Chinese dragon elegantly twirled around American eagle’s neck – Asia Times

There is an image that likely increasingly haunts the minds of US strategists: a Chinese dragon, no longer just coiled in defense but elegantly entwined around the neck of the American bald eagle. Not to suffocate but rather to regulate the bird’s breath.

The symbolism is not hyperbole. It captures a world where China, long caricatured as the imitator, has now morphed into a systemic rival, outrunning and outgunning the United States in critical business and security sectors.

From technology to trade, currency to cyber power, the Chinese state has mastered the long game.

As Graham Allison warned in “Destined for War”, the Thucydides Trap is not only about the inevitability of conflict between rising and ruling powers. It’s also about the erosion of assumptions that the West has long taken for granted—namely, that liberal democracies will always innovate faster and govern better.

That assumption is collapsing under China’s weight. Let us now turn to the strategic sectors where China has not just caught up, but, in many instances, sprinted ahead.

1. Semiconductors: from dependency to near parity

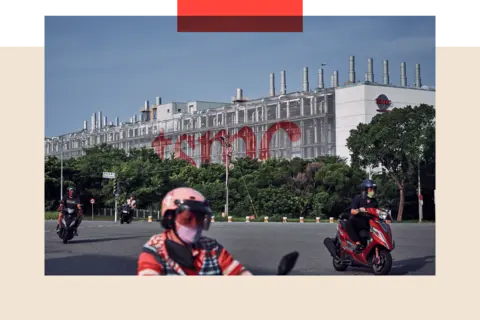

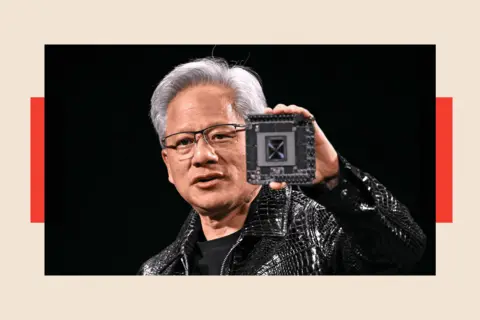

Semiconductors, once China’s key vulnerability, are now the arena of its most dramatic gains. Despite Washington’s embargoes on Huawei and export bans on advanced lithography equipment, Beijing has poured over 1.5 trillion yuan into its domestic chip ecosystem.

China’s 14nm chips are now being produced domestically at scale, and according to Dr Dan Wang of Gavekal Dragonomics, an economic consultancy, “China is only a node or two behind global leaders, and catching up fast.”

This acceleration is powered by “dual circulation”—a policy that embeds state subsidies across the entire supply chain, from rare earth mining to chip design.

In contrast, the US remains fragmented. The CHIPS and Science Act is slow-moving and could be scrapped while American fabs are still dangerously dependent on geopolitical choke points like Taiwan.

And it’s not clear that forcing Taiwan to build fabs in the US will even remotely work due to a lack of skilled labor and relevant supply chains.

2. Electric vehicles: Tesla in the rearview mirror

China’s BYD, not Tesla, is now the world’s top EV manufacturer. In 2023, it overtook Tesla in global sales and its footprint now spans Latin America, Europe and Southeast Asia.

Why? Because China owns the supply chain. From lithium in Bolivia to cobalt in the Congo, Chinese firms like CATL dominate the upstream. They also control over 75% of global lithium battery production.

As Professor Tu Xinquan of the China Institute for WTO Studies notes, “Beijing treats EVs as the next strategic industry, not just a consumer product.” The result? China is setting the global terms for green mobility.

3. Artificial intelligence: authoritarian efficiency at scale

While Silicon Valley battles over ethics and data privacy, Chinese AI firms race ahead by leveraging the scale of their digital ecosystems.

With 1.4 billion citizens contributing to vast data pools, firms like SenseTime and iFlytek are training machine learning models at a rate unimaginable in the US.

Stanford’s AI Index 2024 noted that “China now publishes more peer-reviewed AI papers than the US and the EU combined.”

More importantly, the integration of AI into national surveillance systems—facial recognition, behavioral analytics and even predictive policing—is an institutional advantage in authoritarian governance.

