Why the ‘Trump trade’ has Asia in a panic – Asia Times

TOKYO — Suffice to say, 2024 has n’t turned out the way Japanese Prime Minister Fumio Kishida expected.

Rather than being a superstar in Asia, Japan’s economy is skirting crisis. The , Bank of Japan , still has n’t hiked interest rates, though Tokyo had fully expected a tightening move or two by now.

Instead of coasting to win in September’s Liberal Democratic Party vote, Kishida’s approval rating is stuck in the small 20s. China, which suffers from a deflation, is more of a development drag on Asia than it does a growth engine.

The biggest punch to Kishida’s belief that he knew anything about 2024 is that he is coming from Washington.

Joe Biden’s devastating political discussion with Donald Trump on June 27 was the first. Therefore, Biden’s decision not to work for re-election, leaving Tokyo to know which of its officials may have  , Kamala Harris‘s telephone number.

As the chances of a Trump-friendly White House rise and drew nearer to the Northern Asian economic perspective, China, South Korea, and Taiwan also face political whims.

In Beijing, Xi Jinping’s government abruptly sees the risk of 60 % across-the-board taxes as a clear and present danger as Trump’s political prospects rise to once-unthinkable rates.

The People’s Bank of China announced a surprise rate cut on Thursday ( July 25 ) amid concerns about slowing growth. The PBOC cut the medium-term lending facility , by 20 basis points to 2.3 %.

As Trump attempts to restart trade wars, President Yoon Suk-yeol’s troubled administration in Seoul is immediately playing out losses. Additionally, North Korean authorities may develop emergency plans for Trump to deepen his crazy relationship with Kim Jong Un’s violent regime.

Taiwan, however, senses a , great bullseye , on its market. Lately, Trump accused Taipei of stealing America’s market share in the US$ 500 billion business of making computer chips. In a Bloomberg interview,  , the Republican candidate , said Taiwan snatched “almost 100 %” of the business. ” We should have never permit that happen”, Trump complained.

Wedbush Securities researcher Dan Ives says that” we have seen a terrible software sell-off post Trump responses to the press.” about enforcing stronger Chinese taxes and protecting Taiwan from China, which caused the Street’s Ban on Semis, AI Revolution labels, and Big Tech.

For today, though, authorities in Tokyo are perhaps the most befuddled about what might lie ahead.

Before then, the ghost of a Trump 2.0 White House had n’t been taken too seriously by , Tokyo government. Today, the situation has Japan’s state scrambling to examine the many risks this would cause — starting with Asia’s second-biggest business.

” Japan’s economy is in for a big ‘ Trump shock ‘ if Donald Trump returns to the White House”, says economist Richard , Katz, author of ,” The Contest for Japan’s Economic Future”  , and the Japan Economy Watch newsletter.

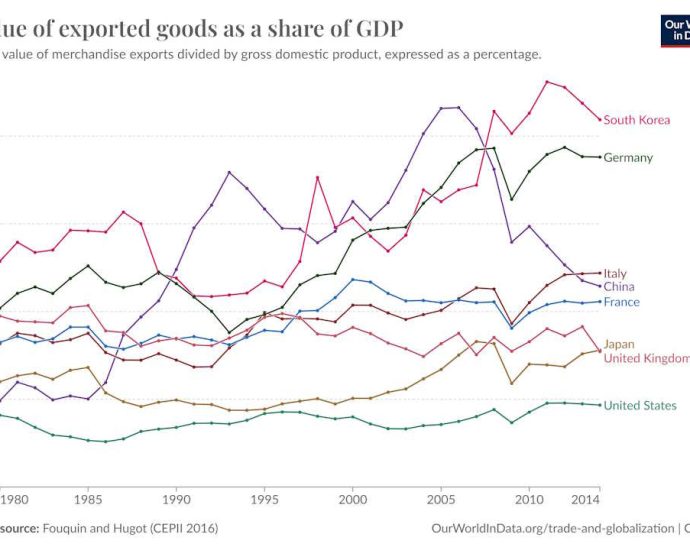

His plan to impose an all-inclusive 10 % tax on all imports and 60 % on imports from China will seriously affect both the delicate global supply chains and the need for Japanese exports, Katz claims.

Katz warns that Trump’s inflationary plans, including more significant tax cuts and tariffs, will force the Fed to raise interest rates beyond what the Reserve currently intends. That, in turn, will put upward pressure on the renminbi”.

These challenges, and other uncertainties, are now complicating the Bank of Japan’s selection at next year ‘s , July 30-31 , plan meeting. Anticipation that Governor Kazuo Ueda’s crew might raise interest rates may actually be overstated.

Now, Ueda confronts conflicting financial currents. On the one hand, the secret market is displaying encouraging signs of recovery, as demonstrated by the rise in the Jibun Bank Flash Japan Composite getting professionals index to 52.6 in July. It marked the fifth straight month of development.

Nevertheless, BOJ representatives notice a decline in consumer spending at a time when the market is only just starting to expand. Tightening today might even end , Japan’s best inventory rally , in more than 35 times.

This last tidbit explains why BlackRock Inc. is so confident that the BOJ wo n’t act next week. ” We expect an flexible environment to remain in Japan”, Yuichi Chiguchi, chief investment strategist at the Japan component of the country’s biggest asset manager, tells Bloomberg.

