more for furniture, footwear, and other items in the form of higher prices.

However, in a research note, Oxford Economics described the latest plans as “more symbolic bark than bite”.

The company called the result a “rounding error” and predicted that inflation would likely rise by a negligible 0.01 percentage point while weighing growth similarly.

World Business Report radio contributed reporting