4. Space & hypersonics: leaping over the Pentagon’s horizon

In 2021, China tested a hypersonic glide vehicle that stunned Pentagon officials. It circled the globe before hitting its target—a demonstration of capabilities that America did not anticipate and does not have.

Today, China launches more satellites than any other country, and its Tiangong space station functions independently of NASA.

This is not just about prestige. It’s about owning low-Earth orbit (LEO) infrastructure and building an integrated command architecture.

According to James Acton of the Carnegie Endowment, “China’s civil-military fusion in space tech gives it a decisive asymmetry—the ability to repurpose civilian launches into military capacity overnight.”

5. Quantum computing and cyber sovereignty

China’s quantum leap is not metaphorical. It has already built a city-level quantum communication network in Hefei and launched the Micius satellite to demonstrate secure quantum encryption.

While the US still grapples with theoretical breakthroughs, China is operationalizing quantum networks—one step closer to unhackable communication.

Simultaneously, China’s cyber units under the PLA Strategic Support Force have matured into a formidable force.

As cybersecurity expert Adam Segal warns, “Unlike the US, where cyber operations must go through inter-agency review, China’s centralized command is more agile, more ruthless and more strategic.”

6. Infrastructure diplomacy: steel, fiber and sovereignty

The Belt and Road Initiative (BRI) was once dismissed as “debt-trap” diplomacy. Yet in 2025, it has morphed into a network of real-world influence.

Over 70 ports, 150 countries, and countless rail links are now locked into Chinese logistics systems. Malaysia’s ECRL and industrial parks under the “Two Countries, Twin Parks” initiative are cases in point.

In contrast, America’s Build Back Better World (B3W) never took off due to a lack of institutional backbone and material delivery.

7. Financial innovation: dollar dependency, yuan strategy

Though the dollar still dominates, China’s Cross-Border Interbank Payment System (CIPS) now clears over US$400 billion in yuan-denominated transactions annually.

As Professor Eswar Prasad of Cornell observes, “CIPS, when coupled with the digital yuan, offers China a way to de-dollarize bilateral trade without directly challenging the dollar’s global reserve status.”

Even in ASEAN, Indonesia and Malaysia have signed local currency settlement agreements with Beijing. The implications are serious: the US no longer controls the plumbing of international finance unilaterally.

8. Pharmaceuticals and public health diplomacy

Sinopharm and Sinovac may have drawn Western skepticism during Covid-19, but they reached over 80 countries. China became the pharmacy of the Global South, capturing new health markets.

Meanwhile, China controls up to 70% of active pharmaceutical ingredient (API) exports—vital for antibiotic and chronic disease drugs. Even the US Food and Drug Administration has flagged this as a national security risk.

9. Maritime dominance: steel leviathans in Asian waters

The People’s Liberation Army Navy (PLAN) is now the largest navy in terms of number of vessels, with China launching new destroyers, frigates and carriers at an unmatched pace.

According to the International Institute for Strategic Studies (IISS), China’s naval shipbuilding capacity exceeds the US by a ratio of 3:1 annually.

This has strategic consequences: with militarized reefs and carrier-killer missiles, Beijing is remaking the Indo-Pacific naval order—challenging the US Seventh Fleet’s dominance.

Conclusion: The end of complacency, the beginning of multipolar discipline

The Chinese dragon did not roar its way to supremacy. It studied the American system—its think tanks, capital markets, academic networks and defense-industrial base—and replicated a version of it with Chinese characteristics: centralized, agile, state-backed and global.

This is no longer a contest of ideologies. It is a contest of capacities.

For Malaysia and ASEAN, the time for strategic hedging has reached its limit. As Professor Lee Jones warns, “Neutrality in a bifurcating world must be underwritten by genuine resilience—economic, technological and political.”

China’s dragon does not need to strangle the eagle. It merely needs to squeeze at the right moments. And in that tightening grip lies the uncomfortable truth of 21st-century power: it is no longer about who dominates, but who endures.

Phar Kim Beng, PhD, is professor of ASEAN studies at the International Islamic University Malaysia. His analyses have been published across Asia and Europe, with a focus on strategic diplomacy, interdependence and power asymmetries.