Another danger: a skyrocketing change level may unsettle global investors as the so-called “yen-carry business” goes awry. Immediately, investors who borrow cheaply in the yen could sell their positions in high-yielding assets all over, including those in Seoul and Shanghai.

Forex traders ‘ opinions about the BOJ meet next week are much more divided than usual. According to Charu Chanana, head of FX approach at Saxo Capital Markets, “potentially squeezing the yen small posts is a popular approach over the last few times.”

According to Chanana, Fed easing bets coincide with “expected that the Bank of Japan may increase rates further at the July meeting.” This potential change in yield differentials favors the yen.

Takeshi Yamaguchi, an economist at Morgan Stanley MUFG Securities, states that” we believe the economic case for a July rate increase is compelling because more data points to a rise in the underlying inflation trend.”

Meanwhile, Kishida’s political fate is getting renewed attention in the days since Biden bowed out of the election.

Within his party, Kishida is under pressure to “pull a Biden” so that the LDP can find a more dynamic successor. A new prime minister is needed, according to party powerbrokers who believe the country’s fragile economy and a string of finance scandals.

Biden’s political recusal robbed Kishida of a top selling point: a strong relationship with the , US leader. Kishida also gained points from trilateral summits with Yoon and Biden as well as his closeness to Biden.

This sort of detente with Seoul disapproves Xi’s Communist Party, which fears that the US, Japan, and South Korea are constructing a democratic bulwark against China. even occasionally involving Philippine President Ferdinand Marcos Jr.

Biden’s exit complicates Kishida’s way forward. In much of his 33 months in office, Kishida struggled to get his support rates into the 30s, never mind the 20s they’re stuck in now. Even though Japan’s opposition parties are in disarray, the LDP may opt for a new face before September.

Should Trump return, Japan is not without leverage. For one thing, Kishida initiated a big jump in defense spending, heading off what’s sure to be a top Trump priority. For another, Japan is America’s top foreign investor.

” Trump wants Japan to keep investing in the United States”, notes David Boling, an analyst at Eurasia Group. Boling continues,” the United States needs Japan as an ally to effectively counter China.” Advisers to Trump will remind him of Japan’s importance”.

Given that” trade policy is one of Trump’s highest priorities and tariffs are in his genetic makeup, it will be difficult for Japan to avoid higher tariffs if Trump returns to office,” Boling writes.

Should the yen resume its decline, Trump might be even harder on Tokyo. According to Jasmine Duan, senior investment strategist at RBC Wealth Management Asia, the markets will be watching for Trump’s actions to increase the yen’s rise.

Bottom line,” we do n’t think Japan would be the , safest market , in Asia if Trump is re-elected”, Duan notes.

Trump’s trade dispute may have a far reaching impact beyond Asia. ” For Europe, the prime concern is tariffs”, says Sharon Bell, an analyst at Goldman Sachs. ” Trump has pledged to impose a 10 % tariff on all US imports. According to our economists, the US GDP could be reduced by 0.5 percentage points and by one percentage point from the Euro area.

Each one percentage point drop in sales-weighted gross domestic product could mean a 10 % drop in earnings per share, Bell explains.

The numerous different scenarios that investors must consider before the US election , on November 5, add to the confusion factor.

David Roche, president of Quantum Strategy, thinks that Harris leading the Democrats boosts the odds of a Trump victory. However, it also makes it less likely that the Republicans will control both of Congress.

On the other hand, says Charles Myers, founder and CEO of advisory firm Signum Global Policy, Harris could spell trouble for Trump’s election hopes. Myers claims that Harris ‘ nomination as the Democratic nominee” a whole new race” makes it” a whole new.”

” There’s a new candidate with an enormous amount of unity and enthusiasm behind her”, Myers explains. She’ll be a key driver of women, young people, Black voters … I think people will underestimate her, “he added.

Bottom line”, I think that it’s a bit too early for the markets to declare victory for Trump, and I think she’s going to give him a real run for his money,” Myers says.

Anatole Kaletsky, economist at Gavekal Dragonomics, adds that” whatever one thinks of Kamala Harris, her chances of winning the election are certainly higher than were Biden’s. And the remote possibility that the Democrats might agree on another, much better candidate than Harris— while a low-probability , tail risk , — would transform the likely outcome of the race.”

Kaletsky notes that, until new polls are released and the Democrats ‘ succession is clarified, it is impossible to quantify the scale of this transformation. My guess is that Trump will hold onto his position of authority for the next few weeks, at most until Labor Day’s traditional start of full-scale campaigning. But I think his probability of winning will fall sharply from last week’s 70 % or 80 % , in the best election models, to something like 55 %.”

In theory, Tokyo would prefer a Harris victory, viewing it as the best chance of continuity. One of Trump’s biggest fears is that he will continue to try to bury Tokyo for$ 8 billion annually to house US troops ( Trump 1.0 tried unsuccessfully to do that policy ).

Japan also worries that Trump, who is “grand bargain,” may negotiate a “grand bargain” trade agreement with Xi, leaving other important Asian nations staring in the face.

But whether a Trump Trade emerges, or Harris wins the presidency, all that officials in Tokyo, Beijing, Seoul and Taipei thought they knew about the year ahead is no longer clear or certain.

Follow William Pesek on X at @WilliamPesek