In Trump we do not trust – Asia Times

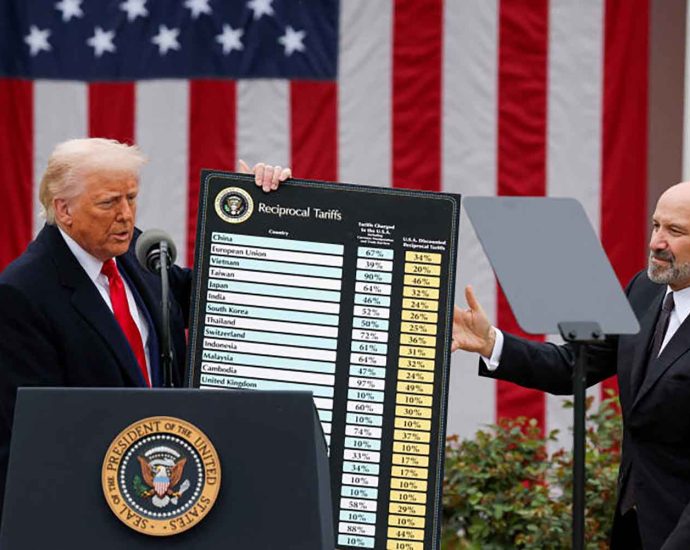

We must then add a monetary problems, one capable of making the others little, much worse, to a political crisis and an economic crisis. President Donald Trump abruptly retreated from his tariff policy to the worst version, a retreat that any ordinary leader would have found humiliating. This was because he and his Wall Street supporters realized that by midweek US economic markets were on the verge of disaster, a disaster that could rival or even surpass the 2007-08 crash.

Trump was persuaded to move back a few feet from the rock’s border to which he had taken America and the world, but that threat has been for the time being. However, the mountain is still standing and is still standing. Trump’s business war has caused a loss of faith in US government bill, but that is where the biggest danger lies.

The lira sovereign debt crisis of 2010 appears to be much more recent. US Treasury securities have been viewed as the safest of all economic assets, just like German government bonds were back then by the most reliable of governments. Interest has turned to the now shattered believe as a result.

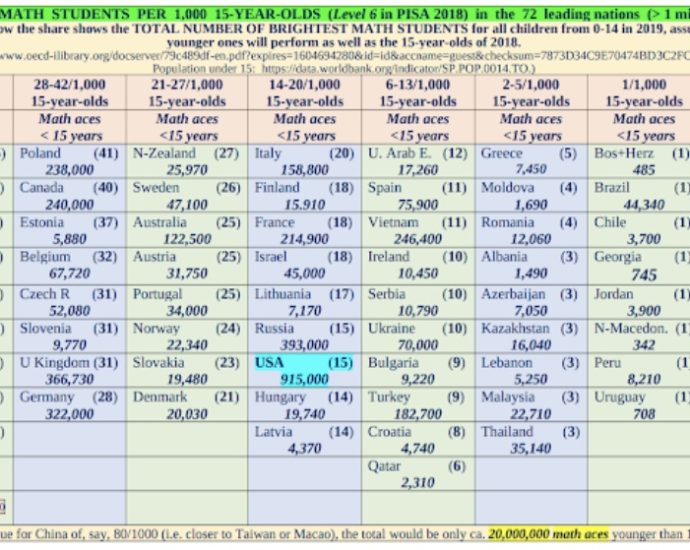

- to America’s$ 36 trillion common loan, which is four times as large as Japan’s loan and is 12 times as large as Italy’s.

- to how a good recession would affect that debt,

- to the resulting increase in interest expenses, and

- to whether the Trump presidency might use the US dollar and public debt as negotiations leverage.

Additionally, the fact that Trump has already declared a total siege against imports from China by imposing a 135 percent price may increase the chances that China may dump its US Treasuries in answer, even if it would suffer a significant reduction in doing so. China is one of the largest foreign holders of US Treasuries. The$ 759 billion of US Treasuries it held at the end of 2024 represent an obvious weapon since Beijing has stated it is willing to fight the trade war” to the end.”

Trade taxes are bad enough, but this economic collapse poses a serious threat to consumers. Businesses are incredibly dependent on the endurance and great belief of the counterparties with whom business is conducted, many of whom have looked powerful because of their holdings of US Treasuries. When healthy assets begin to appear illegal, all financial institution risk factors start to change, and one’s financing costs start to rise.

A similar trend may be occurring in America today, just as the decline of the Lehman Brothers investment bank in 2008 led to a number of other crises. The US Federal Reserve Board can still be relied upon to help the financial structure by purchasing Treasuries, just as the European Central Bank did by promising to get German bill after 2010; however, the country’s chaotic state makes it impossible to rely on the US Treasury and White House in the same way.

Several fundamental information about Trump must be kept in mind. He has filed for bankruptcy four days to mistake on his debt as a business. He is a globe expert at using energy for self-advancement and knowing everything about international trade and finance.

Sad to say, he is capable of deciding that forcing a renewal of its debts would be wise for America and of overriding experts who might have been averse to do so.

This leaves America and the rest of the world dealing with three difficult realities: one about trade, one about confidence and uncertainty, and one about how the countries ‘ current relationships are becoming at least as significant as their interactions with the world’s most powerful nation, the United States.

Trump’s tax surrender has essentially changed the label for his trade policy from “disastrous” to “hugely damaging.” The imports tax of 10 %, which will now be applied to virtually all nations but China, is also three times as high as it was when he took office, and the additional tariffs he has placed on steel, aluminum, and cars also indicate that the general barrier he is putting in place is higher than America has been for a century.

The doubt that the plan is creating is also devastating. No big business, whether domestic or international, can easily plan long-term investments in the United States with the understanding that Trump might have major changes at any time.

Just weeks after declaring that the 90-day “pause” did not reduce tariffs on Chinese goods, he abruptly announced that all exports of phones and other electronic items would gain from the delay, before confirming that this digital deduction would only be for a short period of time. 80 % of Apple’s smartphones are built in China. Nobody is aware of their position.

The deterioration of the rule of law through attacks on courts and big law firms also raises the risk of conducting business in America. Trump may believe that his trade legislation will encourage hordes of businesses to set up factories inside his tax walls, but the doubt and lack of trust are actually causing a lot of people to leave.

The rest of the world is becoming distant from America, who was once a powerful ally and significant business for everyone, both politically and economically. An separation is not always permanent, as in a relationship, but it fundamentally alters behavior and leaves behind long-term harm.

Second fact: This alienation must be resolved by developing new associations with others. Countries must look for ways to establish and maintain international organizations without the influence of America.

Because trade blocs like the European Union, Mercosur in Latin America, and the Trans-Pacific Partnership in Asia now exist and you bargain collectively, that is fairly simple. China won’t get a full participant of those groups, but discussions with it will be simpler than they currently are with Trump’s United States, because typical interests will be simpler to get.

Because the US dollar will be the world’s major reserve currency and the importance of British banks may be difficult and costly to tremble off, the task is more difficult and takes longer. Making sure our personal financial institutions are strong enough to survive a problems is what must be the first task. Countries will need to consider ways to reduce their dependence on the US dollars and reduce their risk of being exposed to American economic bullying over the long term.

Prior to the US’s restrictions, countries like China, Russia, and Iran felt threatened about this. We are certainly in a completely new world.

Bill Emmott, who was previously The Economist’s editor-in-chief, is already president of the , Japan Society of the UK, the , International Institute for Strategic Studies, and the , International Trade Institute.

This post, which was previously published in La Stampa in Italy on April 12, has been republished with kind agreement.